Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Hong Kong dropped more than 1%; China, Singapore, Australia and New Zealand were also weak. Europe currently leans to the upside. Germany, France, Austria, the Netherlands, Denmark, Spain, Italy and the Czech Republic are up. Greece and Poland are down more than 1%; Norway and Portugal are also weak. Futures in the States point towards a slight down open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up huge. Oil and copper are down. Gold and silver are down. Bonds are down.

The market got exactly what it expected yesterday. The reaction by the overall market was fairly normal – the indexes dropped but didn’t move in a way that would be considered out of the ordinary.

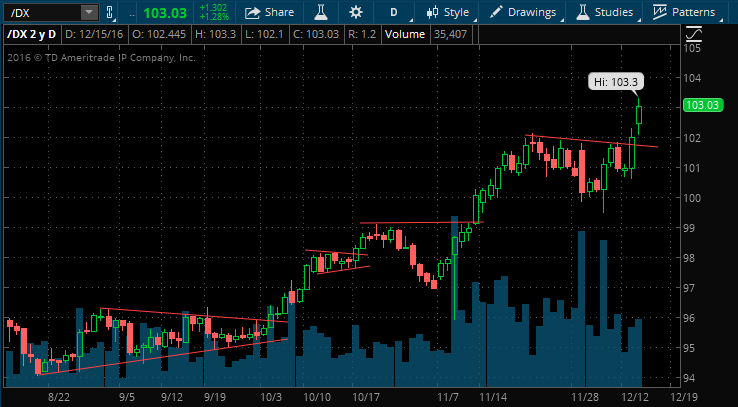

The dollar rallied hard and is following through in premarket action.

Oil also got hit and is adding to its gains in premarket trading.

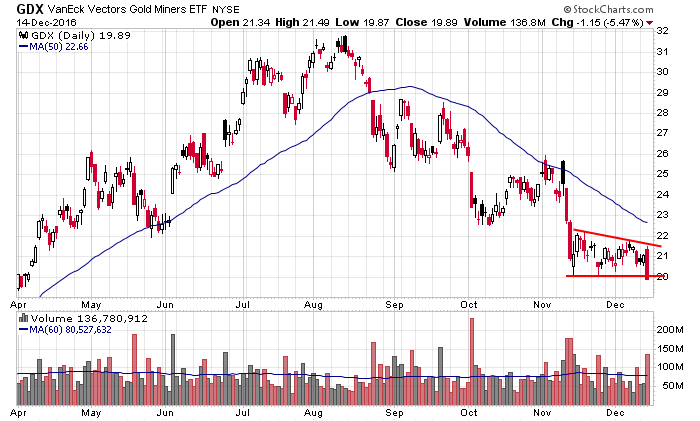

Gold and silver got crushed. Nothing to see there. I turned negative on the group back in September and haven’t really paid much attention since because it’s been trending down and is below its declining 50-day MA. Here’s GDX.

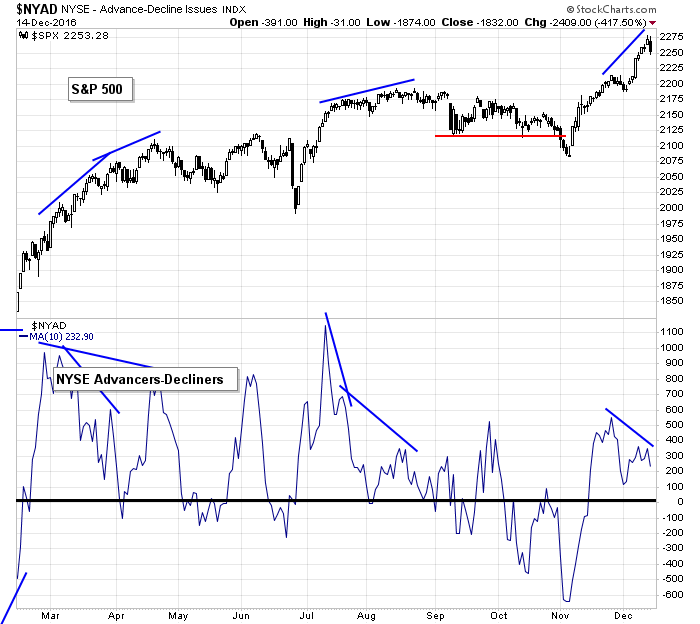

For almost two weeks some breadth indicators have been falling. I looked somewhat foolish last week when the indexes rallied anyways. Now it looks like a little correction will actually play out. Here’s the S&P vs. the 10-day of the NYSE AD line. Advancers have beaten decliners by a smaller margin on this most recent leg up, and at no time over the last five weeks has the indicator climbed to levels seen during previous rallies.

Don’t be a hero out there. Let trades come to you.

Stock headlines from barchart.com…

Chevron (CVX -1.24%) was upgraded to ‘Outperform’ from ‘Neutral’ at Macquarie Research with a 12-month target price of $130.

Hilton Worldwide Holdings (HLT +1.14%) was upgraded to ‘Buy’ from ‘Neutral’ at Bank of America/Merrill Lynch.

Yahoo! (YHOO -1.35%) declined over 2% in after-hours trading after it said it believes 1 billion user accounts may have been hacked in August 2013, twice as many as the 500 million accounts it initially said were affected.

Athenahealth (ATHN -2.10%) rallied 20% in after-hours trading after it said it sees 2017 revenue of $1.29 billion-$1.33 billion, above consensus of $1.29 billion.

United Technologies (UTX -0.94%) said it sees 2017 sales of $57.5 billion-$59 billion, weaker than consensus of $59.2 billion.

Pier 1 Imports (PIR -0.46%) surged 18% in after-hours trading after it reported Q3 adjusted EPS of 22 cents, well above consensus of 15 cents, and then raised guidance on fiscal 2017 adjusted EPS to 37 cents-41 cents from a prior view of 24 cents-32 cents.

Mondelez (MDLZ -0.58%) rallied almost 10% in after-hours trading after Bilanz magazine cited an unidentified “very well-informed” source that said Kraft Heinz plans to acquire Mondelez.

General Mills (GIS -1.36%) lost almost 2% in after-hours trading after Bilanz reported that Kraft Heinz plans to acquire Mondelez.

Diamondback Energy (FANG -3.58%) dropped 3% in after-hours trading after it filed to sell 10.5 million shares and proposed a $250 million offering of senior notes due 2025.

Apogee Enterprises (APOG +2.01%) rose over 2% in after-hours trading after it reported Q3 EPS of 78 cents, better than consensus of 77 cents, and then raised guidance on fiscal 2017 EPS to $2.85-$2.95 from a prior view of $2.80-$2.90.

VTv Therapeutics (VTVT -2.55%) jumped 16% in after-hours trading after it said it met its primary endpoint in a Phase 2 study of patients with Type 2 diabetes that demonstrated a statistically significant reduction in HbA1c.

Gulfport Energy (GPOR -3.69%) slid 3% in after-hours trading after it announced an offering of 29 million shares of common stock.

Amicus Therapeutics (FOLD +0.52%) dropped over 10% in after-hours trading after it proposed a $225 million offering of convertible senior notes due 2023.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Philly Fed Business Outlook

8:30 Consumer Price Index

8:30 Empire State Mfg Survey

8:30 Current Account

9:45 PMI Manufacturing Index Flash

9:45 Bloomberg Consumer Comfort Index

10:00 NAHB Housing Market Index

10:30 EIA Natural Gas Inventory

4:00 PM Treasury International Capital

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Dec 15)”

Leave a Reply

You must be logged in to post a comment.

come on bulls the quad witches want dow 20000 so as the bears can short

especially the financials as the fed is going to sell its bonds to reduce liquidity

and bankrupt the world

we had the shallow correction yesterday now the last attempted push up

before the uncle scrooge cash for xmas /n/year