Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Japan, Hong Kong and Malaysia posted the biggest losses. Europe is currently mostly down. The UK, Austria, Norway, Switzerland, Russia, Greece, Poland and Hungary are down the most. Futures in the States point towards a down open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is up a small amount. Oil and copper are down. Gold and silver are down. Bonds are flat.

Last day of the week and month.

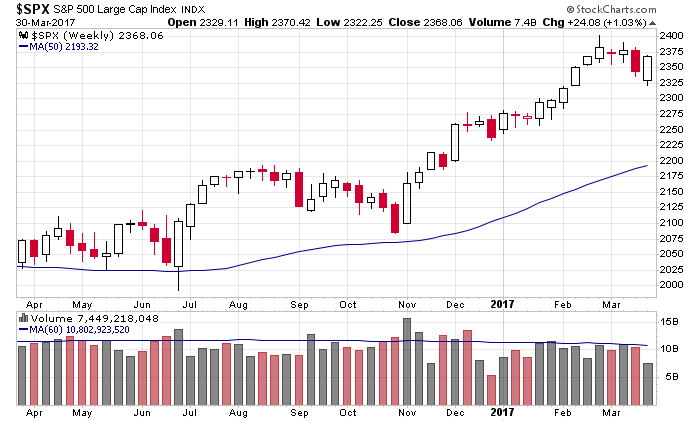

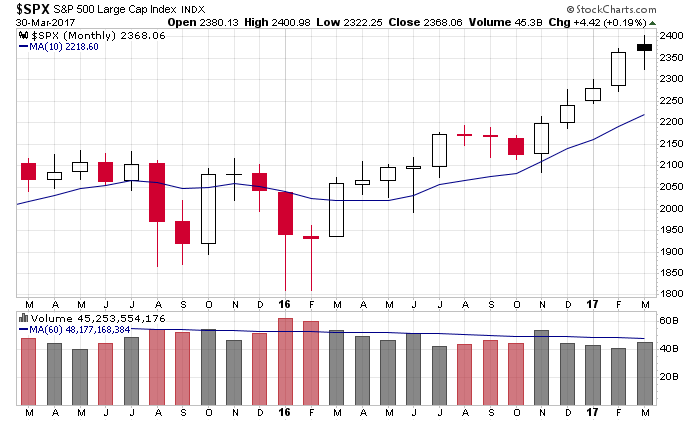

Last week was the biggest down week of the year. Barring a big sell-off today, the biggest up week of the year will be posted.

And if the S&P can resist dropping 4.42 points, it’ll post a gain for the 5th straight month.

There’s no arguing with the overall trend.

In the near term the market’s breadth needs to improve to support further gains, but overall the market has been and remains in good shape.

Stock headlines from barchart.com…

Corning (GLW +0.29%) was downgraded to ‘Neutral’ from ‘Buy’ at Citigroup on valuation.

Boeing (BA +0.20%) was awarded a $2.2 billion contact for 17 P-8A Poseidon jets.

The U.S. Environmental Protection Agency announced that Sherwin-Williams (SHW +0.02%) will pay $14 million to clean up a paint dump in Gibbsboro, New Jersey.

Intel (INTC +0.51%) was rated new ‘Outperform’ at Macquarie Research with a 12-month target price of $40.

CME Group (CME +0.30%) was upgraded to ‘Outperform’ at RBC Capital Markets with a 12-month target price of $134.

Amazon.com (AMZN +0.23%) was initiated with a ‘Buy’ at Loop Capital Markets with a 12-month target price of $1,100.

Broadcom Ltd (AVGO -0.57%) was rated new ‘Outperform’ at Macquarie Research with a 12-month target price of $265.

MacroGenics (MGNX -6.48%) gained nearly 2% in after-hours trading after it was rated a new ‘Outperform’ at Raymond James with a price target of $26.

Exelixis (EXEL +0.33%) was initiated with a ‘Buy’ at Needham & Co with a 12-month target price of $28.

Akari Therapeutics (AKTX +4.96%) rallied 7% in after-hours trading after the U.S. FDA granted Fast Track designation for Coversin to treat the rare blood disorder, paroxysmal noctutnal hemoglobinuria.

CytoSorbents (CTSO -0.91%) dropped 8% in after-hours trading after it announced that it had commenced an underwritten public offering of its common stock, although no size was given.

Orexigen Therapeutics (OREX -2.51%) lost 1% in after-hours trading after it filed a prospectus for $20 million of its common stock.

BioTime (BTX +0.30%) climbed nearly 5% in after-hours trading after it was rated a new ‘Outperform’ at Raymond James with a price target of $6.

Today’s Economic Calendar

8:30 Personal Income and Outlays

9:45 Chicago PMI

10:00 Consumer Sentiment

10:00 Fed’s Kashkari speech

1:00 PM Baker-Hughes Rig Count

10:30 PM Fed’s Bullard: U.S. Monetary and Economic Policy

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Mar 31)”

Leave a Reply

You must be logged in to post a comment.

Some doubt regarding economic performance last quarter, yet the Fed calls for more rate increases? Be careful since there is likely big confusion coming soon. Holding on to reits. best