Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down, but losses weren’t very big. Japan, Hong Kong, South Korea, India and Indonesia lost ground; New Zealand posted a gain. Europe currently leans to the upside. Greece, Russia, Spain, Austria and the Czech Republic are doing well; the UK and Finland are down. Futures in the States point towards a flat and mixed open for the cash market.

—————

Podcast – with Chat With Traders

—————

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are down.

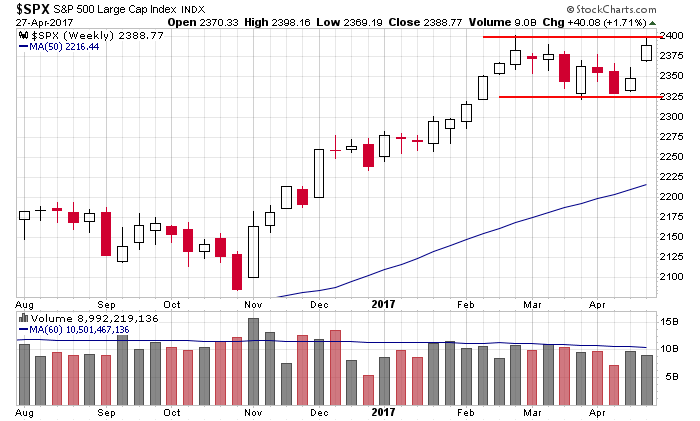

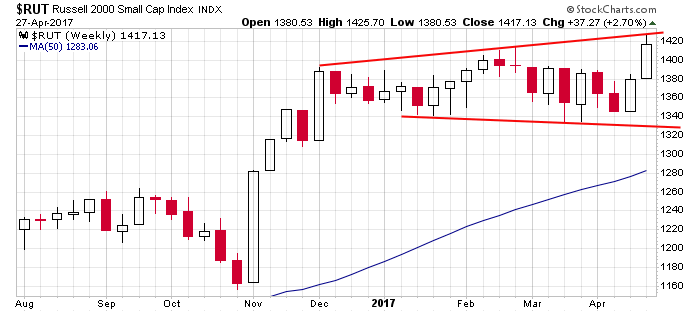

We’ve gotten solid follow through this week. The Russell 2000 hit a new all-time high; the S&P 500 is very close. This is exactly what the bulls wanted to see – follow through from the previous week’s bounce.

There’s no arguing what the long-term trend is. The only question is whether the indexes can break out from their ranges and begin their next legs up. The Nas and Nas 100 are well into new high territory. The Russell is in the process. The other indexes are close.

Here are the SPX and RUT.

Stock headlines from barchart.com…

Amazon.com (AMZN +1.00%) rose nearly 4% in pre-market trading after it reported Q1 EPS of $1.48, well above consensus of $1.08.

Microsoft (MSFT +0.65%) fell over 2% in after-hours trading after it reported Q3 capital expenditures of $1.70 billion, below consensus of $2.27 billion.

Alphabet (GOOGL +0.26%) rallied 4% in pre-market trading after it reported Q1 EPS of $7.73, better than consensus of $7.42.

Expedia (EXPE +0.33%) lost over 2% in after-hours trading after it reported Q1 adjusted EPS of 5 cents, weaker than consensus of 6 cents.

Aflac (AFL +0.33%) slipped over 1% in after-hours trading after it reported Q1 revenue of $5.31 billion, below consensus of $5.33 billion.

Starbucks (SBUX -0.42%) dropped over 4% in pre-market trading after it reported Q1 comparable sales rose 3%, less than consensus of 3.6%.

Athenahealth (ATHN +1.34%) tumbled 15% in after-hours trading after it reported Q1 adjusted EPS of 32 cents, below consensus of 46 cents, and then said it sees full-year revenue of $1.21 billion-$1.25 billion, below consensus of $1.29 billion.

Intel (INTC +1.35%) fell over 3% in pre-market trading after it reported Q1 revenue of $14.796 billion, below consensus of $14.812 billion.

Baidu (BIDU +0.64%) dropped 5% in after-hours trading after it said it sees Q2 revenue of $2.97 billion-$3.05 billion, the midpoint below consensus of $3.04 billion.

Align Technology (ALGN +0.29%) surged 12% in after-hours trading after it reported Q1 net revenue of $310.3 million, above consensus of $297.3 million, and then said it sees Q2 net revenue of $340 million-$345 million, better than consensus of $324.2 million.

Cerner (CERN +0.89%) rose over 3% in after-hours trading after it reported Q1 revenue of $1.26 billion, better than consensus of $1.23 billion.

Ellie Mae (ELLI +1.42%) dropped 9% in after-hours trading after it said it sees full-year adjusted EPS of $1.79-$1.92, the midpoint below consensus of $1.88.

Thursday’s Key Earnings

AbbVie (NYSE:ABBV) +1.6% on strong earnings.

Alphabet (NASDAQ:GOOG) +4% AH smashing estimates.

Amazon (AMZN) +3.9% AH on cloud, retail sales.

Baidu (NASDAQ:BIDU) -3.8% AH as profits slipped 11%.

Bristol-Myers (NYSE:BMY) +3.6% topping estimates.

Celgene (NASDAQ:CELG) -1% raising EPS outlook.

Comcast (NASDAQ:CMCSA) +2.1% beating expectations.

Dow Chemical (NYSE:DOW) -1.8% on mixed results.

Ford (NYSE:F) -1.2% on recall costs, weak sales.

GoPro (NASDAQ:GPRO) -0.8% AH after in-line earnings.

Intel (INTC) -3.6% AH with weakness in data centers.

Microsoft (MSFT) -0.5% AH missing revenue expectations.

Sirius XM (NASDAQ:SIRI) -1.8% with light guidance.

Starbucks (NASDAQ:SBUX) -4.7% AH on light comparable sales.

UPS (NYSE:UPS) +1.1% increasing deliveries.

Today’s Economic Calendar

8:30 GDP Q1

8:30 Employment Cost Index

9:45 Chicago PMI

10:00 Consumer Sentiment

1:00 PM Baker-Hughes Rig Count

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY