Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. China, Hong Kong, South Korea, India, Australia and Singapore are doing the best. Europe, Africa and the Middle East are mostly up. Turkey, Greece, South Africa, Finland, Norway, Hungary, Spain, Belgium and Portugal are leading. Futures in the States point towards a positive open for the cash market.

—————

VIDEO: The Most Bullish Chart Out There

—————

The dollar is up slightly. Oil is flat; copper is up. Gold and silver are mixed and little changed. Bonds are up.

Round 2 of Janet Yellen speaking before Congress today – this time to the Senate Banking Committee.

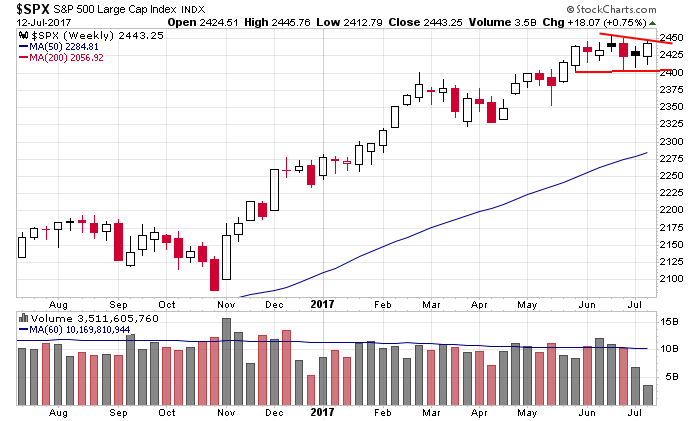

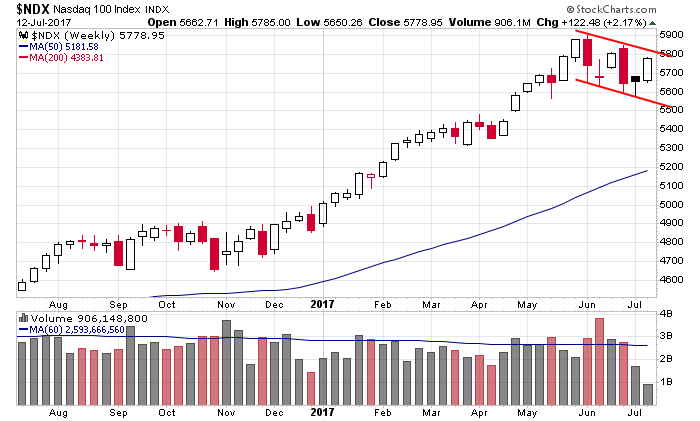

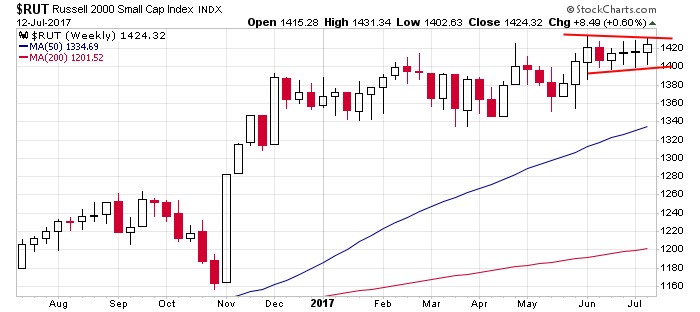

Here are the S&P 500, Nas 100 and Russell 2000 weekly charts. They’re either flat or slanting against the overall trend. In either case, they’re in great, overall shape. Bias remains up.

Stock headlines from barchart.com…

International Paper (IP +0.30%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs with a price target of $64.

Fastenal (FAST -2.00%) was upgraded to ‘Strong Buy’ from ‘Outperform’ at Raymond James with a 12-month target price of $50.

Progressive (PGR +0.63%) was upgraded to ‘Strong Buy’ from ‘Outperform’ at Raymond James with a price target of $52.

AT&T (T +0.63%) was downgraded to ‘Neutral’ from ‘Buy’ at Bank of America/Merrill Lynch.

Intercontinental Exchange (ICE +0.69%) was upgraded to ‘Outperform’ from ‘Sector Perform’ at RBC Capital Markets with a price target of $70.

Agilent (A +1.56%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Wells Fargo Securities with a price target of $67.

Legg Mason (LM +1.37%) was downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

Bruker (BRKR -0.03%) slipped over 2% in after-hours trading after it was downgraded to ‘Underperform’ from ‘Market Perform’ at Wells Fargo Securities with a 12-month target price of $25.

Mallinckrodt PLC (MNK +2.44%) said the FDA granted orphan drug status to its MNK-1411 to treat Duchenne muscular dystrophy.

Amgen (AMGN -0.03%) may move higher this morning after it said late Wednesday that its final analysis of the Phase 3 trial of its Kyprolis with lenalidomide and dexamethansone met the secondary endpoint of overall survival in patients with multiple myeloma.

Box Inc. (BOX +2.08%) gained nearly 1% in after-hours trading after it named Stephanie Carlo, previous vice president of U.S. education sales at Apple, as its new COO.

Amicus Therapeutics (FOLD +1.93%) dropped over 5% in after-hours trading after it announced that it had commenced a $225 million underwritten public offering of its common stock.

China Commercial Credit (CCCR -0.32%) jumped over 10% in after-hours trading after it said it entered into a non-binding letter of intent to acquire Sorghum Investment Holdings Limited.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Producer Price Index

9:30 Yellen testifies before senate Banking Committee

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Results of $12B, 30-Year Note Auction

1:00 PM Fed’s Reserve Gov. Lael Brainard: Monetary Policy

2:00 PM Treasury Budget

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (Jul 13)”

Leave a Reply

You must be logged in to post a comment.

Strange talk is loose today.

“Gold Should Probably Be $5000” – CME Chairman

By Mark O’Byrne July 13, 2017

“Gold Should Probably Be $5000” – CME Chairman Duffy

– Fed has caused “frustration” and “confusion” in market place

– “If you adjust for inflation, you should have gold somewhere around 2 to 3,000 per ounce”

More fed talk today….patience is a virtue.

gold move up to keep a weather eye on gold……