Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. South Korea, Thailand and the Philippines did well; Japan, China, Singapore and Hong Kong posted losses. Europe, Africa and the Middle East currently lean to the downside. Greece and Kenya are down more than 1%; the UK, South Africa and Spain are also weak. Futures in the States point towards a negative open for the cash market.

—————

WEBINAR (Tues, Sep 19): The Real Keys to Surviving and Making Solid Profits in the Market

—————

The dollar is down. Oil is up; copper is down. Gold and silver are down. Bonds are down.

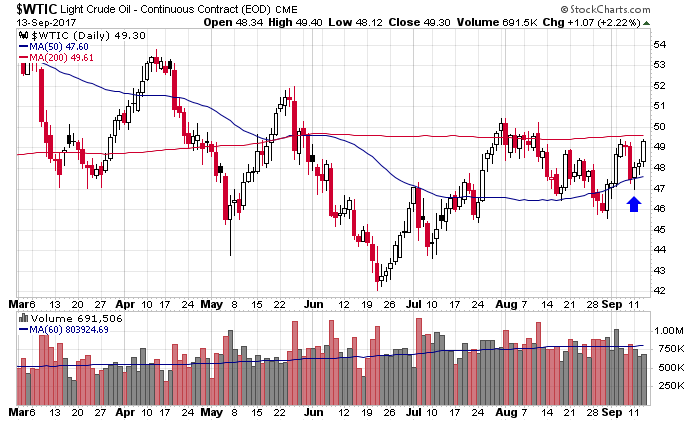

Here’s an update of the daily crude oil chart I posted yesterday. It’s trying to turn the corner. A bounce off the 50 followed and a move through the 200 will bode well for the commodity going forward. I wouldn’t expect a big move, but 10% is doable and that kind of move would light a little fire under oil stocks.

Stock headlines from barchart.com…

Hertz Global Holdings (HTZ +1.40%) was downgraded to ‘Underweight’ from ‘Equalweight’ at Morgan Stanley on valuation.

Beazer Homes (BZH -1.05%) was upgraded to ‘Overweight’ from ‘Neutral’ at JP Morgan Chase with a price target of $21.

Toll Brothers (TOL -0.82%) was downgraded to ‘Neutral’ from ‘Overweight’ at JP Morgan Chase.

eBay (EBAY +0.24%) was initiated a new ‘Buy’ at D.A. Davidson with an 18-month target price of $45.

United Natural Foods (UNFI +1.75%) climbed over 3% in after-hours trading after it reported Q4 adjusted EPS of 72 cents, higher than consensus of 70 cents.

Tenet Healthcare (THC -5.31%) jumped 11% in after-hours trading after the WSJ reported the company is exploring options including a possible sale.

US Foods Holdings (USFD +1.12%) dropped over 2% in after-hours trading after announced a secondary public offering of 40 million shares of its common stock by several investment fund holders.

William Lyon Homes (WLH -0.24%) lost over 1% in after-hours trading after it proposed a secondary offering of 3.32 million shares of its common stock for holder Paulson & Co.

Lakeland Industries (LAKE unch) rose 4% in after-hours trading after it reported Q2 EPS of 25 cents, better than consensus of 20 cents.

Vanda Pharmaceuticals (VNDA -1.45%) fell 5% in after-hours trading after it reported the endpoint of its Phase II clinical study of its Tradipitant failed to show a significant improvement in the intensity of the worst itch patients experienced.

Epizyme (EPZM -6.73%) dropped 4% in after-hours trading after it filed to sell $120 million in common stock.

Array BioPharma (ARRY +5.62%) tumbled nearly 8% in after-hours trading after it announced that it had commenced an underwritten public offering of $175 million of its common stock.

Agenus (AGEN +3.65%) climbed over 3% in after-hours trading after the company received a positive vote from the FDA’s Vaccines and Related Biological Products Advisory Committee that the efficacy and safety data for its Shringrix drug for prevention of herpes zoster (shingles) in adults aged 50 and over.

Lattice Semiconductor (LSCC +3.06%) lost over 1% in after-hours trading after the Trump administration blocked a Chinese-backed investor from buying the company, citing a security risk.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Consumer Price Index

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Sep 14)”

Leave a Reply

You must be logged in to post a comment.

jobless claims up quite a bit and consumer prices up. Not good with debt already high for consumers. Be careful, things are showing stress.