Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Japan, Hong Kong, Singapore, Australia and South Korea posted moderate losses. Europe is currently mostly down. The UK, Germany, France, Austria, Belgium, the Netherlands, Sweden, Switzerland, the Czech Republic, Russia, Poland, Turkey, Finland, Hungary and Italy are down 1% or more. Futures in the States point towards a relatively big gap down open for the cash market (relative to what has become normal lately).

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil is down; copper is up. Gold and silver are up. Bonds are up.

This is the most amount of premarket selling we’ve gotten in a long time.

Two things stand out from the last couple days.

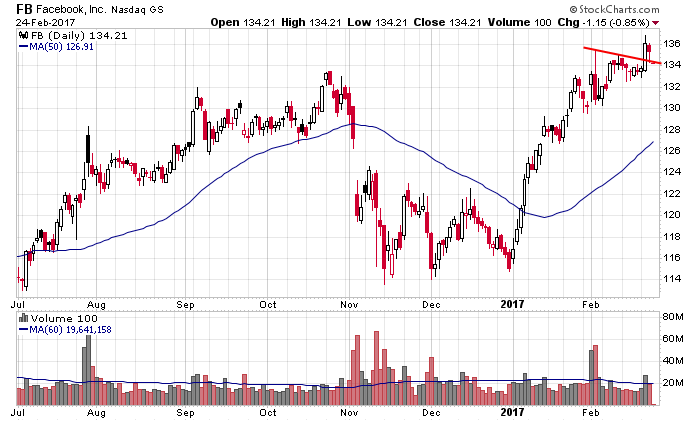

1) The inability of leading stocks to follow through after moving to new highs. Facebook (FB) is an example. It broke out Wednesday on a big jump in volume, but as of today’s open the gains will be gone.

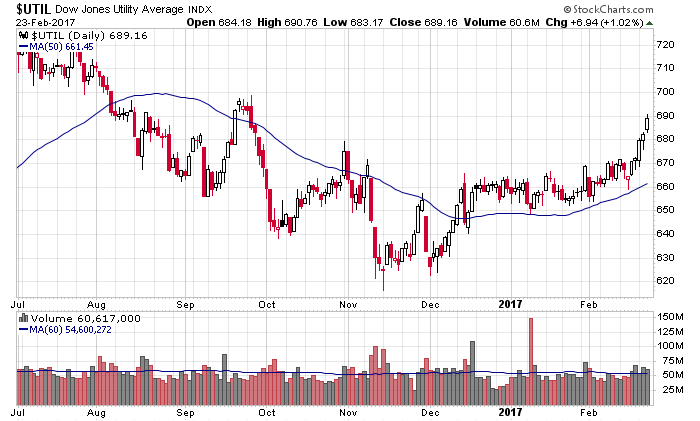

2) Utilities have started doing very well. When they out-perform the market tends to weaken. Here’s $UTIL.

The primary trend is solidly up and will remain solidly up for a long time, but in the near term, more cracks are forming.

Stock headlines from barchart.com…

Goldman Sachs (GS -0.21%) was downgraded to ‘Sell’ from ‘Hold’ at Berenberg with a price target of $190.

Incyte (INCY +0.49%) climbed over 4% in after-hours trading after it was announced that it will replace Spectra Energy in the S&P 500 at the open of trading on Tuesday, February 28.

Nordstrom (JWN -3.11%) rallied 3% in after-hours trading after it reported Q4 adjusted EPS of $1.37, higher than consensus of $1.15.

Stamps.com (STMP -0.52%) fell almost 3% in after-hours trading after it said it sees full-year adjusted EPS of $6.00-$7.00, weaker than consensus of $7.91

Hewlett Packard Enterprise (HPE -0.48%) dropped 6% in after-hours trading after it reported Q1 net revenue of $11.4 billion, weaker than consensus of $12.1 billion, and said it sees Q2 adjusted EPS of 41 cents-45 cents, below consensus of 47 cents.

B&G Foods (BGS -1.37%) slid 6% in after-hours trading after it reported Q4 adjusted EPS of 29 cents, weaker than consensus of 40 cents.

RH US (RH -3.15%) surged 15% in after-hours trading after it reported Q4 adjusted EPS of 68 cents, above consensus of 66 cents.

MercadoLibre (MELI -0.29%) gained 2% in after-hours trading after it reported Q4 net revenue of $256.3 million, better than consensus of $250 million.

Universal Display (OLED -5.33%) jumped nearly 12% in after-hours trading after it reported Q4 EPS of 55 cents, above consensus of 43 cents.

Baidu (BIDU -0.74%) rose 3% in after-hours trading after it reported Q4 adjusted profit for ADS of $1.91, well above consensus of $1.09.

Acacia Communications (ACIA +1.94%) tumbled 11% in after-hours trading after it said it sees Q1 adjusted EPS of 63 cents-70 cents, weaker than consensus of 78 cents.

Sarepta Therapeutics (SRPT -0.76%) gained over 1% in after-hours trading after Point72 Asset Management said it raised its passive stake in the company to 5.2% from 2.5%.

Zoe’s Kitchen (ZOES -1.49%) sank 11% in after-hours trading after it said it sees full-year revenue of $325 million-$327 million, below consensus of $329.1 million.

Accelerate Diagnostics (AXDX +1.23%) rose 3% in after-hours trading after it received clearance from the FDA to market its PhenoTest BC Kit as the first test to identify organisms that cause bloodstream infections and provide information on antibiotic sensitivity.

Emergent BioSolutions (EBS -0.47%) gained over 2% in after-hours trading after it reported Q4 adjusted EPS of 74 cents, better than consensus of 61 cents.

Acadia Healthcare (ACHC +1.41%) fell over 8% in after-hours trading after it said it sees Q1 adjusted EPS of 45 cents-47 cents, below consensus of 56 cents, and then lowered guidance on full-year EPS to $2.40-$2.50, weaker than consensus of $2.53.

Hi-Crush Partners LP (HCLP -6.38%) slid over 7% in after-hours trading after it announced a primary offering of 20.5 million common units.

Thursday’s Key Earnings

Apache (NYSE:APA) -3.5% missing expectations.

Baidu (NASDAQ:BIDU) flat AH hitting the reset button.

Chesapeake Energy (NYSE:CHK) -2.9% after in-line results.

Herbalife (NYSE:HLF) -0.2% AH issuing soft guidance.

Hewlett Packard Enterprise (NYSE:HPE) -6.7% AH on disappointing outlook.

Today’s Economic Calendar

10:00 New Home Sales

10:00 Consumer Sentiment

1:00 PM Baker-Hughes Rig Count

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (Feb 24)”

Leave a Reply

You must be logged in to post a comment.

love to say I know what is happening, but not the last two days. Holding VTI and VFH,& VGK. To hell with gold.

signs of a pull back are beginning to emerge. My last real buy signal was just before the election. I seldom go this long. Still never short a dull market.