Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Japan, Taiwan and the Philippines posted gains. Hong Kong dropped more than 2%, Thailand fell more than 1%, and China, South Korea and Indonesia were also weak. Europe, Africa and the Middle East are currently weak. Turkey and Saudi Arabia are doing well, but the UK, Poland, France, Germany, Greece, Denmark, South Africa, Finland, Russia, Switzerland, Spain, the Netherlands, Italy, Belgium, Israel and Austria are weak. Futures in the States point towards a relatively big gap down open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil and copper are down. Gold and silver are up. Bonds are up.

Long term the market looks fantastic. Short term is less certain due to some weakness from the breadth indicators.

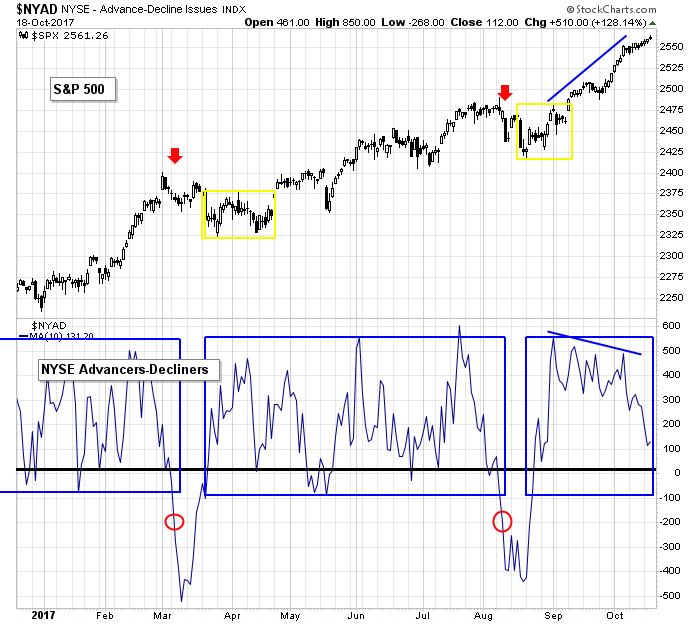

The 10-day of the AD line moved down during September (while maintaining a high level) and then fell hard recently while the S&P has pushed up.

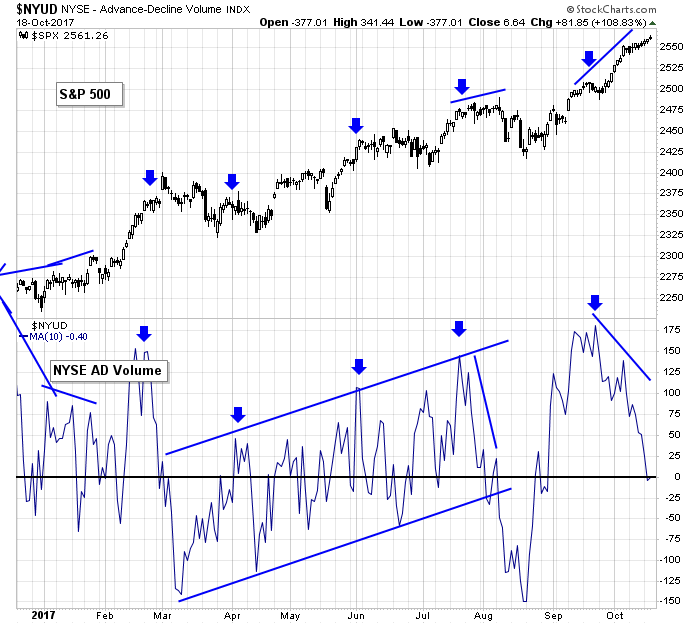

The 10-day of the AD volume line not only formed a negative divergence, it has also dropped to 0.

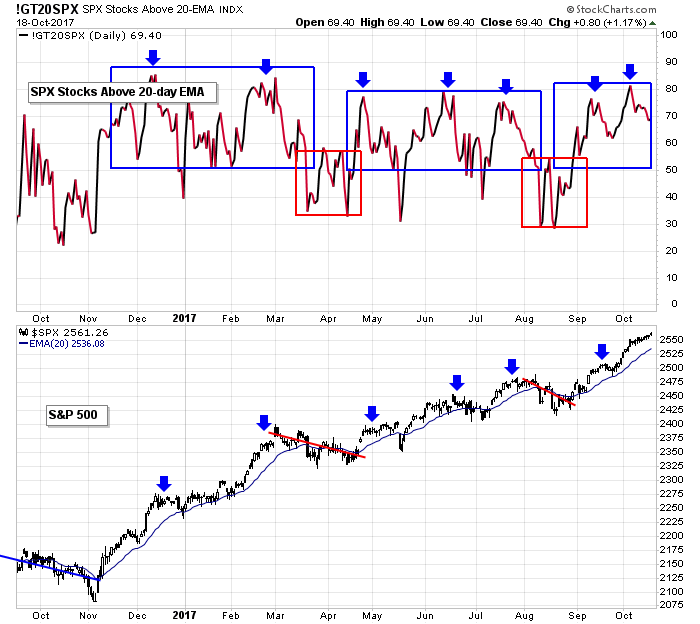

The percentage of SPX stocks above their 20-day EMAs has been moving down for two weeks.

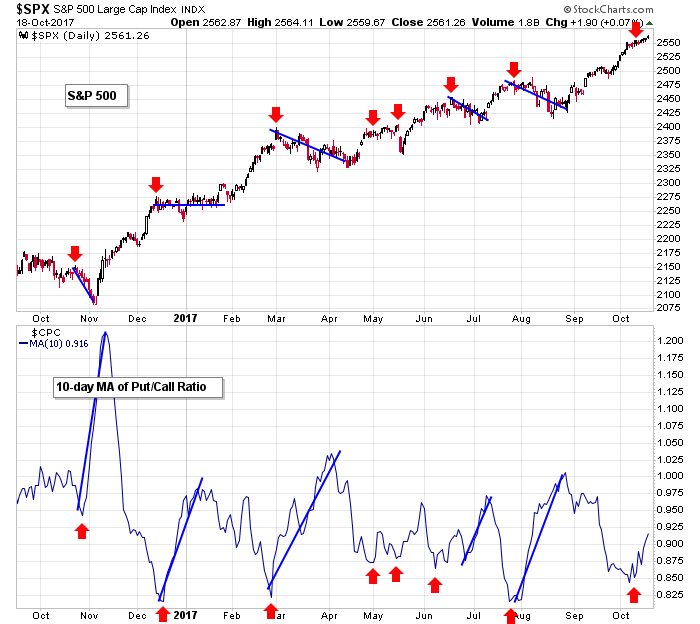

And the put/call has curled up.

Long term the market looks great, but short term, despite the constant grind to new highs, the market needs to let out some air.

Stock headlines from barchart.com…

Nike (NKE +0.58%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Grainger (GWW +1.65%) may open lower this morning after it was downgraded to ‘Sell’ from ‘Neutral’ at UBS with a price target of $195.

Jazz Pharmaceuticals Plc (JAZZ -0.03%) was initiated at a ‘Buy’ at FBR Capital Markets with a 12-month target price of $206.

Sprint (S -0.56%) was downgraded to ‘Neutral’ from ‘Outperform’ at Macquarie.

Adobe Systems (ADBE +1.74%) jumped 8% in after-hours trading after it said it sees fiscal 2018 adjusted EPS of $5.50, better than consensus of $5.20.

eBay (EBAY +1.28%) slid 5% in after-hours trading after it said it sees Q4 adjusted EPS from continuing operations of 57 cents-59 cents, weaker than consensus of 60 cents.

Pattern Energy (PEGI unch) slid 4% in after-hours trading after it said it expects its Q3 operating loss to be materially and substantially greater than a year ago due to hurricanes this fall.

Supernus Pharmaceuticals (SUPN +0.49%) was initiated at a ‘Buy’ at FBR Capital Markets with a 12-month target price of $53.

Ignyta (RXDX +13.24%) fell nearly 4% in after-hours trading after it announced that it had commenced an underwritten public offering of $125 million is shares of its common stock.

Limelight Networks (LLNW +2.75%) rallied 10% in after-hours trading after it raised its 2017 revenue estimate to $182 million-$185 million from a July 26 estimate of $180 million-$182 million.

Earthstone Energy (ESTE -1.40%) dropped over 7% in after-hours trading after it announced that it had commenced an underwritten public offering of 4.5 million shares of its Class A common stock.

Evoke Pharma (EVOK -3.68%) was initiated at a ‘Buy’ at FBR Capital Markets with a 12-month target price of $10.

Conatus Pharmaceuticals (CNAT +0.98%) jumped almost 7% in after-hours trading after it said the European Medicines Agency granted orphan designation to CNAT’s drug candidate IDN-7314 for the treatment of primary sclerosing cholangitis.

—————

VIDEO: There’s a Bull Market Somewhere

—————

Wednesday’s Key Earnings

Abbott (NYSE:ABT) +1.3% after beating estimates.

American Express (NYSE:AXP) -1.1% AH appointing a new CEO.

eBay (NASDAQ:EBAY) -5.3% AH dinged by light profit guidance.

U.S. Bancorp (NYSE:USB) -1.1% following in-line earnings.

United (NYSE:UAL) -1.8% AH hurt by hurricane disruptions.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Philly Fed Business Outlook

9:45 Bloomberg Consumer Comfort Index

10:00 Leading Indicators

10:30 EIA Natural Gas Inventory

2:00 PM Treasury Budget

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

9 thoughts on “Before the Open (Oct 19)”

Leave a Reply

You must be logged in to post a comment.

Will…Jason the market is down a little today, say when to buy…please. My wife is your client, I just work for her.

Jason is very good but if he always knew when to buy and sell he would be very very wealthy.

I used to post my buy and sell signals. It is not worth doing. I only did it to prove the point to myself.

No crash of 87 today but it should be interesting!

this is the start of a multi decade bear market

the bulls can buy anytime they want

just bought some silver bars and gold coins…hedging for the monetary reset…sdr value of us dollar is 70.89

jims

wise,protection for a debt implosion–gold/silver just starting their rise

haven’t seen your posts for ages–are u still daytrading

yes, mostly crude. i am seeing all sorts of very odd anomalies. The Geo weather storms, the burning of calif. by using a plasma weapon and the false flag shootings in vegas. The dark side is ramping up…all for UN agenda 21…

There seem to be very few buyers. Today could be rough. I do think it is short lived.

Buy low sell high. Or sell high buy lower.

Jason

Very good analysis.

If anyone cares I am selling on tomorrows expected gap up everything I bought today.