Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Singapore, Australia, India, Indonesia and Malaysia are leading. Europe is currently mostly up. Greece, Italy and Russia are up more than 1%; Sweden, Norway, Poland, Finland, Spain are also doing well. Turkey is down. Futures in the States point towards a flat open for the cash market.

—————

VIDEO: There’s a Bull Market Somewhere

—————

The dollar is up. Oil and copper are up. Gold and silver are down. Bonds are down.

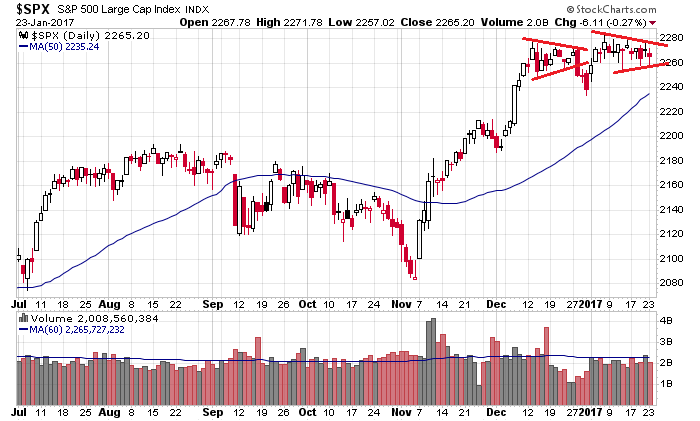

The market is in no hurry to do anything right now. All the indexes are stuck in tight ranges and can’t get any momentum going in either direction. In fact the S&P has alternated between a gain and a loss for 8 straight days.

Gold and silver remain on my radar. I first profiled them two weeks ago as a place money was flowing, and after resting last week, it looks like the groups are finally moving up.

Big cap tech were noticeable winners yesterday. FB, AMZN, GOOGL, PCLN and NTES all did well.

The weakish dollar doesn’t mean much day to day, but over the intermediate and long terms, the ramifications will be much different whether the dollar moves up to 108 or drops back into its 2-year range.

Earnings season is front and center. Fed is next week Wednesday.

Stock headlines from barchart.com…

Verizon Communications (VZ -0.59%) slid over 2% in pre-market trading after it reported Q4 adjusted EPS of 86 cents, weaker than consensus of 89 cents.

Alibaba (BABA +2.45%) jumped almost 5% in pre-market trading after it reported Q3 revenue of 53.2 billion yuan, stronger than consensus of 50.1 billion yuan, and forecast fiscal 2017 revenue will be up 53%, higher than an earlier projection of up 48%.

Humana (HUM +2.24%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

J&J Snack Foods (JJSF -0.97%) reported Q1 EPS of 72 cents, stronger than consensus of 63 cents.

HealthEquity (HQY +0.78%) was rated a new ‘Overweight’ at Keybanc Capital Markets with a 12-month target price of $60.

U.S. Foods Holding Company (USFD -1.11%) lost nearly 1% in after-hours trading after it launched a 30 million share secondary offering of common stock.

The Soros Fund increased its passive stake in Sigma Designs (SIGM -0.79%) to 5.3% from 3.11%.

Enterprise Financial Services (EFSC -0.69%) reported Q4 core EPS of 59 cents, below consensus of 61 cents.

Brown & Brown (BRO -0.91%) reported Q4 adjusted EPS of 42 cents, above consensus of 41 cents.

Yahoo! (YHOO +0.83%) gained almost 1% in after-hours trading after it reported Q4 adjusted EPS of 25 cents, higher than consensus of 21 cents.

Ocular Therapeutix (OCUL -4.79%) slid over 5% in after-hours trading after it announced a $25 million public offering of common stock.

Mercury Systems (MRCY +0.96%) jumped 8% in after-hours trading after it reported Q2 adjusted EPS of 30 cents, better than consensus of 26 cents, and said is it sees Q3 adjusted EPS of 29 cents-32 cents, above consensus of 29 cents.

Fortina Silver Mines (FSM +2.70%) dropped 6% in after-hours trading after it issued 10.32 million shares at $6.30 per common share, an 8.7% discount to Monday’s closing price.

BioAmber (BIOA -11.15%) slumped 11% in after-hours trading after it announces a $10 million underwritten public offering of common stock.

Cascadian Therapeutics (CASC -0.54%) fell 4% in after-hours trading after it announced that it intends to offer and sell shares of its common stock and Series E convertible preferred stock in concurrent but separate underwritten public offerings, although no size was given.

Monday’s Key Earnings

Halliburton (NYSE:HAL) -3% warning of global weakness.

McDonald’s (NYSE:MCD) -0.7% as All Day Breakfast lost steam.

Yahoo (YHOO) +1.1% AH after topping expectations.

Today’s Economic Calendar

8:55 Redbook Chain Store Sales

9:45 PMI Manufacturing Index Flash

10:00 Existing Home Sales

10:00 Richmond Fed Mfg.

1:00 PM Results of $26B, 2-Year Note Auction

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Jan 24)”

Leave a Reply

You must be logged in to post a comment.

still in a fog, no idea if the fed is serious. I am in the weekend ETFs of the round up. Be well.