Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the upside. Japan, China, South Korea, Hong Kong, Taiwan and Singapore did well; Indonesia, Australia and New Zealand closed down. Europe is currently mostly up. France, Germany, Finland, Switzerland, Spain, the Netherlands, Italy, Belgium and Sweden are leading; Hungary is down. Futures in the States point towards a positive open for the cash market.

—————

My podcast – with Chat With Traders

—————

The dollar is up. Oil and copper are down. Gold is flat; silver is down. Bonds are up.

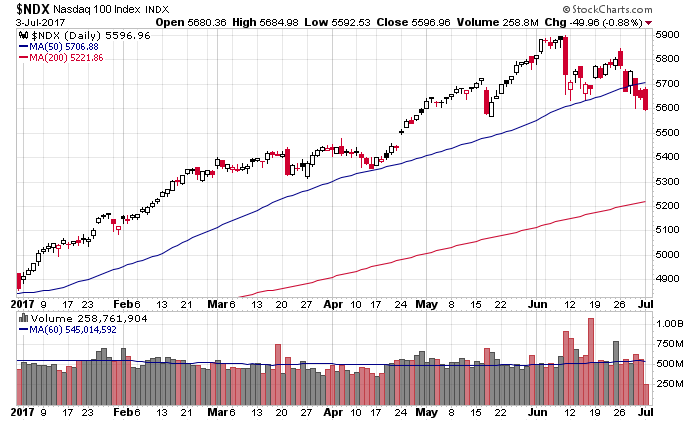

It feels like it’s been a super long weekend. The most noteworthy observation is that the Nas and Nas 100, despite leading the market for many months, are now the only indexes below their 50-day MAs. They’ve put in a lower high and lower low and could be considered in a mini downtrend on a short term basis. Overall they’re doing just fine, but it’s pretty obvious money is rotating out of tech. Here’s the Nas 100.

Stock headlines from barchart.com…

Cabela’s (CAB +0.05%) is up almost 2% in pre-market trading after Bass Pro Shops received FTC approval for its acquisition of Cabela’s.

Weyerhaeuser (WY +0.57%) was downgraded to ‘Neutral’ from ‘Buy’ at Bank of America/Merrill Lynch.

Teledyne (TDY +0.36%) was upgraded to ‘Buy’ from ‘Hold’ at Needham & Co. with a 12-month target price of $148.

Capital One Financial (COF +1.14%) lost over 1% in pre-market trading after it was downgraded to ‘Underperform’ from ‘Neutral’ at Wedbush.

PPG Industries (PPG +0.59%) was upgraded to ‘Buy’ from ‘Hold’ at Argus Research.

Sun Bancorp (SNBC +1.22%) was downgraded to ‘Hold’ from ‘Buy’ at Sandler O’Neill & Partners LP.

Newmont Mining (NEM -1.54%) was upgraded to ‘Sector Outperform’ from ‘Sector Perform’ at Scotia Capital.

Buffalo Wild Wings (BWLD +1.14%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Stephens.

Oracle (ORCL -1.56%) was upgraded to ‘Overweight’ from ‘Sector Weight’ at KeyBanc Capital Markets.

Lockheed Martin (LMT +0.47%) was awarded a $3.77 billion mufti-year contract from the U.S. Army for production and services associated with the Black Hawk helicopter.

Tesla (TSLA unch) may move lower this morning after the company announced late Monday that it delivered “just over” 22,000 vehicles in Q2, below consensus of 22,912.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Gallup U.S. Job Creation Index

8:55 Redbook Chain Store Sales

10:00 Factory Orders

2:00 PM FOMC minutes

2:00 PM Gallup US ECI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Jul 5)”

Leave a Reply

You must be logged in to post a comment.

REIT are looking better for the year to date, INP may be into fall.