Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Japan, Hong Kong, New Zealand, Australia and Singapore lost ground; the Philippines had a good day. Europe currently leans to the upside. France, Denmark, Finland, the Netherlands, Portugal and Austria are up; Poland is weak. Futures in the States point towards a positive open for the cash market.

The dollar is up a small amount. Oil and copper are up. Gold and silver are down. Bonds are down.

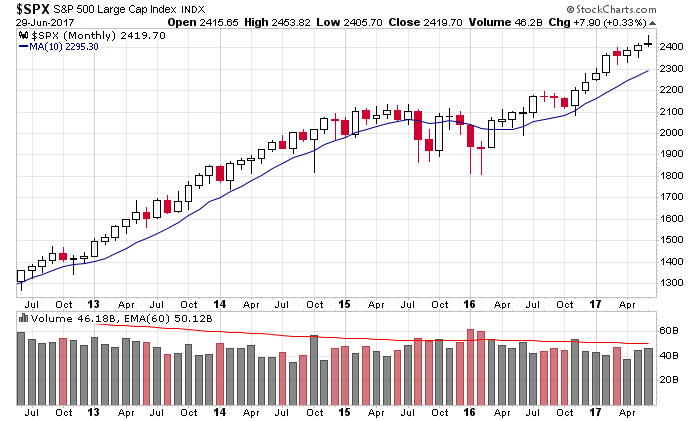

Last day of the month and quarter. Here’s the S&P monthly. Despite the move off the high, the chart is in great shape overall.

Stock headlines from barchart.com…

D.R. Horton (DHI -1.40%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Raymond James with a 12-month target price of $39.

Baxter International (BAX -1.17%) was initiated with an ‘Overweight’ rating at Cantor Fitzgerald with a 12-month target price of $70.

Nike (NKE -0.36%) rallied almost 4% in after-hours trading after it reported Q4 EPS of 60 cents, above consensus of 50 cents.

Re/Max Holdings (RMAX -0.52%) was downgraded to ‘Underperform’ from ‘Neutral’ at Bank of America/Merrill Lynch.

Waste Management (WM -0.68%) was initiated with an ‘Outperform’ rating at BMO Capital Markets with a 12-month target price of $81.

Micron Technology (MU -2.39%) rose nearly 1% in after-hours trading after it reported Q3 adjusted EPS of $1.62, better than consensus of $1.51, and then said it sees Q4 adjusted EPS of $1.73-$1.87, well above consensus of $1.57.

Finisar (FNSR -3.07%) gained almost 1% in after-hours trading after it was initiated with a ‘Buy’ rating as D.A. Davidson with an 18-month target price of $40.

Legg Mason (LM -2.10%) was initiated with an ‘Outperform’ rating at RBC Capital Markets with a 12-month target price of $45.

Guaranty Bancorp (GBNK -1.69%) was initiated with a ‘Buy’ rating as D.A. Davidson with a 12-month target price of $32.

Alkermes PLC (ALKS -0.41%) slid almost 3% in after-hours trading after data from a Phase 3 study showed the most common side effect for its schizophrenia drug ALKS 3831 included weight gain.

American Outdoor Brands (AOBC +1.70%) sank 10% in after-hours trading after it said it sees full-year adjusted EPS of $1.42-$1.62, below consensus of $1.68.

Dermira (DERM -4.77%) rose over 4% in after-hours trading after it was initiated with an ‘Outperform’ rating at Evercore ISI.

Cara Therapeutics (CARA -5.34%) plunged nearly 30% in after-hours trading after a Phase 2B study showed that Cara’s CR845 drug did not significantly reduce mean joint pain in low doses in patients with knee pain.

Thursday’s Key Earnings

Micron (NASDAQ:MU) +3.3% AH blowing past estimates.

Nike (NYSE:NKE) +6.8% AH launching a program with Amazon.

Rite Aid (NYSE:RAD) -26.5% replacing its deal with Walgreens.

Walgreens (NASDAQ:WBA) +1.7% following the drug store shakeup.

Today’s Economic Calendar

8:30 Personal Income and Outlays

9:45 Chicago PMI

10:00 Consumer Sentiment

1:00 PM Baker-Hughes Rig Count

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (Jun 30)”

Leave a Reply

You must be logged in to post a comment.

The market is fragile, But I am flat watching for more disruptions to come to fill the summer months. Fall I will reenter selected stocks and a few bonds. Happy 4TH.

whip crack a way, sings dorris day

the month looks ugly and needs a good flogging