Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed mostly up. Japan, China, Hong Kong, South Korea, Taiwan, Australia and the Philippines did the best. Indonesia was weak. Europe, Africa and the Middle East are currently mixed and little changed. Turkey, South African, Russia, Hungary, Austria and the Czech Republic are doing well; Germany, Belgium and Israel are weak. Futures in the States point towards a positive open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is down. Oil is down; copper is up. Gold and silver are down. Bonds are down.

Some odds movement the last few weeks.

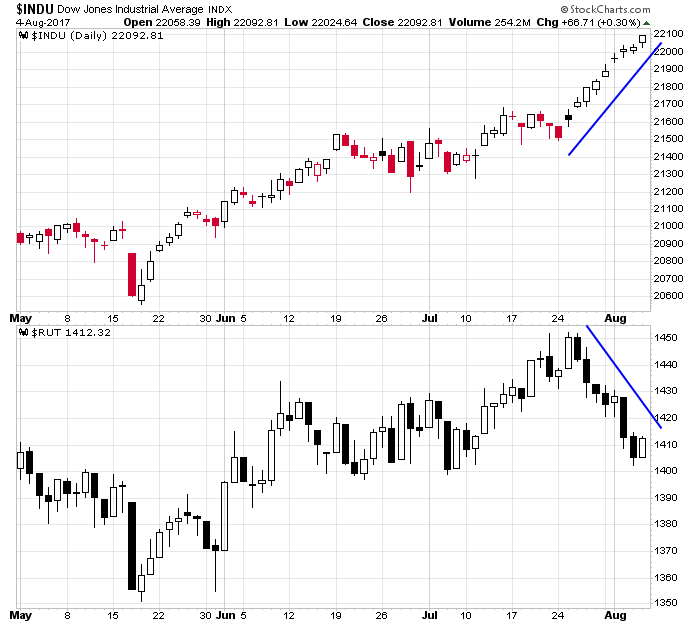

Dow straight up…Russell 2000 straight down.

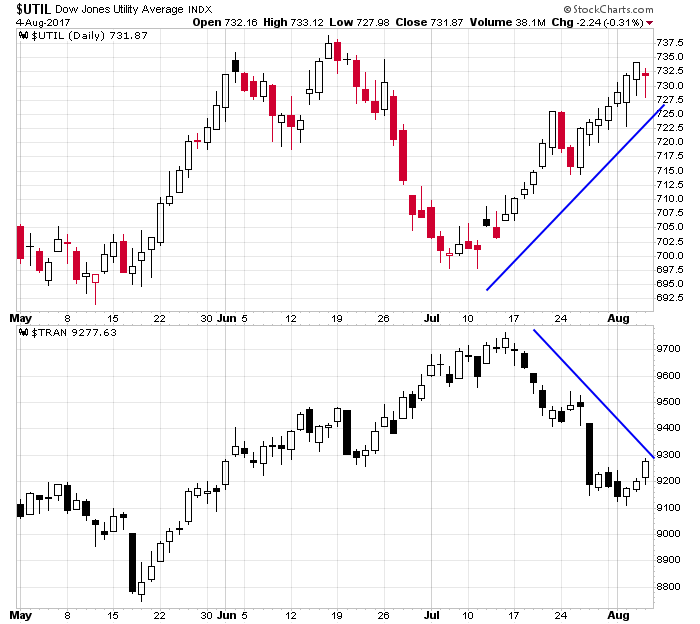

Utilities straight up…transports straight down.

Stock headlines from barchart.com…

GrubHub (GRUB +9.06%) was upgraded to ‘Overweight’ from ‘Equalweight’ at Morgan Stanley with a price target of $59.

Illumina (ILMN -2.01%) was upgraded to ‘Buy’ from ‘Hold’ at Canaccord Gentry with a price target of $215.

Kaiser Aluminum (KALU +0.04%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Cowen.

B&G Foods (BGS -8.68%) was upgraded to ‘Outperform’ from ‘Market Perform’ at BMO Capital Markets with a 12-month target price of $39.

Time Warner (TWX +0.17%) was downgraded to ‘Inline’ from ‘Outperform’ at Evercore ISI.

KLA-Tencor (KLAC -0.15%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel with a price target of $106.

Re/Max (RMAX +9.49%) was downgraded to ‘Equal-Weight’ from ‘overweight’ at Stephens

Lift Storage (LSI +0.30%) was downgraded to ‘Underperform’ from ‘Inline’ at Evercore ISI.

General Motors (GM +1.44%) said it was recalling 800,000 Chevrolet Silverado 1500 and GMC Sierra 1500 pickup trucks worldwide from the 2014 model year to fix a steering defect that could cause drivers to lose electric power steering assist.

Fluor (FLR -8.66%) was downgraded to ‘Accumulate’ from ‘Buy’ at Johnson Rice.

BP PLC (BP +0.53%) was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray with a price target of $42.

Rockwell Collins (COL +0.47%) jumped over 6% in after-hours trading after United Technologies was said to be weighing a potential acquisition of the company.

Berkshire Hathaway ({=BRK/A=}) slipped 2% in after-hours trading after it reported Q2 operating EPS of $2,505, below consensus of $2,791.

Today’s Economic Calendar

8:30 Gallup US Consumer Spending Measure

10:00 Labor market condition index

11:45 Fed’s Bullard: U.S. Monetary and Economic Policy

12:30 PM TD Ameritrade IMX

3:00 PM Consumer Credit

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY