Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Hong Kong rallied more than 1%; Japan and Indonesia also did well. Singapore and Australia led to the downside. Europe is currently mixed and little changed. The UK, Germany, the Netherlands, Norway and Greece are up; France, Russia, Denmark and Portugal are down. Futures in the States point towards a positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil and copper are down. Gold and silver are down small amounts. Bonds are down.

Lots of things happened yesterday.

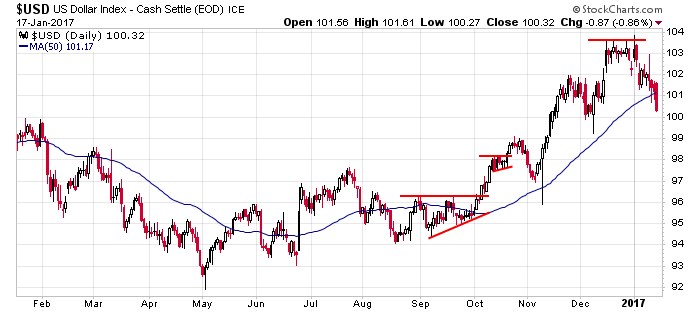

The dollar closed below its 50-day MA for the first time since September. The British pound posted its biggest single-day gain in many years, and Donald Trump said the dollar was too strong. I also believe the Fed is going to sit tight with interest rates at the Feb 1 meeting.

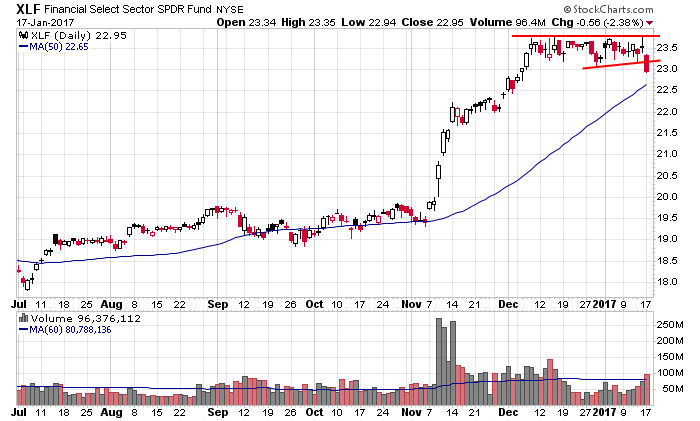

The weak dollar contributed to the financials taking big hits. XLF closed at a 1-month low on heavy volume.

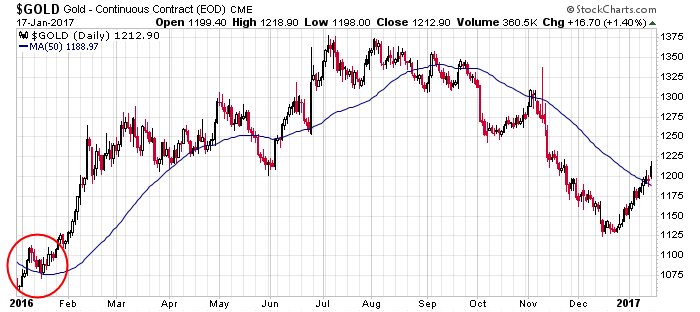

The dollar weakness helped push gold up. It’s at an 8-week high, and the stocks continue to establish themselves above their 50-day MAs.

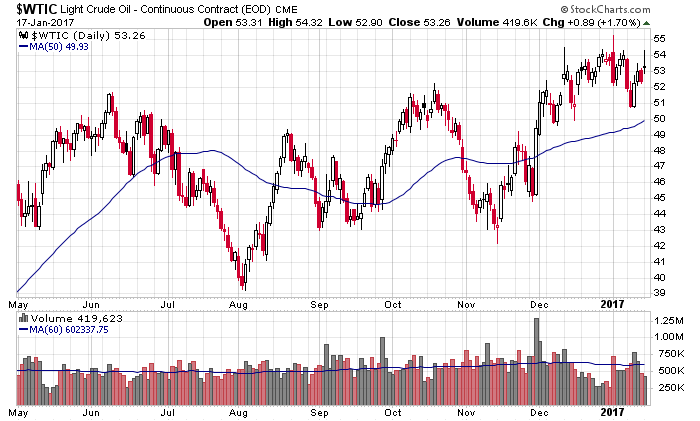

But the dollar drop didn’t help oil much. Crude was strong early but then dropped to close in the bottom-half of its range. I like oil overall, but for the last two weeks I’ve lost my bullish near term bias. Most stocks are not set up to run right now.

On a closing basis, the Dow has traded in its tightest range in history the last month. The index rallied up to 20K and just stopped – a heck of a development considering the post-election rally was one of the biggest in history. Perhaps the market will wake up after Friday’s inauguration?

Stock headlines from barchart.com…

Goldman Sachs (GS -3.50%) fell 2% in pre-market trading after it reported Q4 EPS of $5.08, higher than consensus of $4.84, but said Q4 equities and trading revenue was $1.59 billion, below consensus of $1.61 billion.

Wells Fargo (WFC -2.77%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

McKesson (MCK +0.85%) was upgraded to ‘Market Outperform’ from ‘Market Perform’ at Avondale Partners LLC with a 12-month target price of $193.

Hancock Holding (HBHC -3.46%) reported Q4 EPS of 64 cents, stronger than consensus of 61 cents.

Linear Technology (LLTC -0.05%) reported Q2 revenue of $375.8 million, higher than consensus of $373.8 million.

HP Enterprise (HPE -1.09%) bought Simplivity for $650 million in cash.

Toys R Us (TOY) reported that same-store comparable sales for the 9-week period ended December 31, fell =3.4%.

San Francisco Fed President Williams (non-voter) said more gradual interest rate increases will likely be needed, given a “strong” U.S. economy that’s reached full employment with inflation approaching 2%.

United Continental Holdings (UAL -0.78%) lost over 1% in after-hours trading after it forecast Q1 Prasm growth of down -1% to up +1%, weaker than consensus of up +0.5% to +1.5%.

CSX Corp. (CSX -1.83%) dropped 3% in after-hours trading after it reported Q4 EPS of 49 cents, below consensus of 50 cents.

Neurocrine Biosciences (NBIX -4.92%) fell nearly 5% in after-hours trading after it said a Phase II clinical study of its Ingrezza to treat adults with Tourette syndrome did not meet its pre-specified primary endpoint.

Jazz Pharmaceuticals (JAZZ -1.47%) slid 4% in after-hours trading after the U.S. FDA said it approved the first generic version of Jazz’s Xyrem drug to treat patients with narcolepsy.

Teladoc (TDOC -5.18%) dropped 5% in after-hours trading after certain stock holders are reportedly offering to sell 7.25 million shares of stock.

Interactive Brokers Group (IBKR -1.96%) fell over 2% in after-hours trading after it reported an unexpected Q4 comprehensive loss of -5 cents a share, much weaker than consensus for Q4 adjusted EPS to climb 35 cents.

Shiloh Industries (SHLO -3.23%) jumped 11% in after-hours trading after it reported Q4 adjusted EPS of 50 cents, well above consensus of 18 cents.

Almost Family (AFAM +1.48%) sank 9% in after-hours trading after it announced a proposed underwritten public offering of 2.5 million shares of common stock.

Gigamon (GIMO -2.87%) plunged over 20% in after-hours trading after it reported preliminary Q4 revenue of $84.5 million-$85 million, below consensus of $92.2 million.

Tuesday’s Key Earnings

CSX Corp. (NYSE:CSX) -4% AH on a set of in-line earnings.

Morgan Stanley (NYSE:MS) -3.8% despite an impressive quarter.

United Continental (NYSE:UAL) -1.7% AH predicting flat Q1 revenues.

UnitedHealth (NYSE:UNH) -0.7% amid Obamacare uncertainty.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Consumer Price Index

8:55 Redbook Chain Store Sales

9:15 Industrial Production

10:00 NAHB Housing Market Index

10:00 Fed’s Kashkari speech

2:00 PM Fed’s Beige Book

3:00 PM Janet Yellen speech

4:00 PM Treasury International Capital

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

5 thoughts on “Before the Open (Jan 18)”

Leave a Reply

You must be logged in to post a comment.

So, why am I posting less?

About one month before Thanksgiving, I promoted a seminar on why the Dow would go to 19,100.

Guess what?

Nobody was interested.

Now, people are fighting to get in the market.

And I am telling folks we are going back down to 19,100.

Am I receiving any comments?

No.

With interest rates going up, trump will blame the Fed.

And that conflict will hurt the market.

hmmm, logical…sounds good to me….

Very, very interesting gold company

http://s2.q4cdn.com/606446019/files/doc_financials/quarterly/2016/KGI-Q3-2016-Consolidated-Financial-Statements-FINAL.pdf

https://www.tickerreport.com/banking-finance/2348030/insider-buying-kirkland-lake-gold-ltd-kl-director-acquires-45600-shares-of-stock.html

http://stockcharts.com/h-sc/ui?s=KL.TO&p=W&yr=2&mn=0&dy=0&id=p62871293996

ok ,so small wave 1 of big wave 1 dow to 19000,wave 2 19500

wave3 15000,wave 5 12000

can the quad witches fix that all up for close friday