Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed with a lean to the downside. China dropped 2.5%, Hong Kong 1.4%, and India and Taiwan were also weak. Japan did well. Europe is currently mixed and little changed. Norway, Russia, Finland and Italy are doing well. Poland, Turkey and Denmark are weak. Futures in the States point towards a flat open for the S&P and a down open for the Nas.

—————

LB Weekly – the indexes, the breadth indicators, a look at the big picture

Sector Breakdown & Trading Ideas – the oil set-ups are profiled.

—————

The dollar is down. Oil is up big; copper is down. Gold and silver are down. Bonds are down.

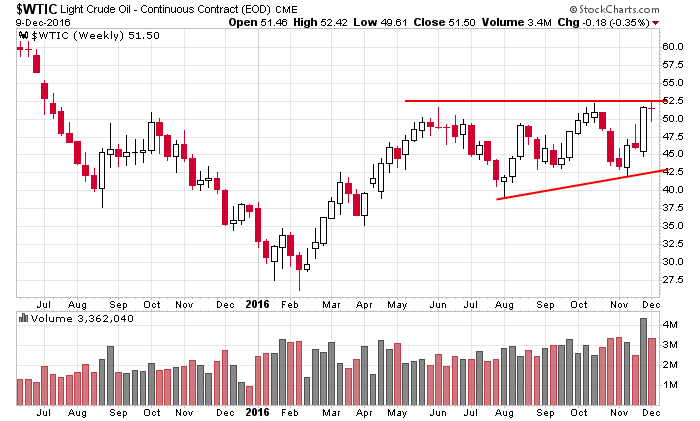

The big news over the weekend comes from the oil space. Non OPED members have agreed to cut oil production 558K barrels/day – short of the target 600K but still a great sign that both OPEC and non OPEC producers are on board with the plan to limit supply to put a floor under the price. Over the weekend I updated my oil picks. You can check them out here. It’s been a very generous group the last few months.

Oil jumped a couple bucks and settled into a range between 53.5 and 54.5 in overnight action. Many oil stocks are posting big gains in premarket trading.

Here’s the daily crude chart heading into today. The commodity will be at a 17-month high at today’s open.

Long term the market looks great. The trend should continue into 2017. Short term anything goes, especially with the FOMC meeting coming up. More after the open.

Stock headlines from barchart.com…

ConocoPhillips (COP +1.99%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Cowen with a 12-month target price of $59.

Cheniere Energy Partners LP Holdings LLC (CQH -3.02%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse with a target price of $28.

The Brink’s Company (BCO -1.33%) was upgraded to ‘Outperform’ from ‘Neutral’ at Macquarie Research with a 12-month target price of $50.

Seattle Genetics (SGEN -3.08%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

Hanesbrands (HBI +0.04%) was upgraded to ‘Buy’ from ‘Neutral’ at D.A. Davidson & Co. with a 12-month target price of $29.

Itegra LifeSciences Holdings (IART +0.71%) was rated a new ‘Buy’ at UBS with a 12-month target price of $96.

MiMedx Group (MDXG +1.16%) was rated a ‘Sell’ at UBS with a 12-month target price of $9.

People familiar with the matter said that Cornerstone OnDemand (CSOD -0.28%) is said to mull a sale amid activist pressure.

A U.S. International Trade Commission Judge said that Arista Networks (ANET -1.41%) infringed on 2 Cisco patents.

Axovant Sciences Ltd (AXON -0.56%) jumped 5% in after-hours trading after it said data from a Phase 2b trial shows the addition of its Intepirdine drug to standard therapy may help people with Alzheimer’s disease maintain independence longer.

Today’s Economic Calendar

1:00 PM Results of $24B, 3-Year Note Auction

1:00 PM Results of $20B, 10-Year Note Auction

2:00 PM Treasury Budget

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Dec 12)”

Leave a Reply

You must be logged in to post a comment.

The fed wants to raise rates, but EU/Draghi say no, or not yet. I think it happens at .25 BP for US with promises of more to come soon, soon…. maybe. What would you say to a little tax cut? I hate Christmas as a commercial holiday. I know I am tasteless, not sorry this is a free speech board.. Buy equal weights.

Was that lighting bolt???