Good morning. Happy Friday. Happy Quad Witching Day.

The Asian/Pacific markets closed mostly up. South Korea, Taiwan, Malaysia and Indonesia did the best; China dropped 1%. Europe is currently mostly up. Russia is up 1.5%; France, Greece, Poland and Norway are also doing well. Hungary is weak. Futures in the States point towards a flat and mixed open for the cash market.

—————

Subscribe to LB Weeky – our weekly report that will keep you on the right side of the major and minor trends.

—————

The dollar is flat. Oil and copper are up. Gold and silver are up. Bonds are up.

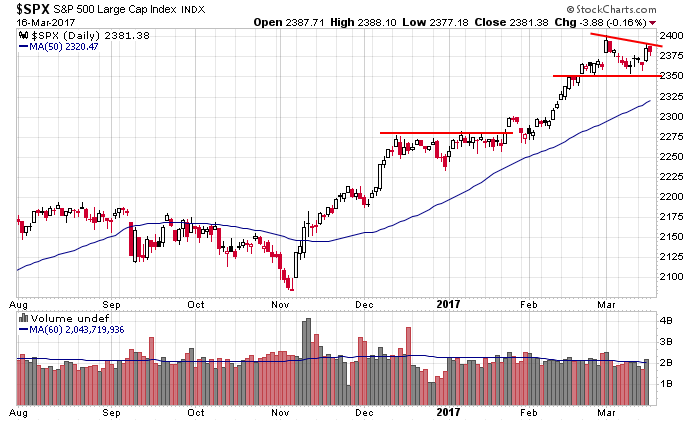

Here’s the S&P daily to remind ourselves what the current situation is. I see no warnings here. The trend is solid, and even if sideways movement persists for a few weeks, the overall health and structure will remain in place.

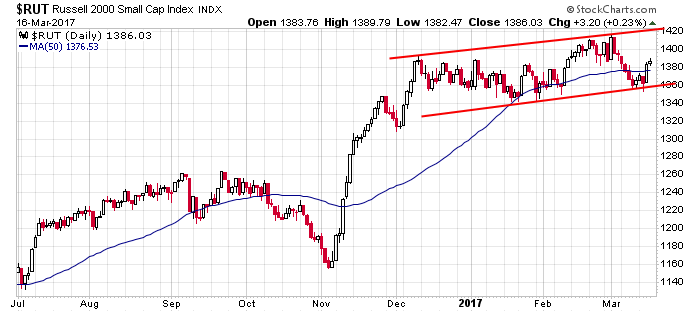

Here’s the Russell – not as bullish as the S&P but certainly not bad. Not bad at all. If this is the weakest index, the market is in great shape.

The market has been in a little funk lately. The quality and quantity of good set ups has declined, the February momentum is gone, and the internals have deteriorated some. No biggie. The market can’t always trend. In fact it spends more time trading in a range than trending, It’s our job to vary position sizes based on the opportunities given.

The Fed is out of the way, and options expire today. There aren’t any major events on the horizon in the near term. The market will be more free to run its course without outside influences.

Stock headlines from barchart.com…

Macerich (MAC -0.42%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sach.

Adobe Systems (ADBE +0.20%) rose over 3% in after-hours trading after it reported Q1 adjusted EPS of 94 cents, higher than consensus of 87 cents. Adobe was then upgraded to ‘Buy’ from ‘Hold’ at Wunderlich Securities with an 18-month target price of $145.

Texas Roadhouse (TXRH +0.52%) was upgraded to ‘Buy’ from ‘Neutral’ at BTIG LLC with a 12-month target price of $50.

Booz Allen (BAH -0.56%) was initiated with a ‘Buy’ at Vertical Research Partners with a 12-month target price of $42.

T Rowe Price Group (TROW +0.26%) was downgraded to ‘Underweight’ from ‘Equalweight’ at Morgan Stanley who lowered its target price on the stock to $64 from $67.

Franklin Resources (BEN +2.14%) was downgraded to ‘Underweight’ from ‘Equalweight’ at Morgan Stanley who lowered its target price on the stock to $38 from $39.

Caleres (CAL +1.28%) sold-off nearly 8% in after-hours trading after it reported Q4 adjusted EPS of 3 cents, below consensus of 38 cents, and said it sees full-year adjusted EPS pf $2.10-$2.20, weaker than consensus of $2.35.

Rayonier (RYN +0.03%) slipped 3% in after-hours trading after it proposed an offering of 5 million shares of its common stock.

AveXis (AVXS -2.80%) rallied 12% in after-hours trading after it reported positive results from the Phase 1 trial of its AVXS-101 drug in treatment of spinal muscular atrophy.

Veritiv (VRTV -5.46%) dropped 5% in after-hours trading after it proposed a secondary offering of 1.8 million shares of common stock for holders.

MidwestOne Financial Group (MOFG -0.49%) fell 4% in after-hours trading after it announced an underwritten public offering of shares of its common stock by a selling shareholder, the John M. Morrison Revocable Trust #4, although no size was given.

Valeant Pharmaceuticals International (VRX +1.73%) climbed 4% in after-hours trading after ValueAct Holdings said it increased its stake in the company to 5.2% from 4.3%.

Exa Corp. (EXA +4.11%) sank over 15% in after-hours trading after it reported Q4 revenue of $19.5 million, below consensus of $20.2 million, and said it sees Q1 revenue in the range of $16 million-$17 million, less than consensus of $18.7 million.

Inventure Foods (SNAK +2.23%) slumped 16% in after-hours trading after it failed to file its 10-K, citing not yet completed Fresh Frozen Foods trademark and goodwill impairment tests.

Thursday’s Key Earnings

Adobe ADBE +4.4% AH after FQ1 beat, raising guidance.

Today’s Economic Calendar

9:15 Industrial Production

10:00 Atlanta Fed’s Business Inflation Expectations

10:00 Consumer Sentiment

10:00 Leading Indicators

1:00 PM Baker-Hughes Rig Count

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (Mar 17)”

Leave a Reply

You must be logged in to post a comment.

NO one expected the reaction the FED action elicited. I guess it means usual seasonal pattern is in play. In the end debt level rises as the executive branch spends and retirement incomes get mauled. Good thing i am getting old before we go bust.

Only one little problem.

Do you believe in Dow Theory? If so, then the fact that the Dow Transports are not confirming the rally in Dow Jones Industrials should be setting your Spidey Senses tingling. It’s a warning of potential ugliness. ;-D

http://stockcharts.com/h-sc/ui?s=%24TRAN&p=D&yr=0&mn=6&dy=0&id=p97143858265