Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Japan, Hong Kong, South Korea, India, Austria and Singapore led the way. Europe, Africa and the Middle East are currently mostly up. France, Turkey, Greece, South Africa, Finland, Russia, Norway, Hungary, Austria and Saudi Arabia are each up more than 1%. Futures in the States point towards a moderate gap up open for the cash market.

It’s been a very good week so far. Here are how a few of our setups have done.

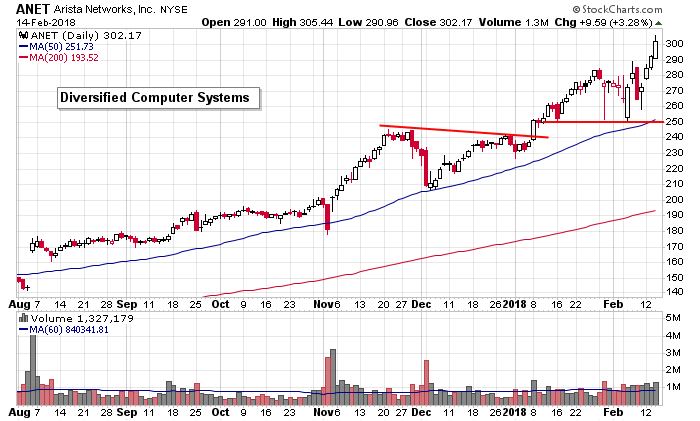

ANET, which bounced off its 50-day last week, took out its high this week.

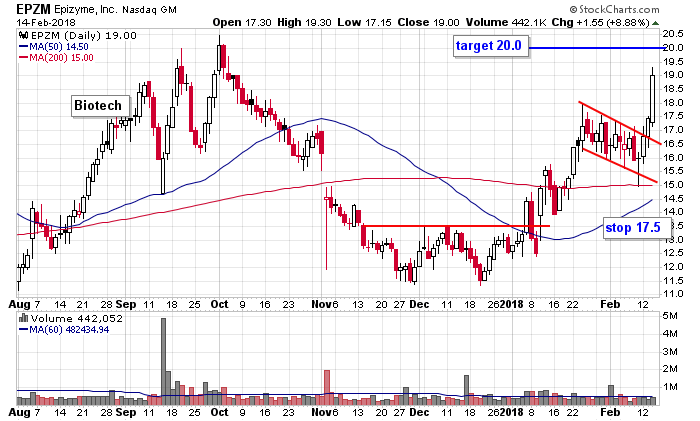

EPZM bounced off its 200 and broke out.

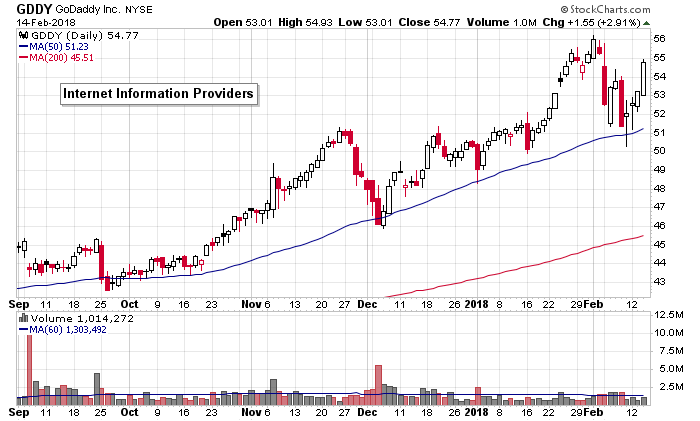

GDDY bounced off its 50 and has moved up 4 points.

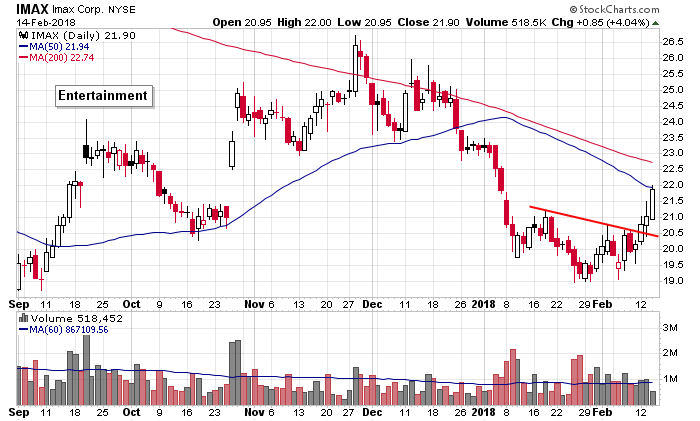

IMAX broke out from a little bottoming pattern.

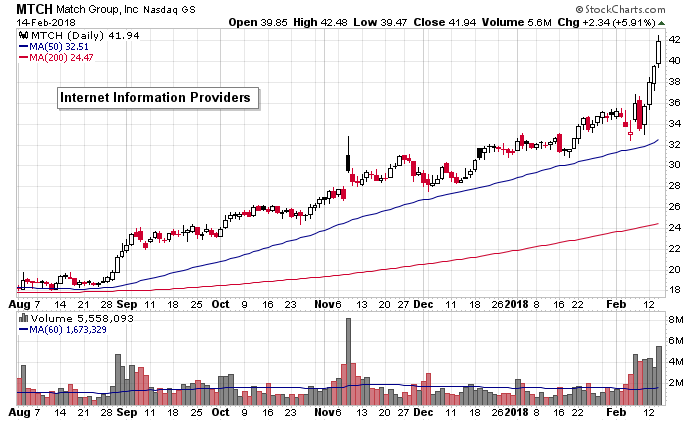

MTCH has seen steady buying all week.

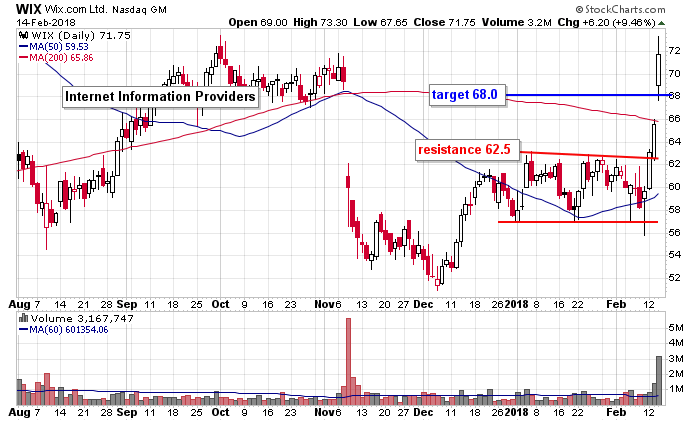

WIX put in a bottoming candle last Friday and then exploded.

You can subscribe to all our trading setups for only $299 for the year. Come check us out

The dollar is down. Bitcoin is up. Oil and copper are down. Gold and silver are down. Bonds are up.

Stock headlines from barchart.com…

Agilent (A +1.99%) rose 3% in after-hours trading after it reported Q1 adjusted EPS of 66 cents, stronger than consensus of 58 cents.

Equinix (EQIX -0.10%) slid over 3% in after-hours trading after it reported Q4 adjusted Ebitda of $564.8 million, weaker than consensus of $570.4 million, and said it sees full-year adjusted Ebitda above $2.39 billion, below consensus of $2.46 billion.

Marriott International (MAR +3.29%) fell 3% in after-hours trading after it said it sees full-year adjusted Ebitda between $3.32 billion and $3.42 billion, well below consensus of $3.47 billion.

Overstock.com (OSTK +4.77%) gained 3% in after-hours trading after Soros Fund Management LLC reported it took a 9.9% stake in the company in Q4.

NetApp (NTAP +3.23%) sank 9% in after-hours trading after it said it sees Q4 adjusted EPS between 95 cents and $1.03, the midpoint below consensus of $1.03.

Applied Materials (AMAT +4.86%) gained 1% in after-hours trading after it reported Q1 net sales of $4.20 billion, higher than consensus of $4.11 billion, and then said it sees Q2 net sales of $4.35 billion to $4.55 billion, well above consensus of $4.20 billion.

Teva Pharmaceutical Industries Ltd (TEVA +4.37%) is up over 10% in pre-market trading after Berkshire Hathaway reported a new 1.86% stake in the company.

TripAdvisor (TRIP +2.11%) surged 16% in after-hours trading after it reported Q4 adjusted Ebitda of $63 million, higher than consensus of $51.4 million.

SolarEdge Technologies (SEDG +2.50%) rallied nearly 15% in after-hours trading after it reported Q4 revenue of $189.3 million, higher than consensus of $180.6 million, and then said it sees Q1 revenue of $200 million to $210 million, well above consensus of $158 million.

PolarityTE (COOL +5.73%) jumped 8% in after-hours trading after it was rated a new ‘Overweight’ at Cantor Fitzgerald with a 12-month target price of $70.

Box (BOX +4.07%) was rated a new ‘Buy’ at D.A. Davidson with an 18-month target price of $25.

Marathon Oil (MRO +5.48%) rose nearly 3% in after-hours trading after it reported Q4 adjusted EPS from continuing operations of 7 cents, well above consensus of 3 cents.

Amicus Therapeutics (FOLD +7.25%) fell over 2% in after-hours trading after it announced that it had commenced a $250 million underwritten public offering of its common stock.

CenturyLink (CTL +2.15%) jumped 13% in after-hours trading after it reported Q4 pro forma adjusted Ebitda excluding integration of $2.2 billion, better than consensus of $2.0 billion.

SunPower (SPWR +1.36%) dropped over 7% in after-hours trading after it said it is already seeing a negative near-term impact from the solar tariff decision as increased costs have delayed certain 2018 projects and made others uneconomical.

Wednesday’s Key Earnings

Cisco (CSCO) +6.8% AH boosting buyback, strong guidance.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Philly Fed Business Outlook

8:30 Producer Price Index

8:30 Empire State Mfg Survey

9:15 Industrial Production

9:45 Bloomberg Consumer Comfort Index

10:00 NAHB Housing Market Index

10:30 EIA Natural Gas Inventory

4:00 PM Treasury International Capital

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Feb 15)”

Leave a Reply

You must be logged in to post a comment.

monthly opts ex targets