Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up, but other than Japan (up 0.9%) gains were small. China fell 0.4%. Europe currently leans to the downside. The Uk, Russia, Greece, Turkey, Portugal and Switzerland are down. The Czech Republic, Finland and Romania are doing well. Futures in the States point towards a down open for the cash market.

—————

VIDEO: There’s a Bull Market Somewhere – how to use this concept to make money

—————

The dollar is flat. Oil is up; copper is flat. Gold and silver are down. Bonds are down.

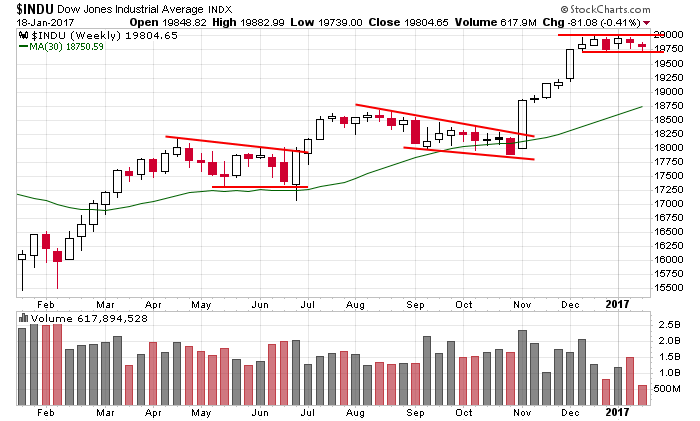

Here’s the Dow – super tight range going back five weeks. Stark change in character compared to the last two months of 2016 when the index would move up day after day.

The market is waiting for something. The inauguration? More earnings? The Fed? Or perhaps it just needs to rest, given the nearly-vertical move at the end of last year.

Stock headlines from barchart.com…

Exxon Mobile (XOM -1.24%) was downgraded to ‘Sell’ from ‘Neutral’ at UBS with a price target of $77.

Netflx (NFLX +0.28%) jumped over 7% in pre-market trading after it reported 1.93 million net streaming adds, higher than consensus of 1.45 million, and said it added 5.12 million new customers in international markets, above consensus of 3.78 million.

Under Armour (UAA -2.62%) was rated a new ‘Buy’ at CLSA with a price target of $37.

CSX Corp. (CSX -3.18%) rallied 8% in after-hours trading after the WSJ reported that outgoing CEO Hunter Harrison and activist investor Paul Hilal are finalizing a partnership and are set to target CSX.

Kinder Morgan (KMI -0.49%) fell over 2% in after-hours trading after it reported Q4 revenue of $3.39 billion, below consensus of $3.53 billion.

Mondelex International (MDLZ +0.29%) rose nearly 3% in after-hours trading after Bega Cheese agreed to buy Mondelez’s Australian grocery business for A$460 million.

Canadian Pacific Railway (CP -0.45%) lost 1% in after-hours trading after the company accelerated the retirement of CEO Hunter Harrison by about 6 months after he inquired about the possibility of working with other major freight railroads.

Rent-A-Center (RCII +1.39%) tumbled over 12% in after-hours trading after it said preliminary Q4 core comparable sales tumbled 14% and that it will have a Q4 loss per share of -20 cents to -30 cents, much weaker than consensus for EPS of 10 cents.

Zynerba Pharmaceuticals (ZYNE +15.18%) declined nearly 7% in after-hours trading after it announced a proposed public offering of common stock.

Oclaro (OCLR -0.61%) jumped nearly 8% in after-hours trading after it reported preliminary Q2 revenue of $153.5 million-$154 million, better than consensus of $150.5 million.

PTC Inc. (PTC +0.04%) rose over 1% in after-hours trading after it reported Q1 adjusted revenue of $287.2 million, above consensus of $285.6 million.

Heron Therapeutics (HRTX -0.39%) dropped over 3% in after-hours trading after it proposed a $150 million public offering of common stock.

La Quinta Holdings (LQ +1.40%) gained almost 2% in after-hours trading after it said it will pursue plans to separate into two stand-alone publicly traded companies which could involve a spinoff of its real estate assets.

Plexus (PLXS +0.58%) slid over 2% in after-hours trading after it said it sees Q2 revenue of $620 million-$650 million, below consensus of $658.7 million.

EP Energy (EPE -2.79%) dropped nearly 4% in after-hours trading after it was downgraded to ‘Sell’ from ‘Neutral’ at UBS.

Wednesday’s Key Earnings

Canadian Pacific (NYSE:CP) -1.2% AH with its CEO stepping down early.

Citigroup (NYSE:C) -1.7% as revenues fell short of estimates.

Goldman Sachs (GS) -0.6% with strong results already priced in.

Kinder Morgan (NYSE:KMI) -2% AH on another drop in quarterly revenues.

Netflix (NFLX) +7.5% AH dazzling with subscriber growth.

U.S. Bancorp (NYSE:USB) +0.5% after beating expectations.

Today’s Economic Calendar

8:30 Housing Starts

8:30 Initial Jobless Claims

8:30 Philly Fed Business Outlook

9:45 Bloomberg Consumer Comfort Index

10:00 Fed’s Williams Speech

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

8:00 PM Janet Yellen speech

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Jan 19)”

Leave a Reply

You must be logged in to post a comment.

intrasay did nas 100 exhaust top today