Good morning. Happy Thursday.

The Asian/Pacific markets closed with a lean to the upside. South Korea, New Zealand, Taiwan and Australia did well. Europe currently leans to the downside. Greece, Finland, Norway, Spain, Italy, Portugal and Austria are weak. Futures in the States point towards a slight down open for the cash market.

The dollar is down slightly. Oil and copper are up. Gold and silver are up. Bonds are down.

Solid day yesterday for the Nas and Nas 100 – the other indexes didn’t come along for the ride. They weren’t overly weak; they just didn’t show much interest in moving up with energy.

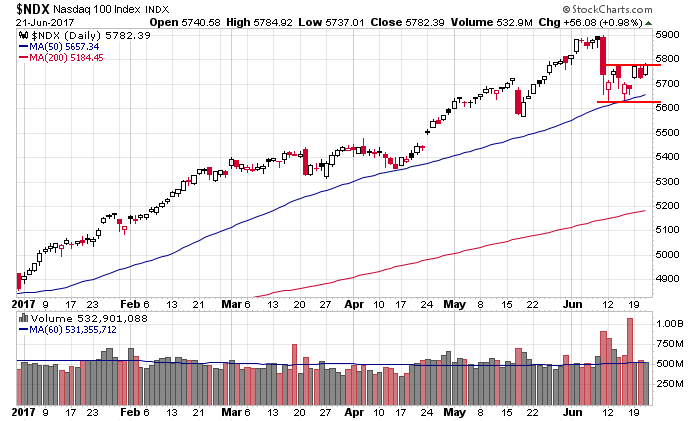

Here’s the Nas 100. Twice it bounced off its 50 and now it sits near a resistance level. This chart is rock solid. You can’t be anything but long. Simple as that.

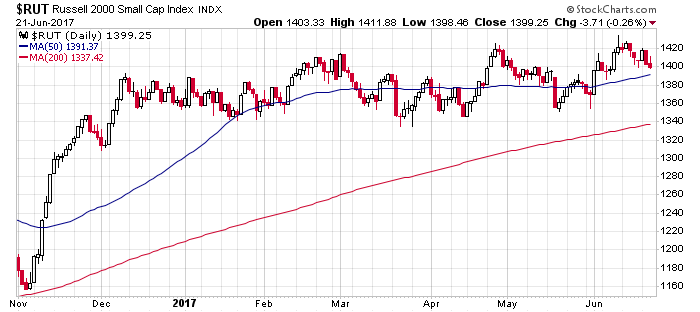

The Russell 2000 was weak yesterday, but I’d consider it extremely bullish if it can hold above its 200-day. When an issue trades above and below a key moving average and then moves up and holds the MA, an uptrend typically follows.

Stock headlines from barchart.com…

CarMax (KMX +0.81%) was downgraded to ‘Neutral’ from ‘Positive’ at Susquehanna.

Texas Roadhouse (TXRH -1.42%) was upgraded to ‘Outperform’ from ‘Market Perform’ at BMO Capital Markets with a price target of $58.

Cinemark Holdings (CNK -0.70%) was downgraded to ‘Underperform’ from ‘Neutral’ at Credit Suisse.

Splunk (SPLK +0.37%) was upgraded to ‘Buy’ from ‘Neutral’ at Guggenheim with a price target of $70.

Abercrombie & Fitch (ANF -1.31%) was upgraded to ‘Hold’ from ‘Sell’ at Wunderlich Securities.

Southwest Airlines (LUV +1.16%) was upgraded to ‘Buy’ from ‘Hold’ at Argus with a price target of $68.

Oracle (ORCL +1.07%) rallied nearly 10% in pre-market trading after it reported Q4 adjusted EPS of 89 cents, higher than consensus of 78 cents

FB Financial (FBK -0.47%) filed to sell 4.81 million shares for holders.

Steelcase (SCS -1.21%) plunged 18% in after-hours trading after it reported Q1 revenue of $735.1 million, weaker than consensus of $744.5 million, and then said it sees Q2 revenue of $750 million-$780 million, below consensus of $799.5 million.

Hain Celestial Group (HAIN +0.39%) climbed over 3% in after-hours trading ahead of the release of its Q1 EPS results before trading on Thursday.

Taylor Morrison Home (TMHC -1.27%) fell over 2% in after-hours trading after it announced that it had commenced an underwritten public offering of 10.0 million shares of its Class A common stock.

Jernigan Capital (JCAP -0.98%) dropped 8% in after-hours trading after announced that it had commenced an underwritten public offering of 3.0 million shares of its common stock.

New Residential Investment (NRZ -0.50%) rose over 2% in after-hours trading after it raised its quarterly dividend to 50 cents a share from 48 cents, the second time this year it has raised its dividend.

Wednesday’s Key Earnings

Oracle (NYSE:ORCL) +10% AH bolstering cloud-based services.

Today’s Economic Calendar

8:30 Initial Jobless Claims

9:00 FHFA House Price Index

9:45 Bloomberg Consumer Comfort Index

10:00 Leading Indicators

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

6 thoughts on “Before the Open (Jun 22)”

Leave a Reply

You must be logged in to post a comment.

Thinking of shorting some Apache Oil.

This stuff can’t seem to hold up!

Thoughts

The chart looks pretty bad, but in an uptrend, I’d rather be long a strong stock than short a weak one.

Fed is concerned, wages/prices appear to be rising: Symptoms. But the banks know it is going to end mean this fall…global decline at best. Running on cash today and 10% is in gld/greenbacks.. and in the safe.

no panic, but watch things.

Too much Oil around.

Nas 100

different viewpoints ,i suppose make a market

to me the chart shows a wave 1 down ,after a exhaustion top of some sort

now a simple A B C ,wave 2 corrective pattern

and last few days distributive consolidation

not saying it wont go up,but i would not be long ,unless day trading

faang could resume a serious large wave 3 down

i dont have any fangs and i dont like faults teeth–to uncomfortable

more volitile now–good

if in a down trend –double bottoms dont hold and lower double tops are common