Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up, but other than Indonesia (up 2.6%), gains were small. Europe is currently mostly up. France, Denmark, Finland, Switzerland, Norway, Spain, Italy, Belgium, Portugal, Austria and the Czech Republic are doing well. Turkey is weak. Futures in the States point towards a moderate gap up open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is down. Oil and copper are up. Gold and silver are mixed and unchanged. Bonds are down.

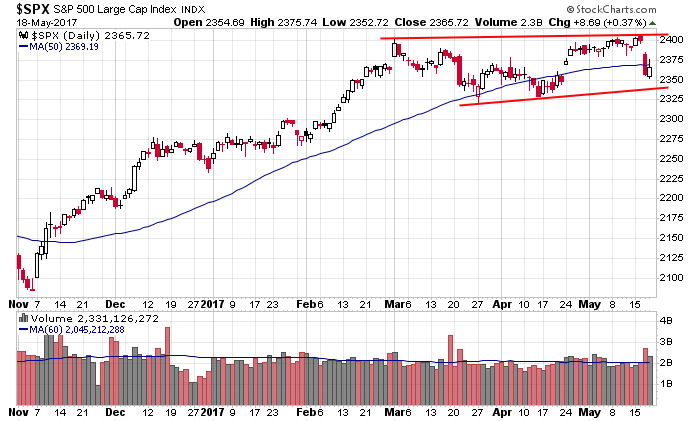

It’s Friday. The market went from an all-time high (Tuesday) to trading below its 50-day MA (Wednesday) on back-to-back days. Now it’s trying to recover. The S&P is back in the middle of the range which has persisted for three months. Here’s the chart.

I looked at many breadth indicators yesterday. Several have dropped to levels that would support a bounce. Now that we’re getting a bounce, we’ll see how they improve. If they get back over key levels, it’ll be back to business as usual. If they fail, we’re likely to get another leg down.

Overall bias remains up. Short term can go either way.

Stock headlines from barchart.com…

Palo Alto Networks (PANW -0.66%) rose nearly 3% in pre-market trading after it was upgraded to ‘Buy’ from ‘Hold’ at Jeffries with a price target of $150.

Autodesk (ADSK +1.98%) jumped 10% in after-hours trading after it reported Q1 revenue of $485.7 million, better than consensus of $470.4 million, and said it sees Q2 revenue of $488 million-$500 million, above consensus of $487.5 million.

McKesson (MCK -0.42%) rallied over 7% in after-hours trading after it reported Q4 adjusted EPS of $3.42, well above consensus of $3.00.

Nvidia (NVDA +4.19%) gained nearly 1% in after-hours trading after Bernstein said the stock may be underestimated as it initiated an ‘Outperform’ rating on the stock with a price target of $165.

Ross Stores (ROST -0.73%) climbed nearly 4% in after-hours trading after it reported Q1 EPS of 82 cents, higher than consensus of 80 cents, and said it sees Q2 comparable sales up 1% to 2%.

Applied Materials (AMAT +2.69%) rose over 3% in after-hours trading after it reported Q2 adjusted EPS of 79 cents, above consensus of 7 cents, and aid it sees Q3 adjusted EPS of 79 cents-87 cents, better than consensus of 68 cents.

The Gap (GPS -1.53%) gained more than 3% in after-hours trading after it reported Q1 EPS of 36 cents, higher than consensus of 29 cents.

Goldman Sachs BDC (GBSD) lost more than 2% in after-hours trading after it announced that it plans to offer 3.25 million shares of common stock.

Halozyme Therapeutics (HALO +2.91%) dropped 8% in after-hours trading after it announced that it has commenced an underwritten public offering of $100 million of its common stock.

RSP Permian (RSPP +0.49%) fell nearly 3% in after-hours trading after it announced a secondary public offering of 15 million shares of common stock by selling stockholders.

XBiotech (XBIT -1.45%) sank 15% in after-hours trading after it received negative opinion from the European Medicines Agency regarding marketing authorization application for its lead product candidate in Europe.

Sportsman’s Warehouse Holdings (SPWH -2.47%) jumped 14% in after-hours trading after it reported Q1 net sales of $156.9 million, better than consensus of $151.7 million, and said it sees Q2 sales of $189 million-$194 million, the midpoint above consensus of $190.4 million.

Thursday’s Key Earnings

Alibaba (NYSE:BABA) +0.5% on mixed results.

Applied Materials (NASDAQ:AMAT) +0.4% AH on record profits.

Gap (NYSE:GPS) +4.1% AH helped by Old Navy.

McKesson (NYSE:MCK) +8.2% AH on fiscal Q4 beat.

Salesforce (NYSE:CRM) +1.4% lifting its outlook.

Wal-Mart (NYSE:WMT) +3.2% on solid comparable sales.

Today’s Economic Calendar

9:15 Fed’s Bullard: U.S. Monetary and Economic Policy

1:00 PM Baker-Hughes Rig Count

1:40 PM Fed’s Williams Speech

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (May 19)”

Leave a Reply

You must be logged in to post a comment.

The slowing banking loan growth and the banking surveys prove the peak of the credit cycle is in and we are in a period of decelerating growth. The fat lady is going to sing soon. Go on the defensive this summer, recession is coming in the fall of 2017……