Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Japan, New Zealand and Indonesia led the way; Hong Kong, South Korea, India and Australia also did well. Europe is currently quiet. Poland and Greece are up; Hungary and Spain are down. Futures in the States point towards a flat open for the cash market.

—————

My podcast – with Chat With Traders

—————

The dollar is up. Oil is down; copper is flat. Gold and silver are down. Bonds are down.

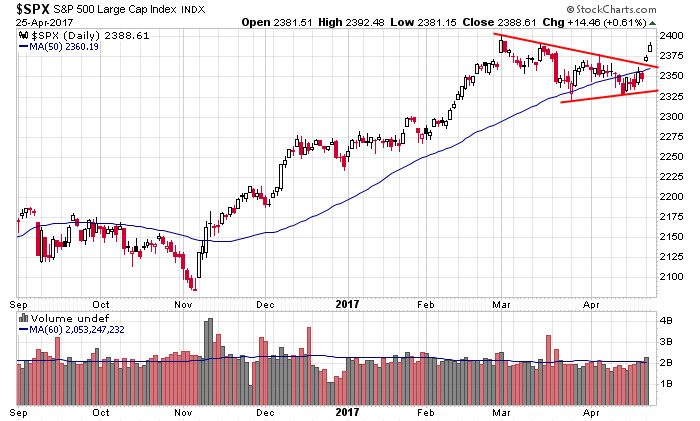

Two big up days in a row on strong volume. It’s a great start…it somewhat wakes the market up…but the indexes are still mostly range bound. Both the S&P and Russell are near their highs. A rest here, followed by a higher high would be great movement for the bulls. A dip to successfully test the 50-day MAs would be just as bullish. Here are the SPX and RUT charts.

Stock headlines from barchart.com…

Edwards Lifesciences (EW +0.98%) climbed 9% in pre-market trading after it reported Q1 adjusted EPS of 94 cents, above consensus of 82 cents, and then raised guidance for full-year EPS to $3.43-$3.55 from a February 1 forecast of $3.30-$3.45.

U.S. Steel (X -0.29%) plunged 16% in pre-market trading after it reported Q1 adjusted Ebitda of $74 million, well below consensus of $254.7 million, and then cut guidance on full-year EPS to $1.50 from a January 31 estimate of $3.08.

Costco Wholesale (COST +0.20%) rose nearly 3% in pre-market trading after it raised its quarterly dividend to 50 cents a share from 45 cents, higher than consensus of 49 cents, and said it will pay a $7 a share special dividend May 26 to holders of record May 10.

Capital One Financial (COF +1.06%) fell 4% in after-hours trading after it reported Q1 adjusted EPS of $1.75, weaker than consensus of $1.92.

Discover Financial Services (DFS +0.55%) slid over 4% in after-hours trading after it reported Q1 revenue net of interest expense $2.34 billion, below consensus of $2.36 billion.

Juniper Networks (JNPR -1.73%) rose 3% in after-hours trading after it reported Q1 adjusted EPS of 46 cents, better than consensus of 42 cents.

iRobot (IRBT -0.17%) jumped nearly 10% in after-hours trading after it reported Q1 EPS of 58 cents, stronger than consensus of 31 cents, and then said it sees full-year EPS of $1.45-$1.70, higher than consensus of $1.54.

CH Robinson Worldwide (CHRW +0.14%) lost 1% in after-hours trading after it said lower revenue at truckload and intermodal services reflects weak pricing.

Neurocrine Biosciences (NBIX +3.55%) slid 4% in after-hours trading after it announced its intention to offer $450 million of convertible senior notes due 2024.

Crown Castle International (CCI -0.46%) lost 1% in after-hours trading after it announced that it has commenced an offering of 4.75 million shares of its common stock in a registered public offering.

Medical Properties Trust (MPW +0.22%) fell 3% in after-hours trading after it announced that it has commenced an offering to sell 37.5 million shares of its common stock in an underwritten public offering.

Flexion Therapeutics (FLXN -0.95%) tumbled 12% in after-hours trading after it announced its intention to offer $125 million of convertible senior notes due 2024.

Aratana Therapeutics (PETX -1.15%) jumped nearly 7% in after-hours trading after it reached agreement with the FDA’s Center for Vetinary Medicine regarding resubmission for Entyce which may be commercially available by fall of 2017 if submission is approved.

Zix Corp (ZIXI -2.62%) rallied 10% in after-hours trading after it boosted its fiscal 2017 revenue view to $66.2 million-$66.7 million from a February estimate of $64.5 million-$666.0 million.

Amtech Systems (ASYS -0.90%) surged 30% in after-hours trading after it received a follow-on order for the second phase of a IGW solar project in China.

Wednesday’s Key Earnings

3M (NYSE:MMM) +0.5% raising outlook for 2017.

AT&T (NYSE:T) -0.3% AH as wireless equipment sales slid.

Biogen (NASDAQ:BIIB) +3.6% exceeding expectations.

Caterpillar (NYSE:CAT) +7.9% crushing estimates.

Chipotle (CMG) +2.9% AH increasing comparable sales.

Coca-Cola (NYSE:KO) -0.4% with flat organic revenues.

Corning (NYSE:GLW) +3.7% posting strong sales growth.

DuPont (NYSE:DD) +3.6% beating expectations.

Eli Lilly (NYSE:LLY) -2.7% lowering EPS guidance.

Freeport-McMoRan (NYSE:FCX) +7.1% seeing big cash flows.

Lockheed Martin (NYSE:LMT) -2.2% trimming outlook.

McDonald’s (MCD) +5.6% growing comparable sales.

Realty Income (NYSE:O) +1.1% AH beating estimates.

Rite Aid (NYSE:RAD) +6.4% following an earnings beat.

U.S. Steel (NYSE:X) -17% AH after a shocking loss.

Valero (NYSE:VLO) -1.5% expecting higher biofuel costs.

Wynn Resorts (NASDAQ:WYNN) +4.1% AH getting nod for a lagoon-theme park.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

10:30 EIA Petroleum Inventories

1:00 PM Results of $15B, 2-Year FRN Auction

1:00 PM Results of $34B, 5-Year Note Auction

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Apr 26)”

Leave a Reply

You must be logged in to post a comment.

mUCH HAPPENING, BUT the taxation game starts today. It could be a driver to new highs in stks again. AS it was the last two days have moved the ETFs and mutuals hard. Made money, but will I keep it?? Then the Senate is briefed at the presidents house could be the big news on NKorea. Do not nap today.