Good morning. Happy Thursday.

The Asian/Pacific markets closed with a lean to the downside. Japan fell 1.2%; Hong Kong and China also posted losses. South Korea, Taiwan and India did well. Europe currently leans to the downside. Denmark and Luxembourg are down more than 1%; Germany, Finland and Switzerland are also weak. Turkey is up more than 3%; Greece, Spain and Poland are also posting gains. Futures in the States point towards a moderate gap down open for the cash market.

—————

Introducing the new Leavitt Brothers – same great service, unbundled, so you can subscribe to only what you want.

—————

The dollar is getting hit hard. Oil and copper are up. Gold and silver are up. Bonds are up.

Yesterday the dollar rallied early (took out the highs from the previous four days) but then sold off and gave everything back. Today it’s down another 1%. A close at the current level would be at a 1-month low.

The dollar weakness is helping gold and oil.

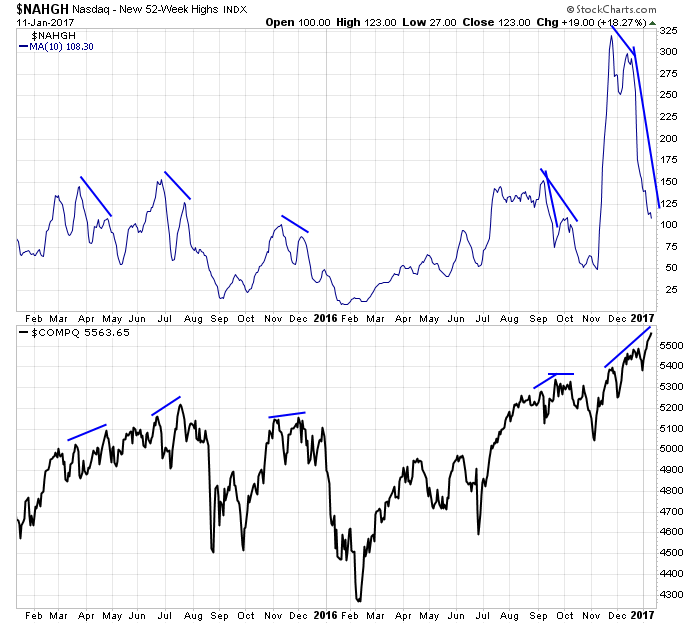

The lack of new highs at the Nas is starting to bother me. I’m picking on the Nas because it has moved up 7 straight days and has hit an all-time high 3 of the last 4 days, yet, new highs among individual companies are sitting at a low level. How can the index hit new highs while so few components doing the same? In the past, when the index moved to a higher high but the 10-day of the new highs put in a lower high, the market corrected. Here’s a image comparing the two.

It’s a data point. But if the market attempts to leg up and we don’t get improvement from these types of indicators, the upside will be limited. This helps determine if you can hold positions or whether you should take profits. Keep it in mind. The market’s breadth needs to improve.

Stock headlines from barchart.com…

Adobe Systems (ADBE +0.67%) was downgraded to ‘Hold’ from ‘Buy’ at Pivotal Research Group LLC with a 12-month price target of $104.

U.S. Steel (X -0.85%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse with a price target of $30,

Disney (DIS +0.98%) was downgraded to ‘Sell’ from ‘Hold’ at Pivotal Research Group LLC with a 12-month price target of $85.

SunTrust Banks (STI +0.59%) was upgraded to ‘Strong Buy’ from ‘Market Outperform’ at Vining Sparks.

Boeing (BA +0.21%) was rated a new ‘Underperform’ at RBC Capital Markets with a 12-month target price of $136 saying Boeing’s market position is inferior as it is shut out of the next generation of fighter and bomber plane platforms.

Raytheon (RTN -0.25%) was rated a new ‘Outperform’ at RBC Capital Markets with a 12-month target price of $180.

Callaway Golf (ELY -1.49%) jumped nearly 6% in after-hours trading after it purchased Ogio International for $75.5 million.

KB Home (KBH +2.15%) rallied nearly 3% in after-hours trading after it reported Q4 revenue of $1.19 billion, higher than consensus of $1.14 billion.

Century Aluminum (CENX -0.33%) rose nearly 2% in after-hours trading after people with knowledge of the matter said the U.S. is said to prepare a complaint with the WTO against China on subsidies to its domestic aluminum producers that is suppressing global aluminum prices.

Zendesk (ZEN +2.44%) climbed 3% in after-hours trading after it was rated a new ‘Outperform’ at Cowen with a price target of $30.

Kosmos Energy Ltd (KOS +1.00%) dropped 5% in after-hours trading after the two top holders of its stock, Blackstone and Warburg Pincus, offered to sell 30 million shares of their holdings of Kosmos.

World Wrestling Entertainment (WWE +0.05%) gained 1% in after-hours trading after it was rated a new ‘Buy’ at Guggenheim Securities.

Applied Optoelectronics (AAOI -0.66%) surged 18% in after-hours trading after it said preliminary Q4 adjusted EPS will be 77 cents-82 cents, higher than a November estimate of 46 cents-51 cents.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Import/Export Prices

8:30 Fed’s Harker: Economic Outlook

8:30 Fed’s Evans: Monetary Policy

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Results of $12B, 30-Year Note Auction

1:15 PM Fed’s Bullard: U.S. Monetary and Economic Policy

2:00 PM Treasury Budget

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

7:00 PM Janet Yellen speech

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Jan 12)”

Leave a Reply

You must be logged in to post a comment.

Agree “The market’s breadth needs to improve.”

And it is getting worse today.