Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Japan rallied 1.2%, and China moved up 0.5%. Hong Kong dropped 0.4%. Otherwise the other markets didn’t move much. Europe currently leans to the upside. Switzerland is up more than 1%; France, Austria, the Netherlands, Norway, Sweden, Denmark and the Czech Republic are also doing well. Greece and Poland are down more than 1%; Italy is also weak. Futures in the States point towards a flat-to-positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil and copper are up. Gold and silver are down. Bonds are down.

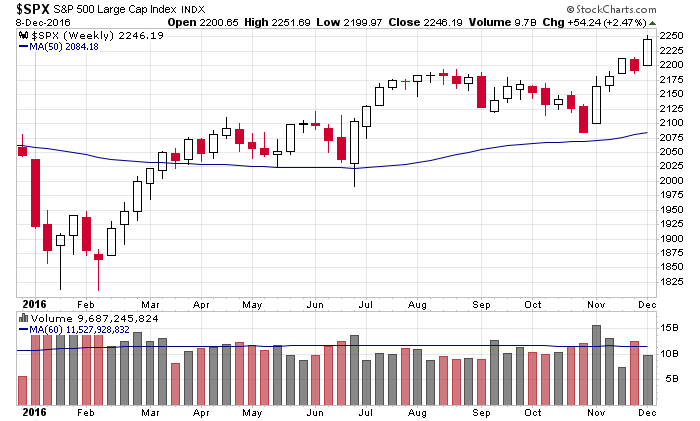

The market is on a heck of a run. Here’s the S&P weekly. One pause last week and then off to the races again this week.

Many groups are too far gone to chase. Financials rocketed higher after the election. Airlines, which I’ve profiled and we’ve played, continue to do well. Restaurants are moving up with force. Oil stocks are doing great. We’ve gotten off some good trades, and now many stocks are setting up for continuation breakouts.

Other than oil, which is presenting some new set-ups, most other groups aren’t playable any more. The risk/rewards just aren’t very good.

Be selective. I expect higher prices going forward, but make sure you get good entries in the near term.

Stock headlines from barchart.com…

Fluor (FLR +2.43%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

Aflac (AFL +0.23%) was downgraded to ‘Underperform’ from ‘Sector Perform’ at RBC Capital Markets with a 12-month target price of $65.

Finisar (FNSR +5.86%) rallied over 3% in after-hours trading after it reported Q2 adjusted EPS of 58 cents, higher than consensus of 46 cents, and then said it sees Q3 adjusted EPS of 58 cents-64 cents, above consensus of 48 cents.

NCI Building Systems (NCI +2.45%) tumbled 10% in after-hours trading after it reported Q4 adjusted EPS of 28 cents, weaker than consensus of 32 cents, and then said it sees Q1 revenue of $370 million-$390 million, weaker than consensus of $399 million.

USA Compression Partners LP (USAC -0.77%) dropped 3% in after-hours trading after it announced a public offering of 4.5 million common units.

Broadcom Ltd (AVGO +1.28%) climbed nearly 4% in after-hours trading after it reported Q4 adjusted EPS continuing operations of $3.47, above consensus of $3.36.

Restoration Hardware (RH +2.77%) slid 2% in after-hours trading after it lowered guidance on full-year adjusted EPS to $1.19-$1.29 from a September 8 view of $1.60-$1.80.

Galapagos NV (GLPG +1.22%) rose 3% in after-hours trading after it said its first patient dosed in a “Selection” Phase 2b/3 study of filgotinib in ulcerative colitis triggered a $10 million milestone payment from Gilead.

Xactly (XTLY +2.50%) slipped 2% in after-hours trading after it said it sees Q4 revenue of $23.6 million-$24.4 million, below consensus of $25.9 million.

Fred’s (FRED +1.40%) dropped 4% in after-hours trading after it said during a conference call that it will take no questions due to a pending transaction that it declined to identify.

Valley National Bancorp (VLY +0.76%) lost 2% in after-hours trading after it filed to sell 8.4 million shares of common stock.

Frontline Ltd (FRO +5.04%) dropped 4% in after-hours trading after it offered 13.4 million shares.

Duluth Holdings (DLTH +9.10%) tumbled over 13% in after-hours trading after it cut its full-year GAAP EPS view to 52 cent-60 cents from a September 8 view of 66 cents-70 cents.

Thursday’s Key Earnings

Broadcom (NASDAQ:AVGO) +3.9% AH on FQ4 beat, doubling dividend.

Sears Holdings (NASDAQ:SHLD) +5.3% after topping expectations.

Today’s Economic Calendar

10:00 Consumer Sentiment

10:00 Wholesale Trade

1:00 PM Baker-Hughes Rig Count

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers