Good morning. Happy Thursday.

The Asian/Pacific markets closed with across-the-board gains. Japan rallied more than 6%, Australia more than 3%, South Korea and Taiwan more than 2%, and India, New Zealand, Hong Kong, China and Singapore did better than 1%. Europe is currently mostly up. Russia is up more than 2%, and Austria, Norway, the Czech Republic, Greece, Poland, Finland, Italy, Sweden and Romania are up more than 1%. Futures in the States point towards a moderate gap up open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil is down, copper is up. Gold and silver are up. Bonds are down.

The huge overnight drop on Election Day completely reversed. By the time the market opened yesterday, 70% of the losses had been recovered, and then the rest of the loss was recovered during trading. Now we’re going to get a gap up that puts the S&P about 20 points from its all time high. Here’s the daily S&P.

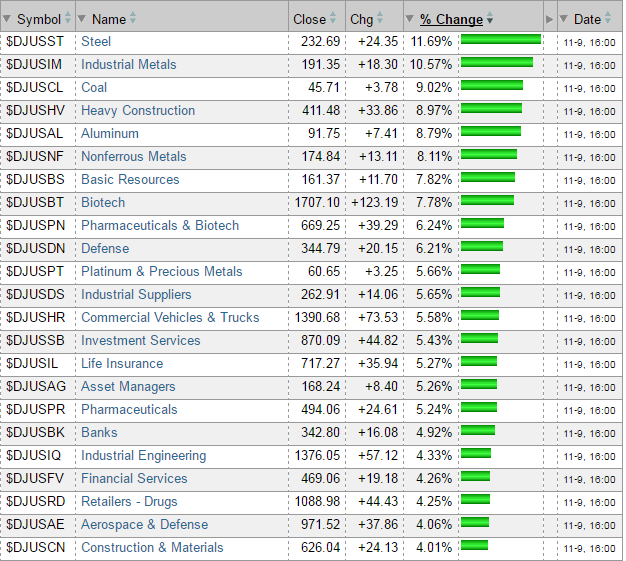

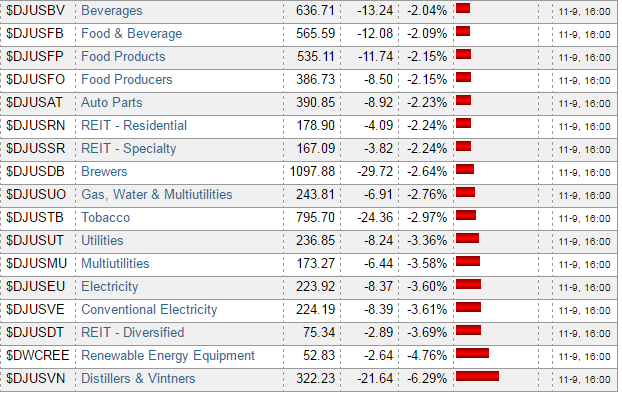

It’s super important to watch the flow of money right now. When power switches hands, some industries will do better while others will do much worse. If the market trends up, you don’t just want to be long, you want to be long the groups that are out-performing.

Here are yesterday’s best-performing groups.

And here are the worst.

Narrow your research to the best performers.

Stock headlines from barchart.com…

Urban Outfitters (URBN +4.49%) was upgraded to ‘Buy’ from ‘Hold’ at Wunderlich Securities with an 18-month target price of $40.

Shake Shack (SHAK +2.15%) jumped 8% in after-hours trading after it raised its full-year sales forecast to $264 million-$265 million from a previous estimate of $256 million.

Mylan (MYL +4.88%) lost almost 1% in after-hours trading after it reported Q3 adjusted EPS of $1.38, below consensus of $1.45.

TASER International (TASR +5.25%) rallied 9% in after-hours trading after it reported Q3 net sales of $71.9 million, well above consensus of $59 million.

Alexion Pharmaceuticals (ALXN +6.54%) slid 2% in after-hours trading after it filed to delay its 10-Q and said it is investigating whether personnel engaged in sales practices that were inconsistent with company policies.

Rapid7 (RPD +1.43%) sank 10% in after-hours trading after it said it sees a Q4 adjusted loss of -26 cents to -28 cents, a wider loss than consensus of -24 cents.

Zeltiq Aesthetics (ZLTQ -1.49%) rallied nearly 8% in after-hours trading after it reported Q3 EPS of 12 cents, higher than consensus of 9 cents, and then raised its full-year revenue estimate to $350 million-$352 million from an August 8 view of $240 million-$350 million.

SolarEdge Technologies (SEDG -5.41%) fell 5% in after-hours trading after it reported Q1 revenue of $128.5 million, below consensus of $132.4 million.

Tabula Rasa Healthcare (TRHC +3.46%) rose nearly 5% in after-hours trading after it reported Q3 adjusted EPS of 6 cents, better than consensus of 4 cents, and said it sees Q4 revenue of $25 million-$26 million, above consensus of $22.9 million.

Avid Technology (AVID +4.46%) dropped over 10% in after-hours trading after it lowered guidance on full-year GAAP revenue to $502 million-$517 million from a prior view of $535 million-$565 million.

Merrimack Pharmaceuticals (MACK +13.87%) lost nearly 8% in after-hours trading after it reported Q3 total revenue of $28.1 million, well below estimates of $41 million.

Bovie Medical (BVX -0.64%) slid nearly 6% in after-hours trading after it announced primary and secondary offerings of common stocks.

Harmonic (HLIT +8.08%) slumped over 20% in after-hours trading after it reported an unexpected Q3 adjusted loss of -1 cent, weaker than consensus of a 2 cent profit, and then said it sees Q4 adjusted EPS of 5 cents-7 cents, below consensus of 13 cents.

Wednesday’s Key Earnings

Dish Network (NASDAQ:DISH) +2.2% despite losing more subscribers.

Mylan (NASDAQ:MYL) -2% AH hurt by lower EpiPen volumes.

Silver Wheaton (NYSE:SLW) -0.3% AH missing estimates.

Shake Shack (NYSE:SHAK) +8.2% AH beating expectations.

SolarCity (NASDAQ:SCTY) +0.7% AH after expanding installations.

Taser (NASDAQ:TASR) +6.9% AH following a Q3 beat.

Viacom (NYSE:VIA) -1.1% AH as networks, movies slumped.

Today’s Economic Calendar

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Results of $12B, 30-Year Note Auction

2:00 PM Treasury Budget

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

3 thoughts on “Before the Open (Nov 10)”

Leave a Reply

You must be logged in to post a comment.

Getting long today spy vti,bonds not so much, maybe VIP,

markets turned into a day-trader’s paradise after the election. volatility everywhere. not just equity indices, but also bonds and currencies and commodities. holding leveraged positions overnight seems equivalent to throwing dice at this moment. i guess the mantra should be “sell down to the sleeping point” (morgan). when there is this much volatility from hour to hour, why take chances overnight anyway, unless they are longer term positions of course.

IWM is up almost 2% while NASDAQ is down 1%. This does not happen often. I burned a lot of dry powder on the RUT before hours Wed. and have most of dry at this point.

I don’t recall seeing the NASDAQ down significantly and the RUT up nicely.