“The game taught me the game.” Jesse Livermore said it 100 years ago, and it remains true today. Any trader who has done well and survived for a long time has a long list of stories involving bad trades, improper operations, terrible discipline and horrible luck. But those situations provide the stepping stones to success. Each unfortunate event, whether within or outside the trader’s control, provided a valuable lesson that, if listened to and heeded, paved the way for a successful career.

—————

Not a Leavitt Brothers subscriber but appreciate our work? Consider making a small donation.

—————

I’ve had plenty of mishaps. Here, I spill my guts and tell you about my worst trade ever. It happened many years ago, when I was relatively new in the industry. It wiped me out and put me in a big hole.

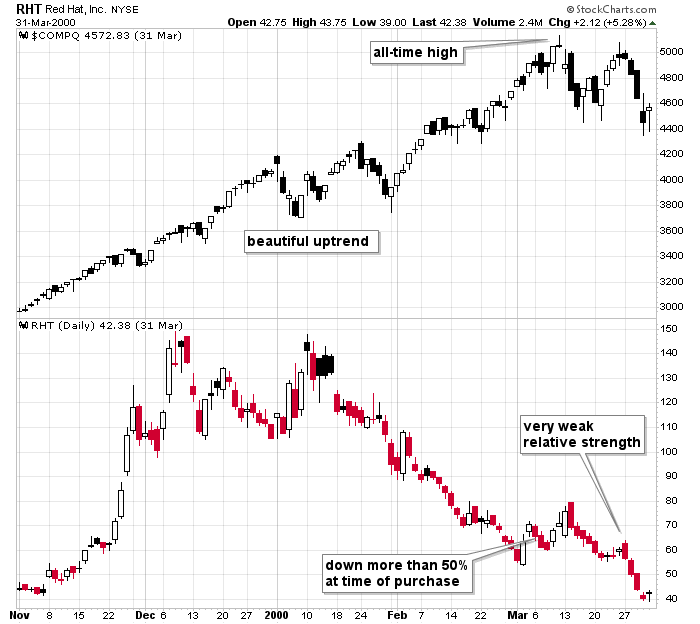

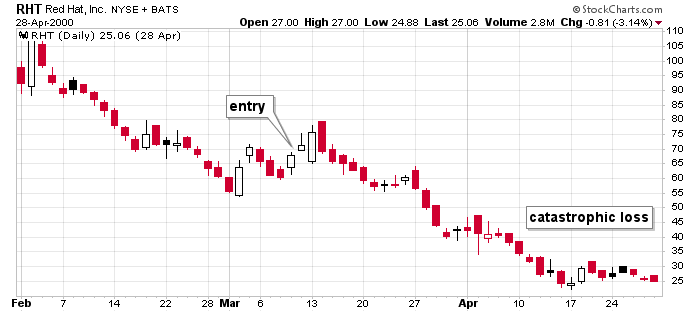

The trade, which took place in 2000, involved Red Hat (RHT) (IBM is in the process of acquiring them). At the time Red Hat traded at the Nas. It has since moved to the NYSE and changed its ticker. This also changed the price chart – for some reason the chart shifted up about 23% – so the movement of the charts shown below is accurate, but the absolute price levels are not.

I’m going to go step by step, show you what happened, talk about mistakes I made, what I should have done, and then sum everything up at the end with some quick takeaways.

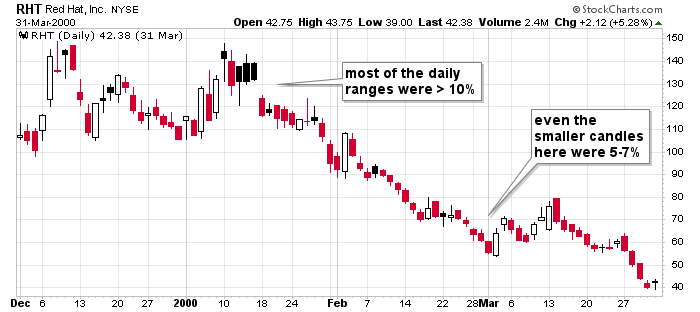

1) For starters Red Hat was not a stock I should have been trading. It was a high-flyer. It was one of many dot com stocks that rallied too much, and even if the company survived when the market topped – the market was going to eventually top – it was so overpriced, it was going get crushed. Moving 10% in a single day was normal, and considering my experience level at the time, the stock should have been off limits. There were plenty of other stocks that offered decent day-to-day and week-to-week movement. But I go lured in. Until then I was chipping away, making 50 cents or a dollar/day with moderately-priced stocks. But I wanted more action. I wanted bigger gains. It was a mistake. I was in over my head, which meant mistakes would be amplified. Stock selection is important. It’s your first line of defense. A poorly executed trade can have horrible consequences if a trader isn’t yet ready for the big leagues. Or have minimal consequences if the “right” stock is chosen. It’s the difference between giving a new driver a Toyota Corolla with a small engine, or a race car. I had no clue. I chose a race car even though I had no business stepping on the track. Big mistake.

2) I bought 1000 shares of Red Hat in March of 2000. This by itself was insane because it was all my money. I had slowly worked my account up from $10K to $60K over the previous couple months by making $500 or $1000 on each trade. I was a plunger. I would just put all my money in one stock, and when the trade was over, I’d put all my money in the next stock. I cringe at the thought of how clueless I was. It never occurred to me anything bad could happen. No matter how long you last in this business and how good you get, never put yourself in this position. It’s okay to have concentrated bets, but you build a position over time, as it shows you a profit. You don’t go all-in, all at once with every penny you have.

3) At the time the Nasdaq was at an all-time high – in fact it had just rallied about 25% in the previous six weeks – but Red Hat was 50% off its high. Relative strength is super important. It’s much better to play a leader than a laggard. With Red Hat being so weak relative to the overall market, it should not have even been on my list, even if I was a competent trader at the time.

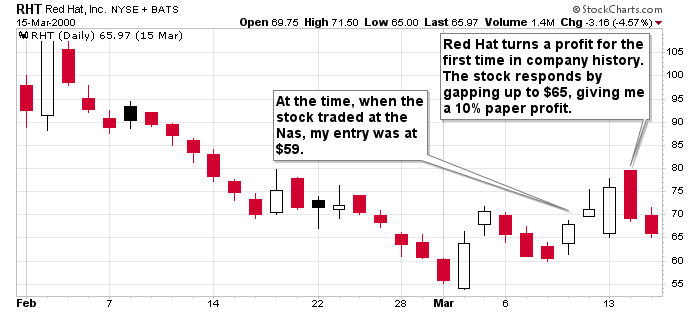

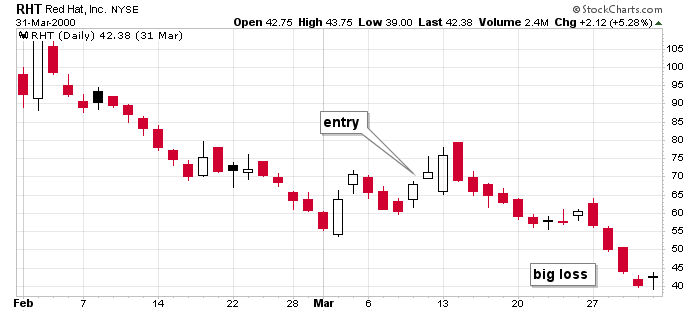

4) I held the stock into earnings. Let’s see – it’s was a high-flyer that could move 10% in a day without news and I had no business trading it in the first place, yet I put every penny I had into the stock and held into earnings? This is a recipe for disaster, but I got lucky. For the first time in company history, Red Hat turned a profit. They made a penny/share, and the stock gapped up about 10%, from $60 to $66. I had a $6K profit at the open, but I didn’t take it. I wanted more. The opening tick turned out to be the high of the day, and the stock sold off all day and closed with a sizeable loss. My pure luck $6K profit was whittled away until there was nothing left. My profit turned into a breakeven trade, which then turned into a small loss, and as you’ll soon see, the small losses turned into a massive loss.

I didn’t have a plan – literally, I had no plan whatsoever. I bought without knowing where I might take profits or where I would get stopped out. I just bought in hopes the stock, which was very volatile, would rally a bunch and give me a big profit.

I didn’t have a stop.

I let a pretty good, quick gain turn into a loser – a big no-no. Any time you have a decent profit, you gotta protect it. You can always get back in, but you cannot ever let a decent gain turn into a loss. You just can’t do it.

Another clue: The absolute best possible news that could be released was released, and after a gap up, the stock dropped. This was my introduction to the concept of good news being priced in. I was clueless. I just figured they’re making money, and after some profit-taking the stock was going roar back to the highs. Obviously it didn’t happen. When great news hits, and the stock goes down, you know that news was already factored into the stock price. Get out. Seriously. At that point, nothing could help the stock. If the stock was going to drop on great news, there was no upside potential.

5) I continued to not have a plan. I continued to not operate with a stop. At this point I was hoping the stock would bounce. That’s it. Day after day just hoping it would bounce. No contingency plan if it didn’t happen. Just kept hoping.

My small loss turned into a big loss.

And then my big loss turned into a catastrophic loss.

I bought a stock that was out of my league. I bought a stock that had weak relative strength. I didn’t have a plan. I didn’t have a stop. I didn’t have a clue. I let a 10% profit turn into a loss and then a small loss into a big loss and then a big loss into a massive loss. But I wasn’t finished screwing everything up and losing money.

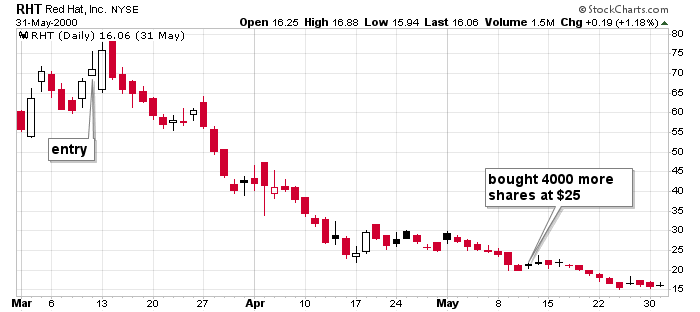

6) I borrowed money. Even though my $65K account (at the opening gap up price after earnings) was whittling away day after day, instead of taking a loss, I borrowed $100K and bought more. You read that right. With my account down more than 50% and sitting at about $25K, I borrowed $100K and bought 4000 more shares at $25. With 5000 shares, a move from $25 to $20 would have wiped me out. I still didn’t have a plan. I was just adding to a loser without good reason. It was attractive that my breakeven price was then $32. If the stock could just bounce a little, I could salvage the entire thing and write it off as a learning experience.

7) Then I got lucky. Microsoft and Red Hat were battling in court. I don’t remember the issue – if memory serves me right, Red Hat was into of Linux, an open source software, and Microsoft was going to do everything and anything necessary to protect its Windows operating system, including breaking the law. Regardless of the details, it was believed that whatever was good for Microsoft was bad for Red Hat and what was bad for Microsoft was good for Red Hat. The ruling was against Microsoft, so Red Hat, which had moved up into the ruling, gapped up. When the stock gapped up and pushed a little higher, my $35,000 loss was less than $10K, thanks to the additional shares I bought. Not great, but certainly a heck of a lot better. And mind you, the stock could have gapped down several points and wiped me out. I got lucky. Did I say thanks and use the opportunity to exit the position? Heck no. I was too stupid. Too stubborn. I still didn’t have a plan. Literally. I had no idea what I’d do if the stock went up. I had no idea what I’d do if the stock went down. I had nothing. I do remember getting the news while walking through downtown Boston. One of the big brokers had a TV in their window showing CNBC. People would congregate outside and watch. That’s where I got the news. I smiled, believing I was about to get rich, and then continued on my way, totally clueless.

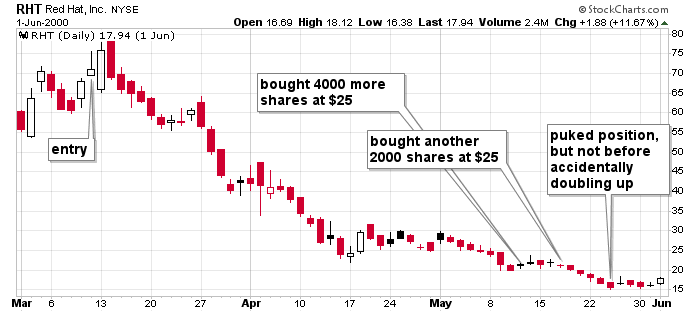

8) It gets worse. When the stock dropped back to $25, I added 2000 more shares, so I added to a loser, on margin, with borrowed money. Why did I add? Well, the previous time the stock dropped to 25 it popped back to 30, so why not add enough shares, so when it happens again, I’ll get back to breakeven?

9) I wasn’t done screwing everything up. I never did get out, and the stock dropped and dropped and dropped, and when I finally couldn’t take it anymore, I went to sell my 7000 shares, but somehow bought 7K shares. In the time it took me to realize I was long 14K shares instead of flat – which was only 10-15 seconds – the stock dropped another half point, so that little mistake cost me another 7 grand.

In the end I lost 90 grand. I was wiped out, and more than half the money I had borrowed was gone. I was 27 years old. Despite graduating college with no debt, I was $60K in the hole. And despite having a BS and MS in engineering, I was waiting tables at a seafood restaurant in Boston, making $2/month. That was rock bottom.

I played a stock that was out of my league.

Even if I was capable, it had weak relative strength.

I didn’t know that when great news comes out and a stock drops, I wasn’t supposed to fight it. I didn’t understand the concept of news being priced in.

I let a 10% winner turn into a breakeven trade. I don’t do this anymore. No matter how much I love a stock, I just don’t let that happen.

I let a small loss turn into a big loss and then a big loss into a horrendous, portfolio crippling loss.

I added to a loser with borrowed money. Then I added more, using margin.

I held into two major news announcements, and both times I got lucky, but neither time did I take advantage.

I didn’t have a plan.

I didn’t use stops.

I did everything wrong, and I paid a massive cost. 90 grand down the drain in about 2 months.

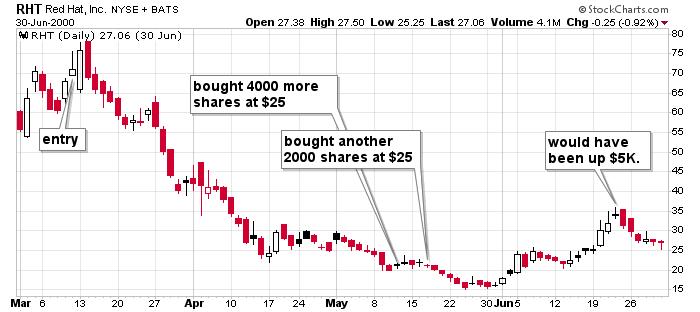

And to add insult to injury, if I would have held for another month, I would have made money, assuming I would have sold, which is no guarantee.

Now…

I don’t enter a position unless I have a clear plan. Why am I getting in? What can I realistically expect to happen? What if it doesn’t happen? How long will I give the position to work? I have a plan. I have contingency plans. There’s no more flying by the seat of my pants.

I have stops in place, although I rarely use them. They’re there to take me out if I don’t take myself out, but most of the time I manually get out before my stop is triggered.

I don’t let profits turn into loses.

I don’t let losses turn into big losses. I just can’t do it.

I’ll add to a losing position if it’s part of my plan – to scale into a position – but otherwise I don’t throw good money at a bad position.

I don’t get in over my head. I don’t put so much in one position where that one position can do huge damage.

It was a very expensive lesson. Don’t do what I did.

3 thoughts on “My Worst Trade”

Leave a Reply

You must be logged in to post a comment.

I know your pain….I got into GPRO a few years ago at $65/share…..and rode it down thinking it’s just gotta turn, it has to go up, it must go up….WRONG….WRONG…..!!!

Thanks for sharing your pain.

Best trading education on the internet!

The perils of youth and inexperience. I wonder how many crypto and sports betting stories are being generated by today’s young ones?