Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Hong Kong did well; Australia and the Philippines closed down. Europe currently leans to the upside. Turkey and Greece are up more than 1%; the UK, Germany, Finland, Switzerland, Norway, the Netherlands, Italy, Portugal, Austria and Sweden are also doing well. Futures in the States point towards a positive open for the cash market.

—————

VIDEO: The Trend is Your Friend

—————

The dollar is up. Oil is down; copper is up. Gold and silver are down. Bonds are down.

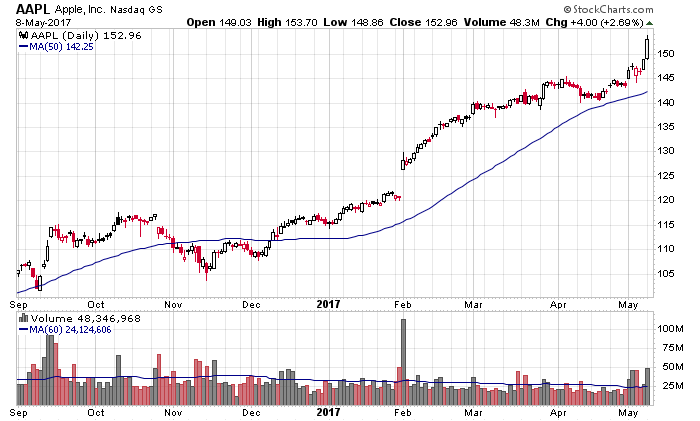

Apple (AAPL) was yesterday’s big story. It jumped 2.7%, which is a pretty common move, but for the largest publicly traded company, it’s a huge 1-day move. Apple’s market cap is now north of $800 billion. Becoming the first trillion-dollar company seems like a matter of when, not if.

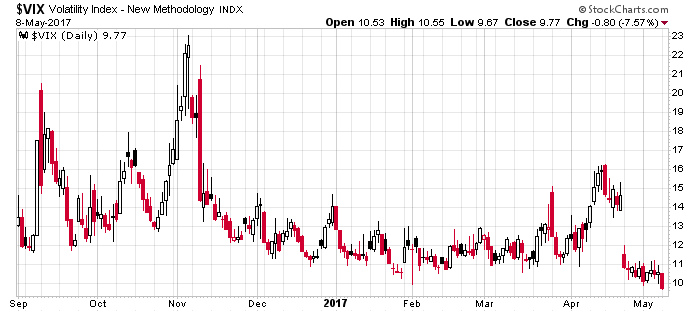

Also of note yesterday was the VIX, which closed below $10 for the first time in 10 years and at its lowest level since 1993. To me this is the new normal – except during hysterical times, which don’t happen much. There has been massive inflows into index funds in recent years. This removes a lot of volatility from the market. Also, so much of the trading volume is just computers trading back and forth with each other – the machines, which are far less emotional than us human beings, keep things in check. We just don’t have wild swings any more – not intraday or on the daily charts. Here’s the daily VIX chart going back to September.

The low VIX reading has been accompanied – to no surprise – by an historically small 10-day S&P range. Even with last Friday’s late-day jump, the S&P has traded in a 0.91% range going back two weeks. Since 1970, this is the third-smallest. Somehow, some way, while getting decent movement from individual stocks, virtually everything has canceled out and resulted in the market sitting tight in a small area.

Stock headlines from barchart.com…

Micron (MU +1.48%) is down 3% in pre-market trading after it was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Tyson Foods (TSN +0.57%) reported Q2 adjusted EPS of $1.10, slightly below consensus of $1.02.

Varian Medical Systems (VAR +0.60%) is up over 2% in pre-market trading after it was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup with a price target of $119.

Fluor (FLR -4.78%) was upgraded to ‘Buy’ from ‘Hold’ at Canaccord Genuity with a price target of $55.

Louisiana-Pacific (LPX -3.61%) was downgraded to ‘Neutral’ from ‘Buy’ at DA Davidson & Co.

United Rentals (URI +1.49%) was upgraded to ‘Outperform’ from ‘In-Line’ at Evercore ISI.

NXP Semiconductors NV (NXPI -0.19%) was downgraded to ‘Neutral’ from ‘Buy’ at Nomura/Instinet.

LyondellBasell Industries NV (LYB +3.37%) was downgraded to ‘Underperform’ from ‘Buy’ at Bank of America Merrill Lynch.

Temper Sealy International (TPX +2.31%) was upgraded to ‘Hold’ from ‘Sell’ at SunTrust Robinson Humphrey.

Berkshire Hathaway ({=BRK/B=}) fell slightly in after-hours trading after its Q1 operating EPS was a little below consensus due to disappointing insurance results.

Delta (DAL +0.12%) is reportedly considering a delay in a $3 billion Airbus order.

Williams Cos (WMB +2.44%) was raised to “Outperform” from “Market Perform” by Wells Fargo.

Monday’s Key Earnings

Hertz (NYSE:HTZ) -17.7% AH on a big earnings miss.

JD.com (NASDAQ:JD) +7.7% following a surprise profit.

Marriott (NYSE:MAR) +3.9% AH beating estimates.

Pandora (NYSE:P) +2.9% AH reviewing strategic options.

Today’s Economic Calendar

6:00 NFIB Small Business Optimism Index

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

10:00 Wholesale Trade

1:00 PM Results of $24B, 3-Year Note Auction

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

3 thoughts on “Before the Open (May 9)”

Leave a Reply

You must be logged in to post a comment.

The vix is below suggesting that all is well. Be careful it is ambiguous when low.Own some foreign stocks.

the vix is below 10.

AINT THE BULLS FUNNY CREATURES