Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed mostly up. China, Hong Kong, South Korea, New Zealand and Taiwan led the way; India and the Philippines lagged. Europe is currently mostly up. The UK, Poland, France, Germany, Italy, Spain, Switzerland, the Netherlands, Belgium and Austria are posting solid gains. Futures in the States point towards a moderate gap up open for the cash market.

—————

VIDEO: There’s a Bull Market Somewhere

—————

The dollar is up a small amount. Oil and copper are up small amounts. Gold and silver are down. Bonds are mixed.

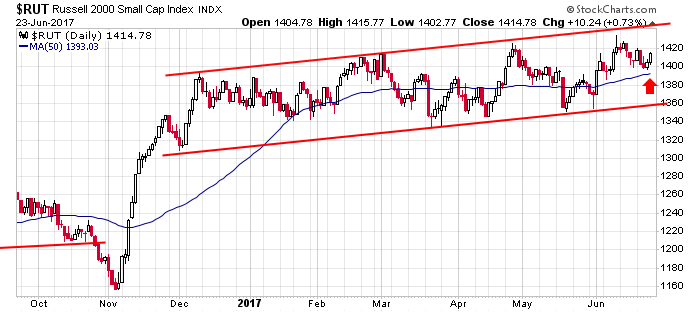

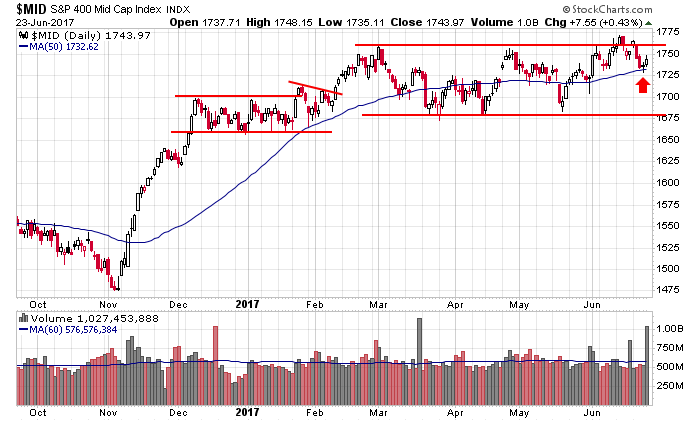

The two most encouraging charts heading into this new week are the Russell 2000 and S&P 400. Both traded above and below their 50-day MAs for several months, but recently they moved above and successfully tested the moving averages. This is a great first step in beginning the next directional move.

Stock headlines from barchart.com…

Costco Wholesale (COST -1.66%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Raymond James with a 12-month target price of $173.

Duke Energy (DUK -0.37%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

Children’s Place (PLCE +1.41%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Telsey Advisory Group with a 12-month target price of $135.

DaVita (DVA -0.28%) was downgraded to ‘Hold’ from ‘Buy’ at Jeffries.

Intuit (INTU +0.29%) was downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

Regeneron Pharmaceuticals (REGN -1.75%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Bernstein.

GrubHub (GRUB +2.96%) fell 4% in pre-market trading after it was downgraded to ‘Equal Weight’ from ‘Overweight’ at Morgan Stanley.

Coach (COH +0.49%) was upgraded to ‘Buy’ from ‘Neutral’ at Buckingham Research Group with a price target of $58.

Stratasys Ltd (SSYS -0.36%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs with a price target of $20.

Pandora Media (P +6.15%) jumped nearly 7% in pre-market trading after it was upgraded to ‘Sector Weight’ from ‘Underweight’ at Pacific Crest Securities.

Point2 Asset Management reported a 5.3% passive stake in Conn’s (CONN +0.88%) .

General Atlantic said it boosted its stake in 58.com (WUBA +2.05%) to 5.9% from 4.8%.

Cidara Therapeutics (CDTX -2.90%) was assumed with an ‘Overweight’ rating at Cantor Fitzgerald with a price target of $15.

Today’s Economic Calendar

8:30 Durable Goods

8:30 Chicago Fed National Activity Index

10:30 Dallas Fed Manufacturing Survey

1:00 PM Results of $26B, 2-Year Note Auction

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

4 thoughts on “Before the Open (Jun 26)”

Leave a Reply

You must be logged in to post a comment.

Holiday buys today but six months follow with much ado about little or nothing. Sell in May or June and go to sea. holding few dividends stocks.

A wait and see game.

Yea I am buying on weakness.

i sold on strength