Good morning. Happy Tuesday.

2010 started off on a good note. Most indexes made new highs, and about 95% of the market groups gained ground. If there’s any truth to the first week of January and the entire month of January being a good barometer, we’re off to a good start. But it is only one day and last year’s January weakness was wrong to suggest the entire year would be weak.

As noted in yesterday’s PM Obs, the internals are not in screaming bull mode but they do support the uptrend. I guess that means there’s more upside potential before indicating an overbought situation.

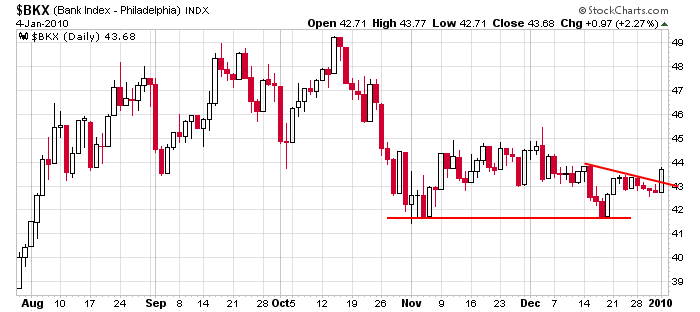

It was nice to see the banks do so well yesterday. They got a free pass in 2009 and were able to build up reserves, but it seemed like the punch bowl was taken away late in the year. They successfully tested their low and yesterday moved to a 3-week high. The group is still lagging, but at least they’re moving in the right direction. Here’s the daily.

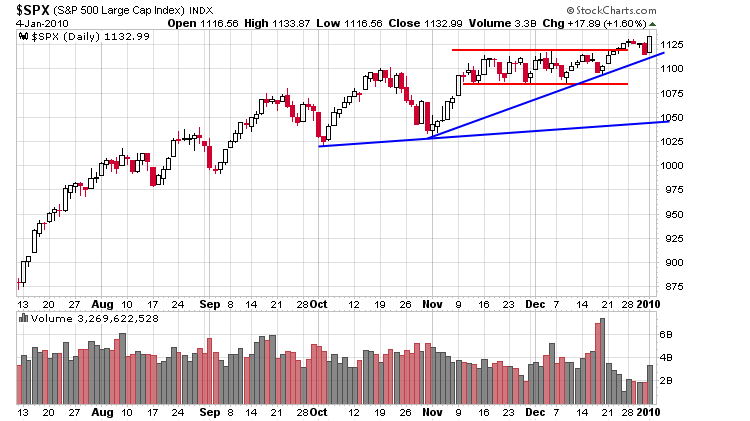

Here’s an update of the SPX daily. The index had drifted above resistance on light volume and got no follow through. For now, yesterday was a successful test.

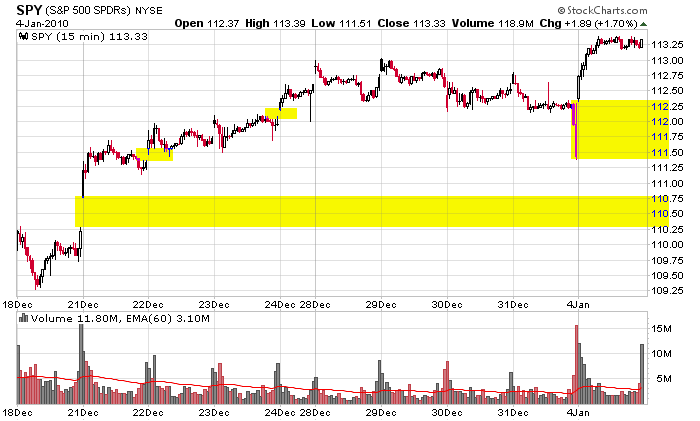

Zooming in with the 15-min SPY. Another gap remains unfilled.

As of now, today’s open will be near yesterday’s high. The trend is up; the only direction I’m interested in playing is the long side. If the market drops, I’ll cash out and wait for things to settle down.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports and Economic Numbers