Good morning. Happy Tuesday.

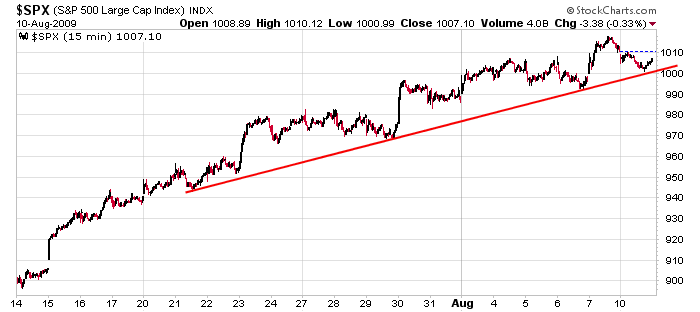

The market was sluggish yesterday. Early weakness got bought late in the day…volume was light…and the day’s movement was entirely contained within the previous day’s high and low. Here’s the 15-min chart. The move off the July low has been steady and consistent, so even if the support line drawn is penetrated, … there will be several layers of additional support below.

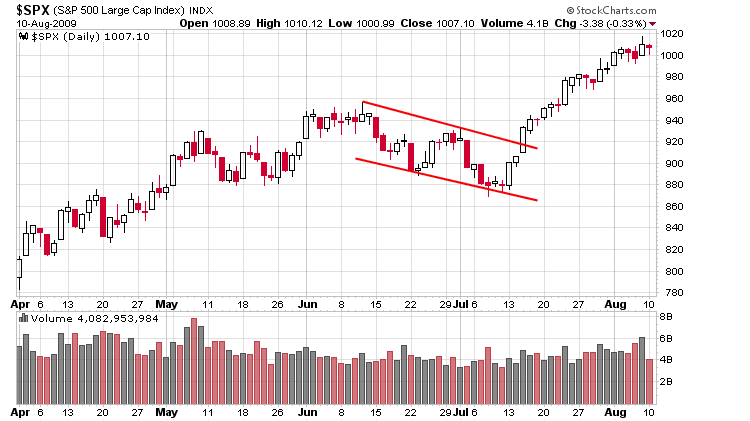

Here’s the daily – sloppy action the last week if you ask me. You can’t deny the trend, but we have to wonder if the market has gone too far, too fast. The MACD Histogram negative divergence still exists and given the move over the last month, the risk/reward for entering new swing trades is not favorable.

Manage what you have. I can see a blow-off top as well as a stiff sell-off. I don’t have a strong gut feeling regarding the next move.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 11)”

Leave a Reply

You must be logged in to post a comment.

Aren’t you concerned by the really light volume? do you think a bear market trap will be sprung when everybody comes back from the Hamptons?

Nick…a bear trap is definitely possible. It happened in early July when everyone predicted a big move down when the head & should top penetrated the neckline, but you saw what happened. Short term I’m being very cautious. I’ve been telling LB members the risk/reward for initiating new longs is not favorable. But I don’t see a huge move down materializing. One that scares the bulls and suckers in more bears will nicely set the stage for a fall rally.

That trap could even snap shut before the first day of school. Bear market rally is running out of Oooomph! If I were Goldilocks, I wouldn’t be looking for Grandma.

Put call ratios were sky high last week with the markets near 6 month highs. I looked back to 1995 and could never find any time where the put call ratio was high where the market was near any kind of high.

The put call ratio has receded to normal levels as of today.

This market is tough to trade.