Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Other than India and Australia, which dropped more than 1%, there was very little movement. Europe, Africa and the Middle East lean to the downside. France, Germany, Greece, South Africa, Finland, Spain, Belgium and Sweden are down the most. Futures in the States point towards a down open for the cash market.

—————

VIDEO: The Most Interesting Chart #1

—————

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are up.

The market traded quietly yesterday. The Nas and small caps pushed to higher highs; the rest of the indexes formed inside days. The market is strong and healthy and doing just fine.

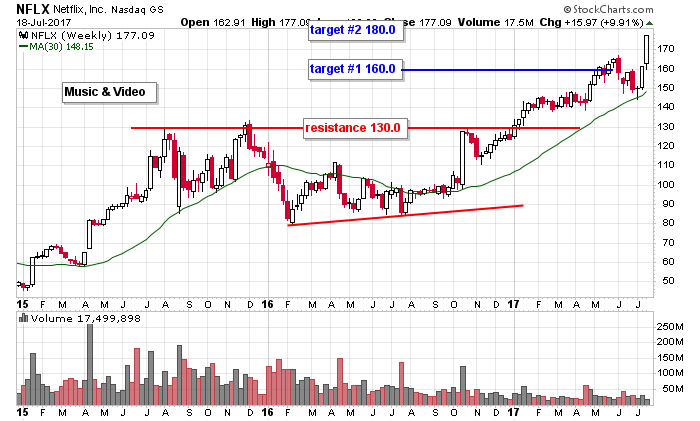

Netflix will be a big winner today. The stock has been on our “long term” list since December. It broke out at 130 in January and moved to our first target (160) in May, and then after a pullback to its rising 30-week MA, it bounced. Today’s open will be a few points from target #2.

When the trend is consistently in up, buying quality stocks and just sitting tight works better for most people than trading in and out.

Stock headlines from barchart.com…

Automatic Data Processing (ADP +0.35%) was downgraded to ‘Equal-Weight’ from ‘Overweight’ at Barclays.

Activision Blizzard (ATVI -0.41%) was initiated with a ‘Buy’ at Needham & Co. with a 12-month target price of $75.

Electronic Arts (EA +0.41%) was initiated with a ‘Buy’ at Needham & Co. with a 12-month target price of $130.

Autoliv (ALV -0.21%) was upgraded to ‘Buy’ from ‘Neutral’ at Mizuho Securities USA with a price target of $130.

Netflix (NFLX +0.36%) rallied over 10% in pre-market trading to a record high after it reported Q2 international streaming net adds of 4.14 million, above estimates of 2.63 million, and said it sees Q3 net streaming adds of 4.4 million, higher than consensus of 3.99 million.

AutoZone (AZO -0.52%) was downgraded to ‘Underperform’ from ‘Peer Perform’ with a 12-month target price of $429.

Rite Aid (RAD -0.86%) climbed 8% in after-hours trading after it said that adjustments from the Walgreens deal to adjusted EBITDA will result in pro-forma adjusted EBITDA for the year ended March 4, 2017 of $742.97 million

Allstate (ALL -0.63%) and Travelers (TRV +0.41%) were both downgraded to ‘Sell’ from ‘Hold’ at Edward Jones.

Select Comfort (SCSS +3.41%) dropped over 4% in after-hours trading after it reported Q2 net sales of $284.7 million, weaker than consensus of $300.1 million.

UnitedHealth Group (UNH -0.29%) gained almost 1% in after-hours trading after it said it extended its marketing agreement with AARP-branded Medicare plans through at least 2025.

Ethan Allen Interiors (ETH -0.49%) fell over 4% in after-hours trading after it said it sees preliminary full-year 2017 adjusted EPS of $1.44-$1.45, below consensus of $1.53.

Paratek Pharmaceuticals (PRTK +3.74%) rallied over 3% in after-hours trading after an all-oral formulation of its antibiotic omadacycline met all primary and secondary endpoints needed to support FDA and European approvals for use as a therapy for acute bacterial skin infections.

Annaly Capital Management (NLY -0.57%) lost nearly 3% in after-hours trading after it announced that it intends to offer 60 million shares of its common stock in a public offering.

Ring Energy (REI +3.30%) dropped 5% in after-hours trading after it announced that it intends to offer $50 million in shares of its common stock in an underwritten public offering.

Accuray (ARAY -2.08%) rose 4% in after-hours trading after it reported Q4 preliminary revenue of $111.5 million-$112 million, above consensus of $111.2 million.

Cymabay Therapeutics (CBAY +5.84%) slid 5% in after-hours trading after it announced that it intends to offer 10 million shares of its common stock in an underwritten public offering.

Monday’s Key Earnings

BlackRock (BLK) -3.1% after missing estimates.

Netflix (NFLX) +10.7% AH boosting subscribers.

Today’s Economic Calendar

8:30 Import/Export Prices

8:55 Redbook Chain Store Sales

10:00 NAHB Housing Market Index

4:00 PM Treasury International Capital

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (Jul 18)”

Leave a Reply

You must be logged in to post a comment.

The house likes this market – inside days and all. Too many nervous tellies? Count me in cash and holding Netflix. Where is everyone, it is summer, but not the end.

Jason

Enjoyed your video on the internet stocks.

I love listing to people who think differently than I.