Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed up across-the board. Hong Kong, China, Australia and Indonesia led the way. Europe is currently mostly up. France, Germany, Austria, the Netherlands, the Czech Republic, Greece, Poland, Turkey, Italy and Spain are doing the best. Futures in the States point towards a moderate gap up open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is flat. Gold is down; copper is up. Gold and silver are down. Bonds are down.

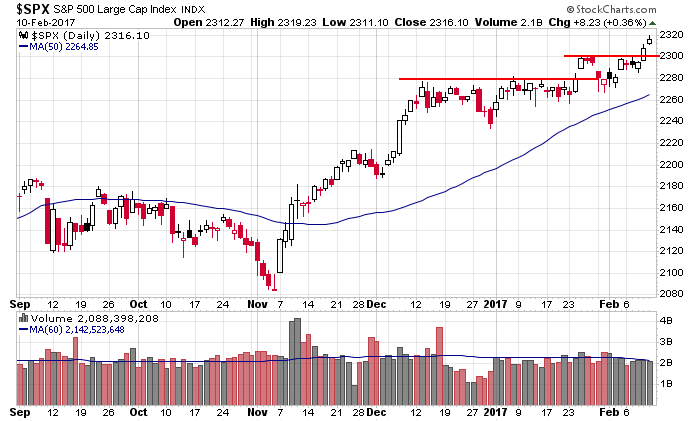

We enter this new week with all the indexes at or near all-time highs. The S&P is on a 7-out-of-8 win streak. Here’s the daily chart. The question is: Can the market go on a run here? Despite the trend obviously being up, the indexes have spent much more time chopping around in ranges than moving directionally. Said another way, a small number of days have accounted for all the gains while all other days have canceled each other out.

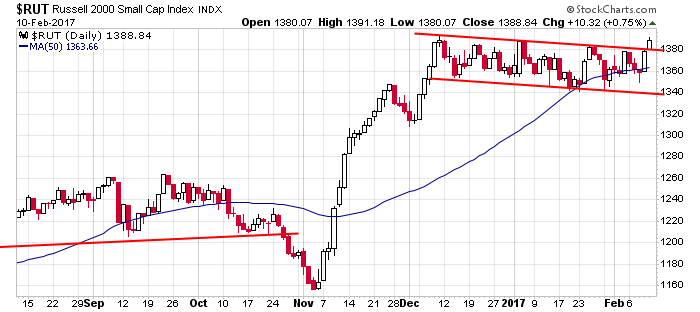

The Russell 2000 may be key here. It’s been lagging, but it’s nicely set up to bust out. Whether it runs or fizzles likely determines the next couple weeks.

Stock headlines from barchart.com…

Nucor (NUE +0.03%) was upgraded to ‘Overweight’ from ‘Equalweight’ at Morgan Stanley with a price target of $78.

AK Steel (AKS -3.12%) was downgraded to ‘Equalweight’ from ‘Overweight’ at Morgan Stanley with a price target of $11.

Occidental Petroleum (OXY +0.41%) was downgraded to ‘Neutral’ from ‘Buy’ at Mizuho Securities USA.

Travelers (TRV +0.80%) was downgraded to ‘Market Perform’ from ‘Outperform’ at FBR Capital Markets.

Gannet (GCI -1.22%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

Hasbro (HAS -0.11%) was rated a new ‘Buy’ at Goldman Sachs with a price target of $110.

J.C. Penney (JCP +0.99%) was upgraded to ‘Equalweight’ from ‘Underweight’ at Morgan Stanley with a price target of $7.

Myriad Genetics (MYGN -0.93%) jumped almost 7% in after-hours trading after it was announced that it will replace Inteliquent in the S&P SmallCap 600 after the close of trading on Tuesday, February 14.

Pershing Square Capital Management said it raised its stake in Restaurant Brands (QSR +1.10%) to 18.1% from a 16.7% stake held in September.

Michael Kors Holdings Ltd (KORS +0.29%) lost 1% in after-hours trading after it said a technical issue with an information technology reporting system made it unable release its Form 10-Q for the quarter ending December 31.

Knoll (KNL +3.09%) slid 2% in after-hours trading after it reported Q4 net sales of $292.9 million, below consensus of $313.5 million.

Hain Celestial Group (HAIN -0.28%) dropped nearly 7% in pre-market trading after it said it doesn’t expect to file 10-Q until internal accounting review and audit process are completed and that the SEC issued a formal order of investigation and issued a subpoena seeking relevant documents.

Vera Bradley (VRA +3.94%) fell 3% in after-hours trading after it was announced that CFO Kevin Sierks will step down on March 31.

Today’s Economic Calendar

none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

3 thoughts on “Before the Open (Feb 13)”

Leave a Reply

You must be logged in to post a comment.

Check WSJ today, DOW outperforms SP they say DIA…….. out performs SPY? Iuse VTI to track the whole show. Live it up, but be somewhere.

break out, not bust out.

bust out, break out – same thing in my eyes