Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. China, Hong Kong, India, Malaysia, South Korea and Japan all did well while Singapore and Indonesia posted losses. Europe, Africa and the Middle East are currently mostly up. The UAE, Greece, Denmark, South Africa, Norway, Hungary, Italy, Portugal, Austria, Saudi Arabia and Russia are leading; Poland and Turkey are weak. Futures in the States point towards a flat and mixed open for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are up. Bonds are down.

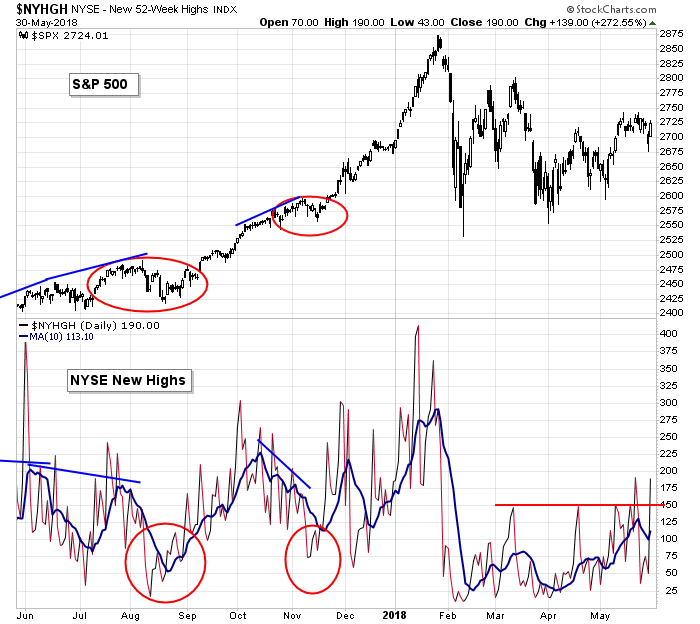

Second attempt to breakout new highs. It has to stick for yesterday’s rally to continue.

Overnight Stock Movers from barchart.com…

Micron (MU -0.08%) fell more than 3% in pre-market trading after it was downgraded to ‘Equal-Weight’ from ‘Overweight’ at Morgan Stanley.

Corning (GLW -1.46%) was upgraded to ‘Overweight’ from ‘Equal-Weight’ at Morgan Stanley with a price target of $34.

Bluebird Bio (BLUE -1.83%) was rated a new ‘Overweight’ at Piper Jaffray with a price target of $240.

Loxo Oncology (LOXO +3.12%) was rated a new ‘Overweight’ at Piper Jaffray with a price target of $200.

HealthEquity (HQY +1.62%) was downgraded to ‘Neutral’ from ‘Overweight’ at Cantor Fitzgerald with a price target of $65.

Keysight Technologies (KEYS -0.08%) rose 4% in after-hours trading after it reported Q2 adjusted revenue of $999 million, better than consensus of $965.8 million, and then forecast Q3 adjusted revenue of $942 million to $972 million, well above consensus of $912.5 million.

Agios Pharmaceuticals (AGIO +0.75%) was rated a new ‘Overweight’ at Piper Jaffray with a price target of $125.

CRISPR Therapeutics AG (CRSP +6.79%) plunged over 20% in after-hours trading after it announced that the FDA had placed a clinical hold on the Investigational New Drug Application for its CTX001 drug for the treatment of sickle cell disease pending the resolution of certain questions that will be provided by the FDA.

Box (BOX +1.94%) slid more than 4% in after-hours trading after it forecast full-year revenue of $603 million to $608 million, the midpoint below consensus of $606.8 million.

Gilead Sciences (GILD +0.53%) was rated a new ‘Overweight’ at Piper Jaffray with a price target of $85.

Cherry Hill Mortgage Investment (CHMI +0.63%) fell 5% in after-hours trading after it announced that it is offering 2.75 million shares of its common stock in an underwritten public offering.

Quality Systems (QSII -0.82%) was upgraded to ‘Overweight’ from ‘Neutral’ at Cantor Fitzgerald with a price target of $21.

Tilly’s (TLYS +2.78%) jumped 12% in after-hours trading after it forecast Q2 EPS of 24 cents to 28 cents, well above consensus of 12 cents.

Wednesday’s Key Earnings

Box (NYSE:BOX) -4.6% AH following mixed guidance.

Dicks (NYSE:DKS) +25.8% despite ditching assault rifles.

Today’s Economic Calendar

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Personal Income and Outlays

9:45 Chicago PMI

9:45 Bloomberg Consumer Comfort Index

10:00 Pending Home Sales

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

1:00 PM Fed’s Reserve Gov. Lael Brainard: Economy and Monetary Outlook

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (May 31)”

Leave a Reply

You must be logged in to post a comment.

liquidity is the next bubble, index funds account for 43 percent of all stock fund assets, and this is projected to be 50 percent in the next 3 years, according to Barron’s.

In total, index funds represent $7 trillion of U.S. stock funds that have no active manager. All buying and selling are done automatically. Active management has gone out of fashion, and as this sea change occurs, the market’s ability to price companies diminishes.

Ownership of stocks in the S&P 500 is concentrated with three companies; Vanguard, BlackRock, and State Street. They represent about 88 percent of the S&P 500, and if we include Schwab and Fidelity, over 90 percent of the S&P 500 is basically now in the hands of five companies.

This is without doubt the greats threat to investors that can exist. Selling long calls, holding 85% cash.