Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Hong Kong, China and Australia were weak; Japan, Indonesia and Malaysia did ok. Europe is currently posting sizeable, across-the-board losses. The UK, France, Austria, the Netherlands, Norway, Italy, Portugal, Sweden, Russia and Greece are down more than 1%. Futures in the States point towards a moderate gap down open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is down. Oil and copper are down. Gold and silver are down. Bonds are up.

Coming into this week I was looking for a local bottom – not THE bottom, just A bottom.

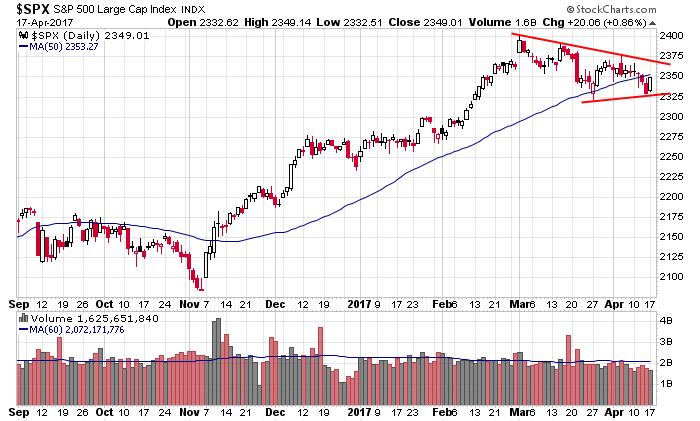

Yesterday the S&P gained 20 points; it’ll give back about 35% of those gains at today’s open.

Overall the S&P is consolidating within a range.

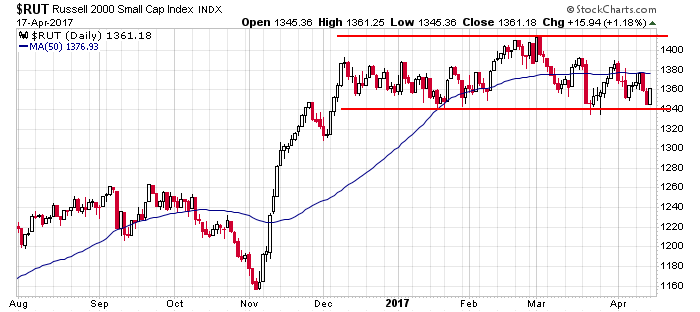

So is the Russell 2000.

The big picture is fine. The near term is much more neutral. The question is: can breadth improve enough to support a resumption of the trend, or do we need more of a washout to set the stage. For now I’m looking for more of a washout.

Stock headlines from barchart.com…

Goldman Sachs (GS +1.32%) dropped over 2% in pre-market trading after it reported Q1 net revenue of $8.03 billion, weaker than consensus of $8.33 billion.

Harley-Davidson (HOG -0.50%) slumped 5% in pre-market trading after it reported Q1 total motorcycles and related products revenue of $1.33 billion, below consensus of $1.35 billion.

Netflix (NFLX +3.03%) rose over 1% in after-hours trading after it reported 3.2 million new subscribers in Q2, higher than consensus of 2.5 million.

First Horizon National (FHN +1.93%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Vining Sparks with a 12-month target price of $21.

United Continental Holdings (UAL +2.46%) gained over 1% in after-hours trading after it reported Q1 adjusted EPS of 41 cents, above consensus of 38 cents.

Synovus (SNV +2.05%) reported Q1 adjusted EPS of 57 cents, higher than consensus of 51 cents.

Celanese (CE +1.50%) reported Q1 adjusted EPS of $1.81, better than consensus of $1.72.

Galapagos NV (GLPG +2.71%) slipped over 2% in after-hours trading after it announced that it will share $275 million in American Depository Shares (ADS) via Morgan Stanley.

Barracuda Networks (CUDA +1.08%) dropped nearly 3% in after-hours trading after it said it expects fiscal 2018 revenue of $370 million-$380 million, the midpoint which trails consensus of $378.1 million.

Agios Pharmaceuticals (AGIO +0.33%) lost 3% in after-hours trading after it proposed selling up to 4.5 million shares of its common stock in an underwritten public offering.

Cabela’s (CAB +0.56%) rallied 6% in after-hours trading after it announced an amended deal with Bass Pro Shops who will buy Cabela’s for $61.50 a share versus an October 2016 offer of $65.50 a share.

Rigel Pharmaceuticals (RIGL +0.32%) gained almost 2% in after-hours trading after it submitted to the FDA an NDA for its fostamatinib drug for patients with chronic and persistent immune thrombocytopenia.

Wi-LAN (WILN +1.01%) jumped 10% in after-hours trading after it announced a pact to buy International Road Dynamics for $47.4 million.

Today’s Economic Calendar

8:30 Housing Starts

8:55 Redbook Chain Store Sales

9:00 Fed’s George speech

9:15 Industrial Production

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

5 thoughts on “Before the Open (Apr 18)”

Leave a Reply

You must be logged in to post a comment.

Banks down in earnings This AM, D Paul gets his buy-in day? I Still gutless but eyeballing five low cost dividend stocks soon.

When Trump shows he is ineffective, look out below.

yummy–volitility chop

scared money going to usa out of europe ,middle east japan

when all the money is electronically in usd in usa

trump will take his close off and show he is no better than nude yellen

its a soverign debt crisis with war for some excitement diversion

join the casino and be a day trader

it is obvious from Jasons spx chart we need another lower low and lower high before the bears are happy

i am only taking very short duration interday scalps

Today’s put call ratio is down to about the low for the last 12 months. I am not predicting a crash BUT I won’t recommend going long here.

I did not get my buy level on the NASDAQ the other day either.

Time to ride the pine!