Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Japan, South Korea, New Zealand, Taiwan, Malaysia, and Singapore are doing well. Europe is currently mostly up. Greece is up more than 2%; Portugal is up more than 1%; the UK, France, Poland, Finland, Switzerland, Norway, Spain, Italy and the Netherlands are doing well. Futures in the States point towards a mixed and flat open for the cash market.

—————

VIDEO: There’s a Bull Market Somewhere

—————

The dollar is flat. Oil is up; copper is down. Gold is down; silver is up. Bonds are down.

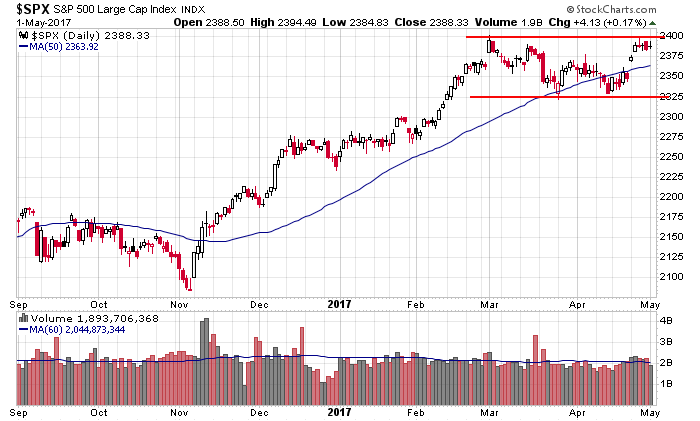

Yesterday big-cap tech stocks jumped while the rest of the market traded quietly. In fact the S&P, despite big gains from FB, AMZN, NFLX, GOOGL, MSFT and TSLA, only gained a couple points on light volume, and it didn’t break out to a new high. Here’s the daily.

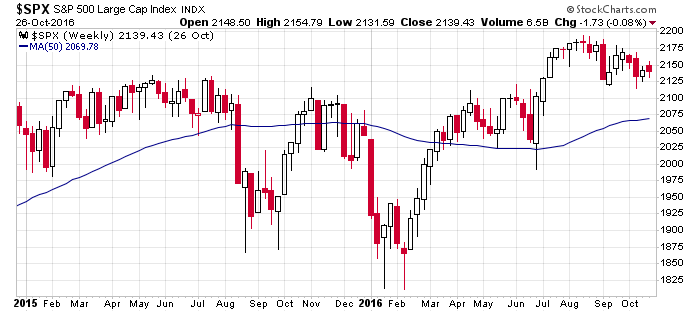

This reminds me of the time period between Jan 1, 2015 and October 26, 2016 (about 22 months), when the S&P increased in market cap by $675 billion but 630 of it was concentrated in just four stocks (FB, AMZN, NFLX, GOOGL). During that time, the market traded range bound. Here’s the chart.

I’d like to see great participation. If these big-cap are doing well, there should be a ripple effect. Suppliers should be doing better. Advertisers should be doing better. Strength should not be concentrated.

Stock headlines from barchart.com…

Cognex (CGNX +0.34%) lost nearly 2% in after-hours trading after it said it sees Q2 revenue of $165 million-$170 million, below consensus of $171.8 million.

Texas Roadhouse (TXRH -1.92%) jumped 10% in after-hours trading after it reported Q1 revenue of $567.7 million, higher than consensus of $560.7 million.

Luminex (LMNX +0.53%) rallied 16% in after-hours trading after it reported Q1 adjusted EPS of 28 cents, well above consensus of 16 cents, and then said it sees full-year revenue of $300 million-$310 million, above consensus of $301.4 million.

Span-America Medical Systems (SPAN -0.18%) surged 35% in after-hours trading after it was bought by Savaria for $80.2 million or about $29 a share.

Exelixis (EXEL +3.35%) rose 4% in after-hours trading after it reported an unexpected Q1 profit of 5 cents per share, better than consensus for a loss of -1 cent per share.

Chegg (CHGG +1.66%) climbed nearly 9% in after-hours trading after it reported Q1 adjusted EPS of 6 cents, double consensus of 3 cents, and then said it sees full-year Ebitda of $38 million-$40 million, higher than consensus of $34.6 million.

Taylor Morrison Home Corp (TMHC +4.55%) lost 3% in after-hours trading after it announced the commencement of an underwritten public offering of 10.0 million shares of its Class A common stock.

Corcept Therapeutics (CORT +1.36%) rallied over 8% in after-hours trading after it boosted its 2017 revenue outlook to $125 million-$135 million from a prior view of $120 million-$130 million.

Tenet Healthcare Corp (THC -2.04%) jumped 13% in after-hours trading after it reported a Q1 adjusted EPS loss of -27 cents, narrower than consensus for a loss of -52 cents, and then said it sees full-year adjusted EPS of $1.05 to $1.30, the midpoint above consensus of $1.13.

Harmonic (HLIT unch) tumbled over 15% in after-hours trading after it said it sees full-year EPS of 2 cents-16 cents, well below consensus of 24 cents.

Advanced Micro Devices (AMD +2.41%) dropped 9% in after-hours trading after it reported Q1 revenue of $984 million, weaker than consensus of $984.5 million.

Community Health Systems (CYH +0.12%) rose over 6% in after-hours trading after it reported Q1 adjusted EPS from continuing operations of 8 cents, higher than consensus of 6 cents.

Angie’s List (ANGI +0.17%) surged 40% in after-hours trading after IAC bought the company for $500 million, or $8.50 a share.

Today’s Economic Calendar

Auto Sales

FOMC meeting begins

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

3 thoughts on “Before the Open (May 2)”

Leave a Reply

You must be logged in to post a comment.

Nothing happens today. But it will pickup shortly in plunge then a recovery followed by another plunge, it is seasonal and god knows what else. Live for the new fed tax plan in your spare time.

the marsians are planning a attack on earths satiltes taking out the internet

instos are short nas and dax

the dax has just topped and is in the hands of the jaws of death

as humans are to be replaced by hollow grams