Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed mostly up. Japan, Hong Kong, South Korea and India each gained more than 1%. New Zealand dropped more than 1%. Europe, Africa and the Middle East are currently mostly up. Turkey is up more than 2%; Germany, Greece, South America, Finland, Russia, Kenya, Norway, Italy and Ireland are up more than 1%. Futures in the States point towards a relatively big gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are up. Bonds are down.

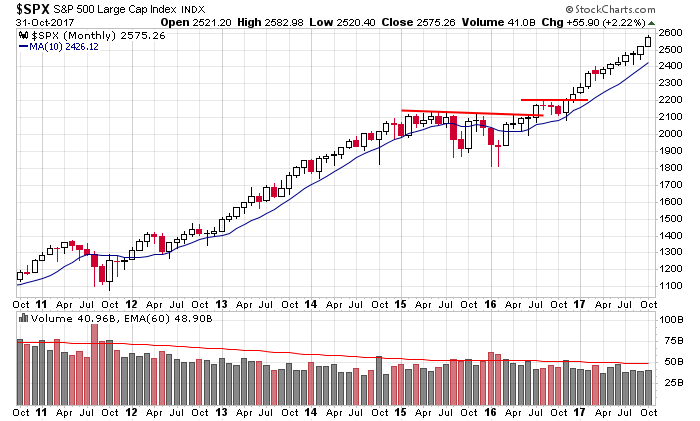

Here’s the S&P monthly. Any questions? The long term trend has been up for a long time. Don’t over-analyze.

Stock headlines from barchart.com…

American Airlines Group (AAL -0.91%) was upgraded to ‘Overweight’ from ‘Neutral’ at JP Morgan Chase with a price target of $65.

Altria (MO +0.27%) was upgraded to ‘Buy’ from ‘Hold’ at Edward Jones.

Check Point Software Technologies Ltd (CHKP +1.05%) fell 8% in after-hours trading after it said in an earnings call that it expects Q4 revenue to be $485 million-$525 million, below consensus of $529.1 million.

Fiserv (FISV -0.02%) lost 5% in after-hours trading after it lowered guidance on the top end of its full-year adjusted EPS view to $5.05-$5.12 from a prior view of $5.03-$5.17.

Paycom Software (PAYC +2.58%) dropped 5% in after-hours trading after it said it sees Q4 revenue of $111.5 million-$113.5 million, the mid-point below consensus of $113.1 million.

B&G Foods (BGS -2.00%) rallied almost 7% in after-hours trading after it reported Q3 adjusted EPS of 55 cents, better than consensus of 46 cents, and then said it sees full-year adjusted EPS of $2.03 to $.217, the mid-point above consensus of $2.05.

Sturm Ruger (RGR -1.00%) fell over 8% in after-hours trading after it reported Q3 sales fell -35% to $104.8 million.

CH Robinson Worldwide (CHRW +0.23%) gained 2% in after-hours trading after it reported Q3 revenue of $3.78 billion, better than consensus of $3.65 billion.

Papa John’s International (PZZA +1.51%) slid almost 3% in after-hours trading after it lowered guidance on 2017 North American comparable sales to up +1.5%, below a prior view of up 2% to 4%.

Qualys (QLYS +1.44%) jumped nearly 8% in after-hours trading after it reported Q3 adjusted EPS of 31 cents, well above consensus of 22 cents, and then said it sees full-year adjusted EPS of $1,04 to $1.06, better than consensus of 90 cents.

Envision Healthcare (EVHC +1.31%) plunged over 25% in after-hours trading after it reported Q3 adjusted EPS of 73 cents, weaker than consensus of 88 cents, and then said it sees Q4 adjusted EPS of 44 cents to 54 cents, well below consensus of $1.00.

Wabash National (WNC +2.23%) dropped 11% in after-hours trading after it reported Q3 adjusted EPS of 34 cents, below consensus of 39 cents, and then said it sees full-year EPS of $1.33 to $1.37, weaker than consensus of $1.45.

Modine Manufacturing (MOD +1.94%) climbed over 3% in after-hours trading after it reported Q2 net sales of $508.3 million, stronger than expectations of $466.5 million.

3D Systems (DDD +4.74%) tumbled 14% in after-hours trading after it reported an unexpected loss of -20 cents per share, weaker than consensus of EPS of 12 cents.

Tuesday’s Key Earnings

3D Systems (NYSE:DDD) -15.1% AH after an unexepected loss.

Electronic Arts (NASDAQ:EA) -2.9% AH on light holiday guidance.

MasterCard (NYSE:MA) -0.1% warning on European fines.

Pfizer (NYSE:PFE) -0.2% challenged by legacy medicines.

U.S. Steel (NYSE:X) +7.5% AH following a strong Q3.

Under Armour (NYSE:UAA) -23.7% slashing its full-year outlook.

Today’s Economic Calendar

Auto Sales

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Treasury Refunding Quarterly Announcement

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

10:30 EIA Petroleum Inventories

2:00 PM FOMC Announcement

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Nov 1)”

Leave a Reply

You must be logged in to post a comment.

“Consumers’ assessment of current conditions improved, boosted by the job market which had not received such favorable ratings since the summer of 2001. Consumers were also considerably more upbeat about the short-term outlook, with the prospect of improving business conditions as the primary driver. Confidence remains high among consumers, and their expectations suggest the economy will continue expanding at a solid pace for the remainder of the year.” Source Gvt BLS, STZ is doing well.