Good morning. Happy Tuesday.

These comments will be brief, and my comments on the Market Window and Message Board may be brief today too. A massive storm last night knocked out my cable and fried my router. So I hooked up each computer directly to my modem and learned two of my computers were fried too. I’m only just now getting internet access on the third and will be spending the day figuring out what’s wrong with the other two. The storm was awesome. I sat out on my back deck and watched and listened to most of it. Lightening filled the sky over the Rocky Mountains, … but the price I’m paying for the show is a destroyed router and two computers that can’t get online.

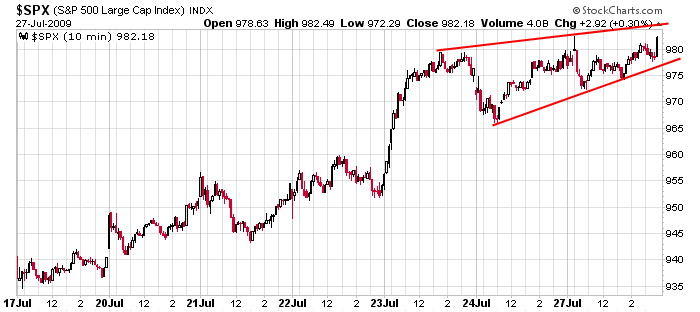

The market traded lethargically yesterday, but it was nice to see the banking index do well. It was the one group that wasn’t participating in the move up, and we needed confirmation from it. Over the last couple days, the market has grinded higher; this type of action tends to lead to swift pullbacks or surges that break the bear’s backs. Here’s the 10-min SPX chart. A rising wedge is forming. Within a downtrend, it’s bearish. Within an uptrend, it neutralizes the uptrend rather than being flat-out bearish.

The trend is up, but the risk/reward for initiating new positions is not very favorable. My gut says the SPX takes out 1000 to sucker in the more longs and get the media excited. Then we’ll get a little pullback.

That’s it for now. I’m not yet sure how much I’ll be on the message board today.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases