Good morning. Happy Friday. Happy Inauguration Day.

The Asia/Pacific markets closed mostly down. India, Indonesia, Australia and Hong Kong were weakest; China did well. Europe is currently mostly up, but movement is minimal. France, Austria, the Netherlands, Norway, the Czech Republic, Turkey, Hungary and Spain are doing the best. Futures in the States point towards a positive open for the cash market.

—————

VIDEO: There’s a bull market somewhere

—————

The dollar is up. Oil is up; copper is down. Gold is flat; silver is down. Bonds are down.

At 12:00 est Donald Trump will be sworn in as the 45th president of the United States.

Today could act as an inflection point, but I can’t predict a direction. The charts and indicators temporarily get thrown out the window when a major news item hits. This event has been known for months, so there should be no surprises. But you never know.

If you trade short term, I wouldn’t be taking on huge risk. Let the dusk settle first. If you’re longer term, you’re fully invested and should stay that way.

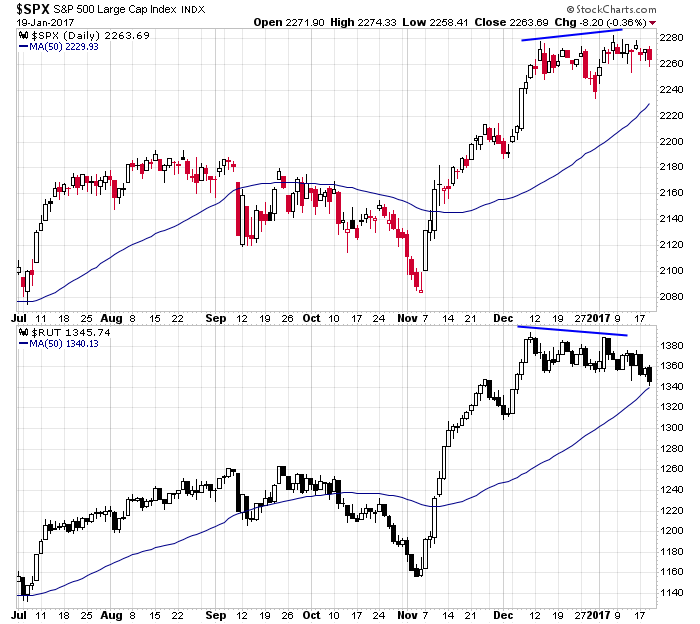

Even without the inauguration there are a few warnings. The large and small caps diverged a few weeks ago, and yesterday the small caps dropped to their lowest level in a month.

Many breadth indicators have flat-lined. The AD lines, AD volume line, new highs and others have done very little recently. When the market moves, these will either support the movement or act as non-confirmation. But first we need movement.

Stock headlines from barchart.com…

Amazon.com (AMZN +0.19%) was rated a new ‘Buy’ at Aegis with a price target of $953.

Goldman Sachs (GS -1.23%) was upgraded to ‘Market Outperform’ from ‘Market Perform’ at Vining Sparks with a 12-month target price of $255.

Pioneer Natural Resources (PXD +0.51%) was upgraded to ‘Overweight’ from ‘Neutral’ at MUFG Securities Americas with a 12-month target price of $212.

Atlassian Corp. PLC ({=TEAM =}) reported Q2 revenue of $148.9 million, better than consensus of $144.1 million.

1st Source Corp. (SRCE +0.02%) reported Q4 EPS of 58 cents, higher than consensus of 56 cents.

Concho Resources (CXO -0.88%) was upgraded to ‘Overweight’ from ‘Neutral’ at MUFG Securities Americas with a 12-month target price of $175.

American Express (AXP -1.03%) lost 1% in after-hours trading after it reported Q4 adjusted EPS of 91 cents, weaker than consensus of 99 cents, although Q4 revenue of $8.0 billion was above consensus of $7.95 billion.

Skyworks Solutions (SWKS -1.02%) jumped nearly 8% in after-hours trading after it reported Q1 adjusted EPS of $1.61, higher than consensus of $1.58, and said it sees Q2 adjusted EPS of $1.40, above consensus of $1.39.

International Business Machines (IBM +0.01%) slid nearly 3% in after-hours trading after it reported Q4 adjusted gross margin of 51.0%, weaker than consensus of 52.8%.

Preferred Bank/Los Angeles (PFBC -1.69%) reported Q4 EPS of 71 cents, above consensus of 65 cents/

Carolina Financial (CARO -2.11%) proposed a $40 million offering of common stock.

TrueCar (TRUE +1.94%) fell 3% in after-hours trading after it filed a $100 million mixed securities shelf offering.

Stemline Therapeutics (STML -5.98%) dropped 5% in after-hours trading after it announced a public offering of common stock.

Thursday’s Key Earnings

American Express (NYSE:AXP) -1.6% AH on higher marketing spend.

IBM (NYSE:IBM) -2.3% AH as revenues fell for the 19th straight quarter.

Skyworks Solutions (NASDAQ:SWKS) +7.7% AH beating expectations.

Union Pacific (NYSE:UNP) +2.4% after topping estimates.

Today’s Economic Calendar

9:00 Fed’s Harker Speech

1:00 PM Baker-Hughes Rig Count

1:00 PM Fed’s Williams Speech

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Jan 20)”

Leave a Reply

You must be logged in to post a comment.

Got a buy signal on the small caps last night on the close.

The NASDAQ is not even close to a buy. so I will buy nothing.

I think we are in for some big moves. I just don’t know the direction.