Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Japan, India and Malaysia moved up; China, Hong Kong, Australia and Indonesia moved down. Europe, Africa and the Middle East currently lean to the downside. Turkey and Finland are up; France, Russia, Switzerland, Hungary, Spain and the Netherlands are down. Futures in the States point towards a slightly down open for most of the market and a big gap down for the Nasdaq.

—————

VIDEO: There’s a Bull Market Somewhere

—————

The dollar is up. Oil and copper are flat. Gold is flat; silver is down. Bonds are up.

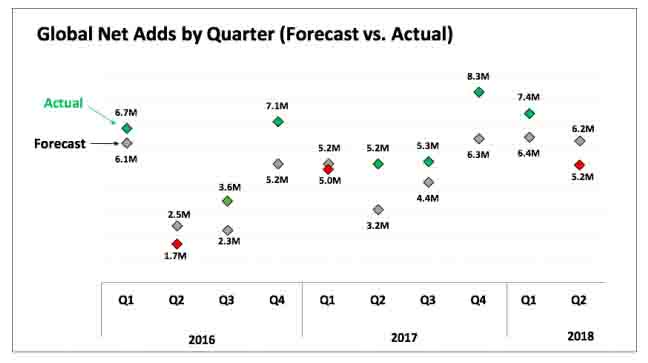

Earnings season is getting started. Netflix missed on revenue and missed big on subscriber adds relative to their own forecast. The stock is down about 12% on the news. Here is subscriber adds vs. forecast the last 10 quarters.

Overnight Stock Movers from barchart.com…

Netflix (NFLX +1.18%) tumbled 12% in pre-market trading after it reported Q2 revenue of $3.91 billion, weaker than consensus of $3.94 billion, and said that it added 5.2 million users in Q2, 1 million below expectations of 6.2 million subscribers.

Amazon.com (AMZN +0.52%) is down more than 1% in pre-market trading after the company reported technical glitches on its website and app during its Prime Day sales promotion.

Intel (INTC -0.40%) was downgraded to ‘In-line’ from ‘Outperform’ at Evercore ISI.

Manitowoc (MTW -1.50%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs with a price target of $22.

First American Financial (FAF +0.12%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Keefe, Bruyette & Woods with a price target of $61.

Wolverine World Wide (WWW +0.86%) was upgraded to ‘Strong Buy’ from ‘Buy’ at CL King & Associates with a price target of $41.

Goodyear Tire & Rubber (GT -1.15%) is down almost 3% in pre-market trading after it was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs with a price target of $18.

International Game Technology PLC (IGT -1.97%) rose nearly 3% in after-hours trading after FanDuel announced that IGT will be the sport’s betting platform provider at Meadowlands Racetrack in East Rutherford, NJ.

Carbonite (CARB -0.13%) dropped 6% in after-hours trading after it announced that it had commenced a proposed public offering of 4.0 million shares of its common stock.

Xeris Pharmaceuticals (XERS -0.54%) was rated a new ‘Buy’ at Mizuho Securities with a price target of $26.

Redfin (RDFN +2.00%) fell almost 5% in after-hours trading after it announced that it intends to offer 3.5 million shares of its common stock in an underwritten public offering.

Evolus (EOLS -3.97%) sank 12% in after-hours trading after it commenced a proposed underwritten public offering of 5.0 million shares of its common stock with 2.5 million shares being offered by Evolus and 2.5 million shares to be offered by a selling stockholder of Evolus.

Switch (SWCH +1.02%) was rated a new ‘Buy’ at Stifel with a price target of $15.

Avid Bioservices (CDMO -3.66%) climbed 6% in after-hours trading after it reported an unexpected Q4 profit of 3 cents, better than consensus of a -15 cents per share loss.

Monday’s Key Earnings

Bank of America (NYSE:BAC) +4.3% bolstered by consumer banking.

BlackRock (NYSE:BLK) -0.6% on disappointing Q2 flows.

Netflix (NFLX) -14.1% AH as subscriber growth missed estimates.

Today’s Economic Calendar

8:55 Redbook Chain Store Sales

9:15 Industrial Production

10:00 Powell to deliver semi-annual monetary policy testimony

10:00 NAHB Housing Market Index

4:00 PM Treasury International Capital

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY