Good morning. Happy Friday.

The Asian/Pacific markets closed with a lean to the upside. Australia, India and Singapore did the best. Europe is currently mostly down, but movement isn’t too extreme. Greece is down more than 3%. Sweden, Norway and France are also weak. Russia is doing well. Futures in the States point towards a flat-to-up open for the cash market.

—————

VIDEO: There’s a Bull Market Somewhere

—————

The dollar is up. Oil is down; copper is up. Gold and silver are down. Bonds are down.

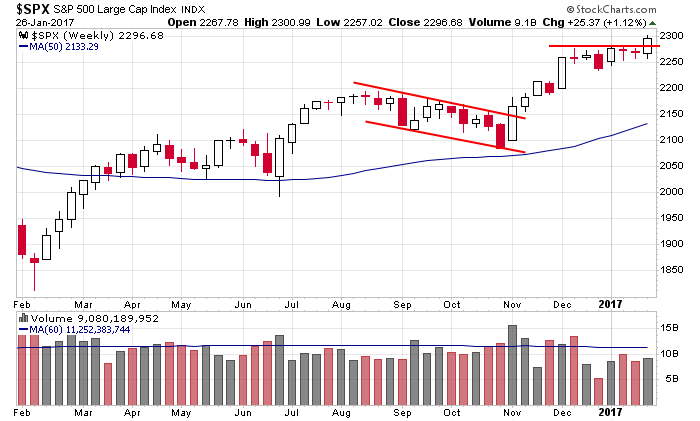

Long is the only side of the market to be on. You can be cautiously long, but you still have to be long. Here’s the S&P weekly.

Stock headlines from barchart.com…

Alphabet (GOOGL -0.17%) slid nearly 3% in after-hours trading after it reported Q4 adjusted EPS of $9.36, lower than consensus of $9.62.

Starbucks (SBUX -0.41%) dropped over 3% in after-hours trading after it reported Q1 comparable same-store sales up 3.0%, weaker than consensus of +3.7%.

Microsoft (MSFT +0.93%) gained nearly 1% in after-hours trading after it reported Q2 adjusted EPS ex-LinkedIn of 84 cents, higher than consensus of 79 cents.

PayPal Holdings (PYPL -0.50%) fell over 3% in after-hours trading after it forecast 2017 adjusted EPS of $1.69-$1.74, weaker than consensus of $1.74.

Wynn Resorts Ltd (WYNN -0.95%) rallied 7% in after-hours trading after it reported Q4 net revenue of $1.30 billion, better than consensus of $1.27 billion.

Juniper Networks (JNPR -1.49%) dropped over 7% in after-hours trading after it said it sees Q1 adjusted EPS of 38 cents-44 cents, weaker than consensus of 46 cents.

Super Micro Computer (SMCI +0.35%) surged 10% in after-hours trading after it reported Q2 adjusted EPS of 48 cents, better than consensus of 46 cents, and then said it sees Q3 sales of $570 million to $630 million, well above consensus of $552.1 million.

Robert Half International (RHI +0.24%) slid nearly 5% in after-hours trading after it reported Q4 EPS of 61 cents, weaker than consensus of 64 cents.

KLA-Tencor Corp. (KLAC -1.68%) rose 3% in after-hours trading after it reported Q2 adjusted EPS of $1,52, higher than consensus of $1.40.

Proofpoint (PFPT +2.26%) fell 4% in after-hours trading after it reported Q4 billings of $138.4 million, below some analysts’ estimates of $140 million.

Valero Energy (VLO -1.40%) gained almost 1% in after-hours trading after it boosted its quarterly dividend to 70 cents a share from 60 cents a share, higher than expectations of 65 cents.

Synaptics (SYNA -2.87%) jumped over 6% in after-hours trading after it reported Q2 net revenue of $461.3 million, above consensus of $451.8 million.

OSI Systems (OSIS -1.66%) climbed 3% in after-hours trading after it reported Q2 adjusted EPS of 68 cents, better than consensus of 61 cents.

Microsemi Corp. (MSCC +0.34%) slipped over 1% in after-hours trading after it reported Q1 adjusted EPS of 86 cents, right on expectations.

Greenhill & Co. (GHL -0.52%) rallied 5% in after-hours trading after it reported Q4 revenue of $101.6 million, higher than consensus of $100.7 million.

Thursday’s Key Earnings

Alphabet (NASDAQ:GOOG) -2.1% AH earnings miss, higher costs.

Baker Hughes (NYSE:BHI) -0.6% on a fourth-quarter loss.

Blackstone (NYSE:BX) +2% as profit nearly doubled.

Biogen (NASDAQ:BIIB) +2.1% on positive guidance for 2017.

Bristol-Myers (NYSE:BMY) -5.5% slashing its outlook.

Caterpillar (NYSE:CAT) -1% dipping on softer guidance.

Celgene (NASDAQ:CELG) -2.2% after acquiring Delinia.

Comcast (NASDAQ:CMCSA) +2.8% boosting its buyback, dividend.

Dow Chemical (NYSE:DOW) +2% after topping estimates.

Ford (NYSE:F) -3.3% seeing lower 2017 profits.

Intel (INTC) +0.1% AH on strong holiday sales.

JetBlue (NASDAQ:JBLU) -3.1% expecting soft January revenues.

Microsoft (MSFT) +1.4% AH buoyed by its cloud business.

PayPal (NASDAQ:PYPL) -0.6% AH with uninspiring Q1 guidance.

Potash (NYSE:POT) -3% on weak fertilizer prices.

Southwest (NYSE:LUV) +9% with record earnings in 2016.

Starbucks (NASDAQ:SBUX) -4% AH on light comparable sales.

VMware (NYSE:VMW) +3.9% AH following strong Q4 results.

Today’s Economic Calendar

8:30 GDP Q4

8:30 Durable Goods

10:00 Consumer Sentiment

1:00 PM Baker-Hughes Rig Count

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Jan 27)”

Leave a Reply

You must be logged in to post a comment.

Friday is nowhere, flat and the nice English lady is here…why?, some good numbers this AM. WYNN is up and Iam doubling a modest position. Yellen is about screw up big.