Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mixed. Hong Kong, Singapore, Indonesia, Malaysia and South Korea closed up; India. Japan and China posted losses. Europe is currently mostly down, but losses are minimal. France, the Netherlands, Norway, Italy, Portugal and Russia are down. Turkey is up. Before the employment numbers were released, futures in the States pointed towards a slight down open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil is up; copper is down. Gold and silver are down. Bonds are up.

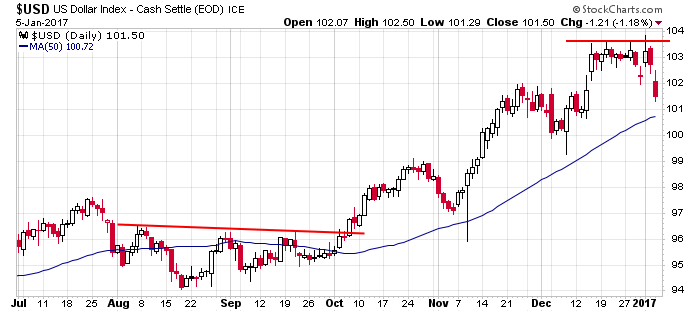

After flirting with breaking out recently, the dollar broke down yesterday. This lent a helping hand to gold and silver, which followed through on their recent strength.

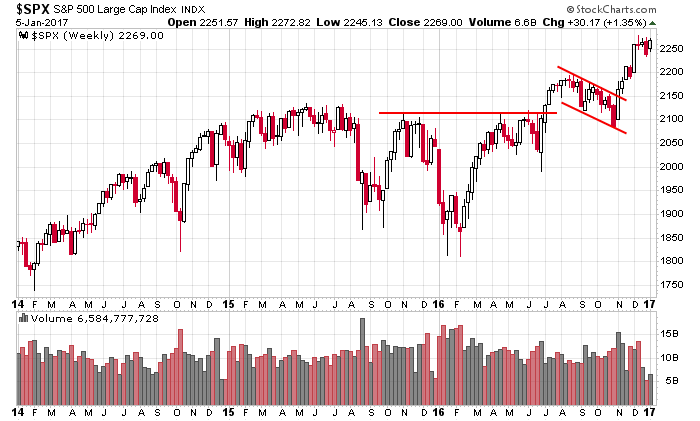

The S&P has recovered its loss from last week and remains in a mini consolidation pattern within an obvious uptrend. Here’s the weekly.

S&P futures jumped after the employment figures were released. The Dow closed yesterday about 100 points from 20K.

Here are the employment numbers:

unemployment rate: 4.7% (was 4.6% last month)

nonfarm payrolls: +156K

private payrolls:

average workweek: unchanged at 34.3 hours

hourly wages: up 0.4% to $26/hour

labor participation rate:

October gain cut from 142K to 135K.

November gain raised from 178K to 204K.

Anything goes in the near term, but over the next few months, I see the market’s strength continuing.

Stock headlines from barchart.com…

Travelers (TRV -1.60%) was downgraded to ‘Underweight’ from ‘Neutral’ at Atlantic Equities LLP with a 12-month target price of $110.

McDonald’s (MCD +0.18%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS with a 12-month target price of $130.

The Gap (GPS -3.93%) jumped 12% in after-hours trading after Retail Metrics reported an unexpected 4% increase in December total comparable sales, stronger than consensus of a -1.7% decline.

Amgen (AMGN +0.07%) rallied over 5% in after-hours trading after it won a court ruling blocking Sanofi and Regeneron from selling their Praluent cholesterol-lowering drug in the U.S. because it infringes patents. Regeneron (REGN -0.57%) dropped 1% and Sanofi (SNY +1.59%) slid 3% on the news.

Burlington Stores (BURL +0.29%) was rated a new ‘Outperform’ at Wedbush with a 12-month target price of $107.

G-III Apparel Group Ltd (GIII -4.47%) sold-off 8% in after-hours trading after it cut its view on 2017 adjusted Ebitda to $148 million-$155 million from a prior view of $163 million-$171 million.

Expedia (EXPE +0.84%) gained almost 1% in after-hours trading after it was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

Helen of Troy Ltd (HELE +1.83%) climbed 3% in after-hours trading after it reported Q3 adjusted EPS of $2.37, higher than consensus of $1.90, and said it sees fiscal 2017 adjusted EPS of $6.20-$6.50, above consensus of $6.13.

Momenta Pharmaceuticals (MNTA -1.46%) climbed 7% in after-hours trading after it joined into a pact with CSL to develop and commercialize Fc mutimer proteins and will receive $50 million in upfront license fee and is eligible for up to $550 million in potential clinical, regulatory and commercialization milestones.

Summit Materials (SUM -1.54%) fell over 5% in after-hours trading after it offered 10 million shares of common stock.

Quotient Ltd (QTNT +6.52%) jumped 18% in after-hours trading after it reported positive results from MosaiQ study for antigen typing and affirmed that European field trials for blood grouping and initial disease screening panel to be completed in the first half of 2017.

Stemline Therapeutics (STML -4.62%) surged over 20% in after-hours trading after it reported a “positive” meeting with the FDA on an expedited registration pathway to full approval of its SL-401, a treatment for an aggressive form of leukemia.

Pandora Media (P unch) fell over 2% in after-hours trading after Sirius XM CFO said M&A with Pandora is “not very likely.”

Ruby Tuesday (RT +0.28%) tumbled 19% in after-hours trading after it reported Q2 revenue of $214.7 million versus $261 million y/y, and said same-restaurant sales were “disappointing” due to a net reduction of 109 company-owned restaurants.

Today’s Economic Calendar

8:30 Non-farm payrolls

8:30 International Trade

10:00 Factory Orders

11:15 Fed’s Evans: Monetary Policy

1:00 PM Baker-Hughes Rig Count

3:30 PM Fed’s Kaplan: Economic Outlook

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Jan 6)”

Leave a Reply

You must be logged in to post a comment.

is today the final hahra,resulting in the end of everything

completed 5 waves up in usd and spx charts could be considered

boarder taxes was the cause of the 1929 depression

trade wars,debt implosions,cheating banks,bankrupt central banks

bankruptcy is a cleansing method for real prosperity