Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Hong Kong, India and Australia did well; China, South Korea, Indonesia and the Philippines were weak. Europe is currently mixed too. Turkey, Greece and Russia are up; Poland, Spain and Portugal are down. Futures in the States point towards a mixed and flat open for the cash market.

—————

VIDEO: No Tech, No Problem

—————

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are up.

We’re getting the typical premarket movement from individual stocks, but all the gains and losses are cancelling each other out and leading to the indexes being flat. Even the firing of the FBI Director isn’t changing anything.

NVDA is up solidly. WIX continues to climb. CROX is jumping, having been in a downtrend for a while. EA is up 7%. TRIP is up 6%. On the flip side, FOSL is down 22%. YELP is down almost 25%. DEPO continues to sell off.

But despite these moves, and others, the indexes are flat – just like they’ve been the last two weeks.

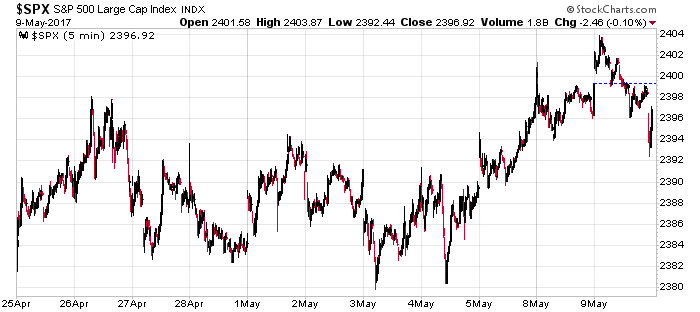

The S&P has traded in a 24-point range the last 11 days. It’s trying to re-assert its intermediate uptrend, but it just can’t get any traction. Every little move up stalls and gets turned back. Other than the Nas, which is obviously trending up, this is how all the indexes are acting – just not able to build any momentum.

Stock headlines from barchart.com…

Disney (DIS +0.58%) slid nearly 3% in pre-market trading after it reported Q2 revenue of $13.3 billion, weaker than consensus of $13.5 billion.

NVIDIA (NVDA +0.17%) is up 11% in pre-market trading after it reported Q1 adjusted EPS of 85 cents, higher than consensus of 81 cents.

Mylan NV (MYL +1.69%) climbed nearly 3% in pre-market trading after it reported Q1 adjusted EPS of 93 cents, better than consensus of 92 cents.

Electronic Arts (EA +0.29%) gained over 2% in after-hours trading after it reported Q4 adjusted EPS of 85 cents, higher than consensus of 75 cents, and then said it sees Q1 adjusted EPS of 25 cents, better than consensus of 17 cents.

Priceline Group (PCLN +0.38%) fell over 3% in pre-market trading after it reported Q1 revenue of $2.42 billion, less than consensus of $2.45 billion, and then said it sees Q2 adjusted EPS of $13.30-$14.00, weaker than consensus of $14.99.

Jazz Pharmaceuticals PLC (JAZZ +1.07%) dropped 5% in after-hours trading after it reported Q1 adjusted EPS of $2.31, below consensus of $2.34.

Microchip Technology (MCHP +1.31%) rose 5% in after-hours trading after it reported Q3 adjusted EPS from continuing operations $1.16, better than consensus of $1.06.

Acacia Communications (ACIA +3.33%) dropped 14% in after-hours trading after it said it sees Q2 adjusted EPS of 22 cents-35 cents, well below consensus of 74 cents.

TripAdvisor (TRIP -0.23%) climbed 5% in after-hours trading after it announced that it will pull back from its struggling instant book feature.

Fossil Group (FOSL +4.49%) slumped over 15% in after-hours trading after reported Q1 comparable sales fell -11%, much weaker than consensus of -3.8%, and then lowered guidance on full-year adjusted EPS to 80 cents-$1.50 from a prior view of $1.00-$1.70.

Coherent (COHR +1.14%) jumped 7% in after-hours trading after it reported Q2 adjusted EPS of $2.91, well above consensus of $2.45.

Yelp (YELP -2.80%) plunged 30% in after-hours trading after it reported Q1 net revenue of $197.3 million, below consensus of $198.4 million, and then said it sees Q2 revenue of $202 million-$206 million, weaker than consensus of $215.3 million.

Nuance Communications (NUAN +0.39%) gained 2% in after-hours trading after it reported Q2 adjusted EPS of 43 cents, higher than consensus of 38 cents.

TrueCar (TRUE +0.58%) jumped 6% in after-hours trading after it reported Q1 revenue of $75.8 million, above consensus of $73.3 million, and then said it sees Q2 revenue of $79 million to $81 million, higher than consensus of $77.7 million.

Electro Scientific Industries (ESIO +4.20%) surged over 20% in after-hours trading after it reported Q4 adjusted EPS of 9 cents, better than consensus for a loss of -5 cents, and then said it sees Q1 adjusted EPS of 15 cents-20 cents, well above consensus of 3 cents.

Tuesday’s Key Earnings

Allergan (NYSE:AGN) -1.4% despite beating estimates.

Electronic Arts (NASDAQ:EA) +6.7% AH after a big rise in revenues.

Nvidia (NASDAQ:NVDA) +11% AH riding an AI and gaming boom.

Plug Power (NASDAQ:PLUG) -7.5% missing estimates.

Valeant (NYSE:VRX) -2.2% as analysts remain wary.

Priceline (NASDAQ:PCLN) -3.8% on sluggish sales.

Walt Disney (DIS) -2.4% AH with concerns at ESPN.

Whole Foods (NASDAQ:WFM) -0.4% after a downbeat quarter.

Yelp (NYSE:YELP) -28% AH chopping guidance for 2017.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Import/Export Prices

10:00 Atlanta Fed’s Business Inflation Expectations

10:30 EIA Petroleum Inventories

1:00 PM Results of $23B, 10-Year Note Auction

2:00 PM Treasury Budget

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

5 thoughts on “Before the Open (May 10)”

Leave a Reply

You must be logged in to post a comment.

The new 1%” gained $260Bn since March 1, the 99% lost $260Bn. The market is heavily favoring just a few stocks. Moreover the old Dow theory shows transport is lagging industrials. We should be very careful if we own a portfolio.

Are those real numbers or are you just making them up?

Jason they are real. Thurs numbers show a heavy bias.

Thanks whidbey

the failed attempted rotation is the teddy bears picnic

the internet to be banned and replaced by beatles

spx to 2344 or is it 44