The rally off the 2009 bottom has been one of the biggest in history. From a time when many predicted the end of Wall Street as know it and the loss of an entire group of investors, the market bottomed.

Now, after 10 years, some analysts are calling for a top, citing the lagging small caps as evidence investors are rotating out of small caps and into large caps, with the expectation they’ll leave the large caps next.

But history says it’s normal for the small caps to lag as the market prepares to trade out of a large and extended consolidation period. And because of this, I’m in the camp that says we need to be selective with our investments and patient. Patient until the small caps catch a bid. Then, be ready to take full advantage of the next bull market.

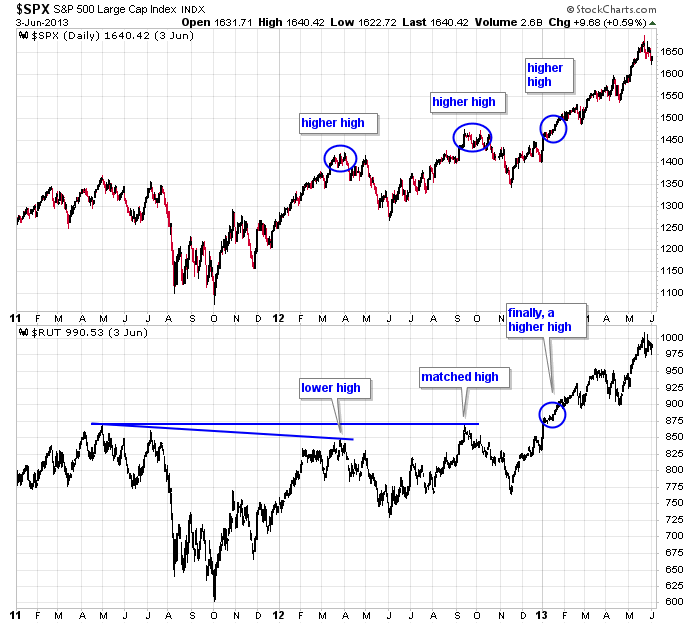

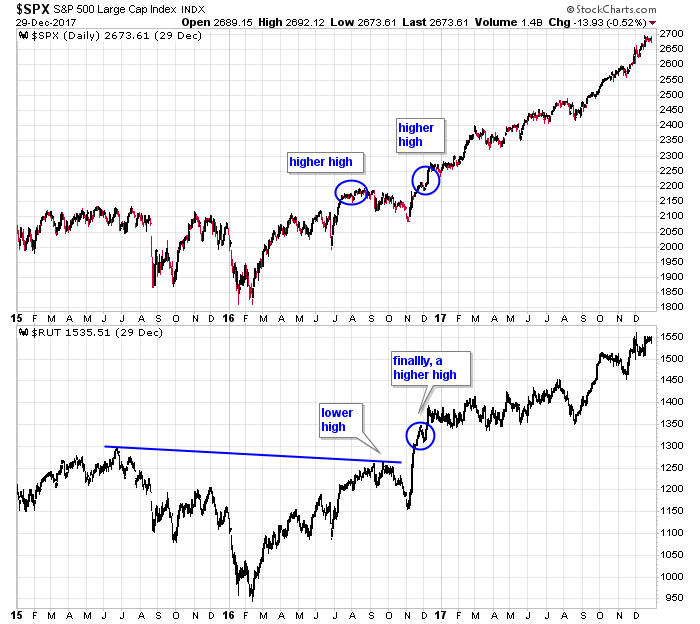

Here are two prior periods where the small caps lagged.

During the 2011-2013 period, the S&P moved to a new high in Q1 2012, but the Russell failed to match the movement. Then the S&P hit another new high later that year while the Russell was only able to match a previous high. More time was needed. It wasn’t until early 2013 when the small caps finally moved to a new high that the spectacular 2013-2014 bull run, that saw the S&P rally 50%, started.

During the 2015-2016 period, the S&P moved to a new high in early Q3 2015, but the Russell put in a lower high. Then, after a 3-month dip, both the big caps and small caps move to a new high in late 2016. This started the 2017 rally, which saw the S&P move 37% off the low.

In both cases, an extended consolidation period wasn’t halted by the lagging small caps; they were simply extended a few extra months. When the small caps finally caught a bid, a new bull run, lasting 1-2 years, began.

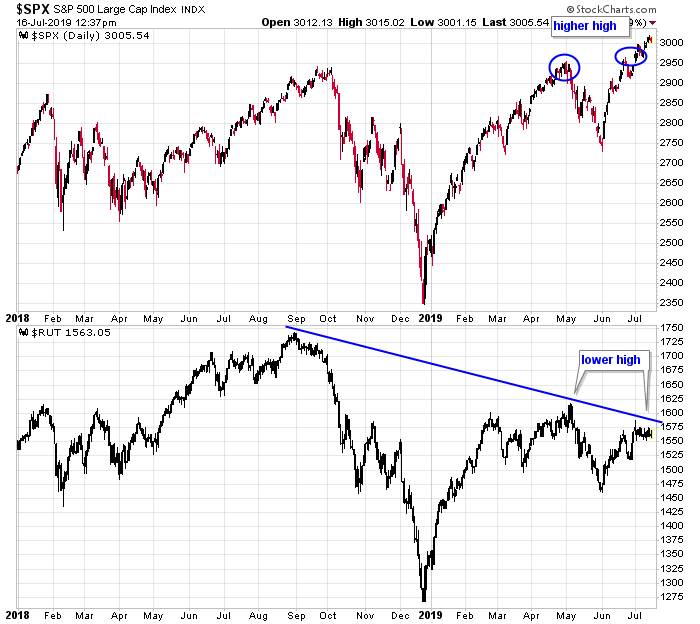

Moving to the current period…

Since the January 2018 top, the market has mostly traded in a large range. The S&P moved to a new high just a couple months ago, but the Russell failed to match the movement. Some technicians predicted a top was forming, but we know better. Lack of confirmation can simply mean more time is needed, not that a top has to form. Then the S&P hit another new high last month, but again, the small caps put in a lower high. Again, more time is needed.

When the small caps finally catch a bid – and I believe they will, given the absence of a major negative development and an accomodative Fed – the next phase of the current bull market should begin, taking the S&P well into the 3000’s.

Be ready to capitalize on the opportunity.

Jason Leavitt

One thought on “The Small Caps are Lagging – Is This a Problem?”

Leave a Reply

You must be logged in to post a comment.

Nice work