Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Japan, Singapore and New Zealand did well; China and Indonesia were weak. Europe is currently mixed and little changed. Greece, Sweden, Austria and Turkey are up; Italy, Spain, Belgium, Switzerland and the Czech Republic are down. Futures in the States point towards a flat open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up a little. Oil is up; copper is flat. Gold and silver are down. Bonds are down.

Last day of the week. It’s been a good one so far…pretty darn good considering last week was so good.

The market isn’t pulling back. Heck, it’s not even pausing. It’s not letting sideline money in. I suspect this will continue to be the case. So many traders want to get long right now. Sorry. The market isn’t going to let you…and least not right now.

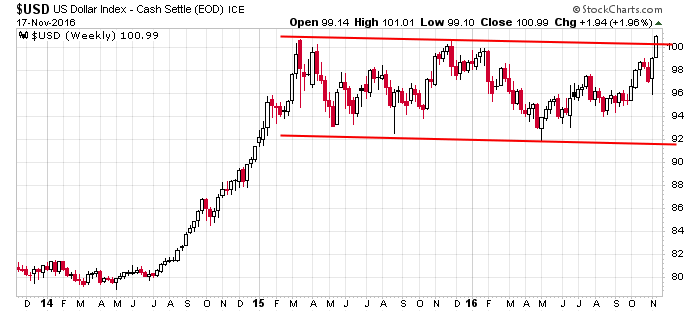

The dollar continues its march higher. I’m not sure when it’ll become an issue, but at some point it will. Stronger dollar and higher rates at the same time? That’s a tough combination for companies…especially ones who have a lot of revolving debt. Here are the daily and weekly dollar charts.

I’m only intersted in the long side right now. The market should do well into the end of the year. More after the open.

Stock headlines from barchart.com…

Wells Fargo (WFC +1.57%) was downgraded to ‘Underperform’ from ‘Market Perform’ at BMO Capital Markets.

Goldman Sachs Group (GS +1.63%) was upgraded to ‘Outperform’ from ‘Neutral’ at Macquarie Research with a 12-month target price of $245.

Salesforce.com (CRM +2.56%) rallied over 5% in pre-market trading after it reported Q3 adjusted EPS of 24 cents, above consensus of 21 cents, and said it sees Q4 revenue between $2.267 billion-$2.277 billion, higher than consensus of $2.24 billion.

Marvell Technology Group Ltd (MRVL -0.52%) jumped over 6% in after-hours trading after it reported Q3 adjusted EPS of 20 cents, well above consensus of 12 cents, and said it sees Q4 adjusted EPS between 17 cents-21 cents, higher than consensus of 13 cents.

The Gap (GPS +0.92%) fell over 8% in pre-market trading after it reported Q3 comparable sales were down -3%.

Ross Stores (ROST +2.62%) rallied over 3% in after-hours trading after it reported Q3 EPS of 62 cents, higher than consensus of 56 cents and raised guidance on full-year EPS to $2.78-$2.81 from an August 18 view of $2.69-$2.75.

Applied Materials (AMAT +2.37%) lost almost 4% in after-hours trading after it said Q4 new orders fell -16% q/q and backlog fell -7% q/q to $4.58 billion.

SolarCity (SCTY +2.87%) gained nearly 2% in after-hours trading after Tesla shareholders overwhelmingly approved the merger with SolarCIty by an 85% vote.

Nuance Communications (NUAN +0.71%) rose over 1% in after-hours trading after it reported Q4 adjusted EPS of 41 cents, higher than consensus of 39 cents.

Williams-Sonoma (WSM +3.29%) fell 4% in after-hours trading after it reported Q3 net revenue of $1.25 billion, below consensus of $1.26 billion.

Sportsman’s Warehouse Holdings (SPWH +0.37%) climbed over 1% in after-hours trading after it raised its view on 2016 revenue to $789 million-$794 million, above consensus of $788.1 million.

Post Holdings (POST +2.64%) gained almost 2% in after-hours trading after it reported Q4 adjusted EPS of 61 cents, higher than consensus of 44 cents.

Synutra International (SYUT +2.27%) surged over 20% in after-hours trading after it agreed to a merger pact to go private with Beams Power Investment.

Announcements and such here

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Nov 18)”

Leave a Reply

You must be logged in to post a comment.

On Sept. 19, iMarketsignals estimated an inflation rate of 2.5% for December 2016. With the Oct. 21 update we predicted 1.7% for October 2016.

inflation or stag inflation