Good morning. Happy Tuesday. Hope you had a good weekend.

The Asian/Pacific markets closed mostly down. Indonesia did well, but Japan, China, India, the Philippines, Hong Kong, South Korea and Malaysia were weak. Europe, Africa and the Middle East are currently suffering big losses. Turkey, Greece, Hungary, Spain, Italy, and Austria are down more than 2%; the UK, Poland, France, Germany, Denmark, South Africa, Switzerland, Belgium, Portugal and the Czech Republic are down more than 1%. Futures in the States point towards a big gap down for the cash market.

—————

Podcast: with Chat With Traders

—————

The dollar is up. Oil is down; copper is up. Gold and silver are down. Bonds are up.

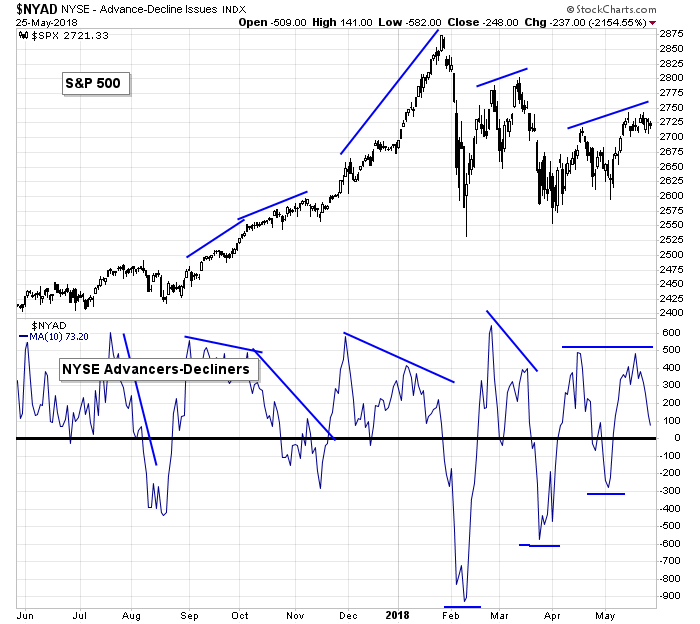

Things neutralized last week. Most of the indicators stayed in their ranges, and many of the indicators cycled down instead of maintaining their levels. Per the report posted over the weekend (even before the news in Europe broke) there is no momentum in either direction. Remember, one of the scenarios for the next couple months is for the range to continue. Five months into the year – the S&P has been range bound. It could continue for many more months. The market doesn’t have to do anything. Here’s the SPX vs. the 10-day MA of the NYSe AD line, as an example of an indicator which doesn’t suggest upside pressure is brewing.

Overnight Stock Movers from barchart.com…

Scana (SCG +0.96%) was downgraded to ‘Sell’ from ‘Hold’ at Williams Capital with a price target of $30.

Genesco (GCO +0.99%) was downgraded to ‘Neutral’ from ‘Buy’ at CL King & Associates.

Infinera (INFN +1.00%) was downgraded to ‘Underperform’ from ‘Hold’ at Jeffries.

Phillips 66 (PSX -2.71%) was upgraded to ‘Outperform’ from ‘Market Perform’ with a price target of $134.

Ford Motor (F -0.95%) was upgraded to ‘Buy’ from ‘Hold’ at Jeffries with a price target of $14.

ION Geophysical (IO -3.93%) was rated a new ‘Buy’ at Janney Montgomery Scott LLC with a price target of $35.

Abiomed (ABMB) may open higher this morning when it was announced after the close of trading Friday that it will replace Wyndham Worldwide in the S&P 500 Index prior to the open of trading Thursday, May 31.

Farmer Brothers (FARM +0.71%) may move higher this morning after holder Leven Capital Strategies boosted its stake in the company to 8.4% from 1.17% in March.

Sparton Corp (SPA +2.28%) may move higher this morning after Gamco reported a 7% stake in the company.

Inovio Pharmaceuticals (INO +1.24%) dropped 11% in after-hours trading after it entered into agreement with Stifel through which it may sell up $100 million of its common stock.

Today’s Economic Calendar

00:40 Fed’s Bullard: U.S. Monetary and Economic Policy

9:00 S&P Corelogic Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:30 Dallas Fed Manufacturing Survey

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

3 thoughts on “Before the Open (May 29)”

Leave a Reply

You must be logged in to post a comment.

Today is volatile in spades. Suspect that Dax could start something in the EU which catch the world by surprise. In index puts, only 20% invested…. watching.

The pushback against Trump’s Zionist blackmail-induced activity in the Middle East could be seen when “the House on May 23 banned Trump from declaring war on Iran without Congressional approval, and Congress on May 24 killed a measure for the U.S. to recognize Golan as part of Israel,” the sources say. In other words, Zionist blackmail against Trump is not going to be enough to allow these fanatics the opportunity to start their long-awaited World War III.

Other Pentagon sources, meanwhile, are saying a major victory against the Zionist-controlled banks was achieved last week and that as a result, trillions of dollars fraudulently obtained after the Lehman crisis is now going to be used for a new financial system. The source says,

“…that a gold-backed U.S. dollar looms on the horizon; that the U.S. government is going to stop borrowing money from the banks; that Donald Trump may have succeeded in getting back perhaps…

$15 trillion in “credits” from the $23-43 trillion now known to have been stolen by the banks; and—most importantly for the American public—that sometime in June over a trillion dollars will be released into the U.S. economy through trusted stewards—normal people, many of them veterans—to inspire a job creation and new construction boom such as we have not seen since the aftermath of World War II. The massive investments in mostly black inner cities and mostly white impoverished rural areas is part of this deal.”

This financial move, if it is realized, is definitely connected to ongoing intrigue in Saudi Arabia, the current main financial backer of the old petro-dollar. Here, de facto monarch Mohammad bin Salman has not been seen in public since a shoot-out was reported at his palace on April 21, 2018. This move against Salman, who was put in power by Israeli special forces, is definitely linked to attacks on Saudi agent and former CIA head John Brennan, the sources say. Brennan is now being blamed as the source for the entire “Russiagate” witch-hunt against Trump, they say.

Spain and Italy, especially, are going to be big in the news cycle over the coming weeks. To put this situation in perspective, the Italian and Spanish GDPs combined are worth more than $3 trillion, or 16 times the $194 billion GDP of Greece. This means the crisis will be 16 times bigger than the Greek crisis that, by itself, nearly undid the Euro.

The Italians now have a government that plans to do something about the slow destruction of the Italian economy caused by its participation in the Euro by issuing a new currency to pay for various plans to fix Italy’s economy. The old establishment is so upset about the new Italian government that Italian President Sergio Mattarella vetoed their candidate for Finance Minister because he is opposed to the Euro. The Italian president is supposed to be a figurehead, and this anti-democratic move is going to result in an open attack on the Italian deep state, according to P2 Freemason lodge sources. Italy’s Five Star leader Luigi Di Maio said on Sunday that President Sergio Mattarella should be impeached for betraying the state because of his rejection of a eurosceptic as economy minister.

https://www.reuters.com/article/us-italy-politics-impeachment/italys-5-star-leader-says-president-should-be-impeached-idUSKCN1IS0S1

https://www.bloomberg.com/news/articles/2018-05-28/italy-s-establishment-vetoes-the-populists

A comparable thing is likely to happen in Spain because of similar structural problems related to the Euro. These problems can only be solved by these countries either giving up economic sovereignty or else issuing their own currency. The governments in both countries favour issuing new currencies. However, any new currencies in Southern Europe would not only endanger the Euro, they would also open the way for the big Kahuna—a new currency for the United States to replace or cohabit with the no-longer-American U.S. dollar.

In other words, the existing financial paradigm is likely to face its biggest crisis since the Lehman shock, and this time it may not survive without a complete reboot. Until that happens, we can expect financial turmoil.

Typically with these crises, the first victims will be those with the riskiest gambling portfolios—in this case people who have been buying junk bonds and stocks at historically unsustainable prices.