Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the upside. Hong Kong, New Zealand, Taiwan, Singapore and the Philippines did well; India dropped more than 1%; Japan was also weak. Europe, Africa and the Middle East currently lean to the upside. Hungary and Spain are up more than 1%; the UK, Germany, South Africa, Italy and Sweden are also doing well. Turkey is down 2%; Greece and Denmark are also weak. Futures in the States point towards a moderate gap up open for the cash market.

—————

Podcast: with Chat With Traders

—————

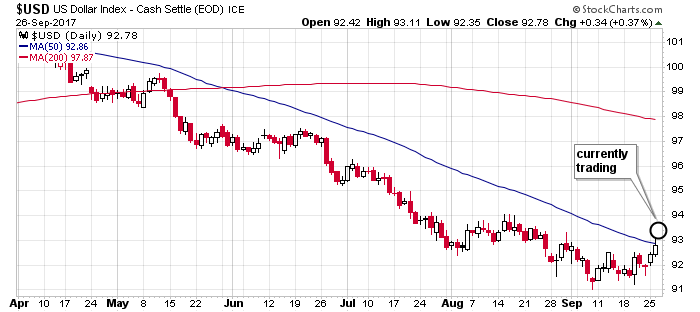

The dollar is up. Oil and copper are up very small amounts. Gold and silver are down. Bonds are down.

The indexes have not been on the same page lately. The small caps and mid caps have moved straight up while the S&P 500 and Dow have stalled and the Nas has moved down. It’s been weird watching the intraday action – Russell up, NDX down and SPX rolling in a range.

The dollar will open today above its 50-day MA for the first time since April. I make no predictions on its future path…just noting the accomplishment.

My stance on the market remains the same. I like it and expect higher prices over the next few months.

—————

Join our email list – get technical research reports sent directly to you.

—————

Stock headlines from barchart.com…

Amazon.com (AMZN -0.13%) was resumed wth an ‘Outperform’ at Wells Fargo Securities awith a price target of $1,400.

Darden Restaurants (DRI -6.53%) was upgraded to ‘Outperform’ from ‘Neutral’ at Baird with a 12-month target price of $94.

Six Flags Entertainment (SIX +0.43%) gained 3% in after-hours trading when it was announced that it will replace Parexel International in the S&P MidCap 400 prior to the open of trading on Monday, October 2.

KEMET (KEM unch) rose 4% in after-hours trading when it was announced that it will replace Astoria Financial in the S&P SmallCap 600 prior to the open of trading on Monday, October 2.

Nike (NKE +0.88%) fell 3% in after-hours trading after it reported Q1 revenue of $9.07 billion, below consensus of $9.09 billion, citing declining growth in North America.

Micron Technology (MU -1.98%) rose over 2% in after-hours trading after it reported Q4 adjusted EPS of $2.02, stronger than consensus of $1.84, and then said it sees Q1 adjusted EPS of $2.09 to $2.33, above consensus of $1.84.

Cintas (CTAS -0.56%) climbed almost 3% in after-hours trading after it reported Q1 revenue of $1.61 billion, higher than consensus of $1.57 billion, and then said it sees full-year revenue of $6.33 billion-$6.40 billion, the midpoint above consensus of $6.33 billion.

Ascendis Pharma A/S (ASND +2.68%) dropped 4% in after-hours trading after it announced that it had commenced an underwritten public offering of $125 million of American Depository Shares, each of which represents one ordinary share of Ascendis.

Westlake Chemical Partners LP (WLKP +0.63%) slid 8% in after-hours trading after 4.5 common units were offered after the close of trading via UBS, Citi, Barclays and Bank of America/Merrill Lynch that were a 6.64% to 8.71% discount to Tuesday’s closing price of $24.10.

Editas Medicine (EDIT -3.93%) rose 3% in after-hours trading after its EDIT-101 drug to treat Congenital Amaurosis type 10 received orphan medicinal product designation from the European Medicines Agency.

Intra-Cellular Therapies (ITCI -2.88%) dropped 7% in after-hours trading after it announced that it had commenced an underwritten public offering of $150 million in shares of its common stock.

Twitter (TWTR -2.30%) gained almost 2% in after-hours trading after it said it will test a new 280-character limit on tweets.

Tuesday’s Key Earnings

Micron (NASDAQ:MU) +4.8% AH on strong memory performance.

Nike (NKE) -3.6% AH with waning demand in N.America.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Durable Goods

10:00 Pending Home Sales

10:30 EIA Petroleum Inventories

11:30 Results of $13B, 2-Year FRN Auction

1:00 PM Results of $34B, 5-Year Note Auction

1:30 PM Fed’s Bullard: U.S. Monetary and Economic Policy

7:00 PM Fed’s Rosengren speech

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Sep 27)”

Leave a Reply

You must be logged in to post a comment.

much confusion but we have an awareness that taxes have limitations for this economy. Be patient we must suspect that a down move is possible, even likely or….. in the offing this week or next. I smell the wind shifting today…