Good morning. Happy Thursday.

Heading into this week I thought the trend was up but that the market needed a rest. There were many reasons to be bullish and many to be bearish, and with the lack of good set ups to be found, it was a time to let the market show its cards before trading aggressively.

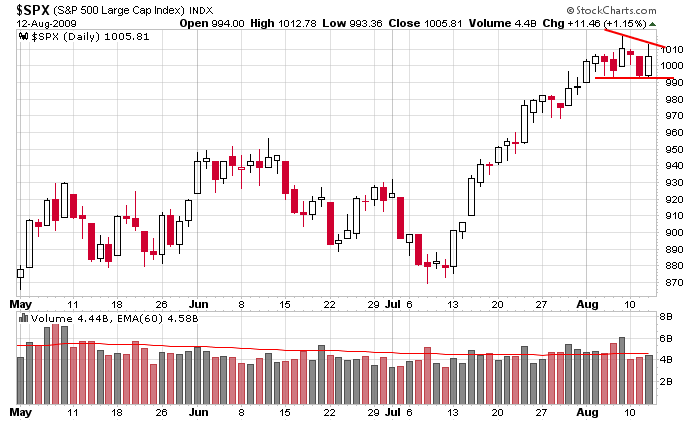

Now that we’ve had 3 days of trading, the current pattern is looking more and more like a bullish consolidation pattern within an uptrend. Some indicators might still be overbought, but at least they’re slowly being worked off. Here’s the daily SPX. …

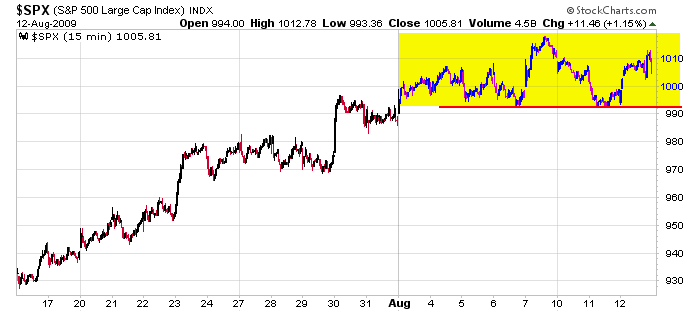

And here’s the 20-day, 15-min. The market has flattened out this month. A huge rally followed by sideways movement is hardly a bearish situation.

My #1 indicator is purely subjective. How many good set ups can I find? If I look at 500 charts and find several dozen good set ups in one direction or the other, that’s where my bias leans. But if the same research doesn’t reveal very many set ups in either direction, then I lay low. This is the current situation. The charts are messy. They’ve either gone too far too fast and need a break or they’re not setting up with easily definable support or resistance. Throw in that it’s summer and volume is going to be light from here until Labor Day, and I have good reason to trade, but not trade aggressively.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 13)”

Leave a Reply

You must be logged in to post a comment.

Light Volume = Me not as keen to participate!

However, your idea of “trading lightly” seems a good one if account balance allows.

I wonder what would happen if traders could agree on a single product to trade, and

build real volume organically so to speak, from the street. We wouldn’t be able to

match the funds, but at least we would (all) be on the same page. My candidate is the Emini S&P.

Hey…, technical analysis might then clarify, by applying it, to less than the broader market.

Everybody agree to trade the same product?

Isn’t that like slowly leading all the amateurs over to the poker table where the pros hangout? After a couple hands, they get up and leave.

There are many ways to trade the market and many products to trade. A key is to find your niche rather than going head to head with someone much better than you. And if what you’re good at isn’t available, it’s probably best to sit out. JMO

This is a philosophical consideration, because there is no way everyone would agree to trade a single product, (maybe?). But it is interesting, based upon volume, that the “amateurs”, (retail traders), are already leaving the table. Show me where the pros are not hanging out, please!

Divide and conquer flourishes when betting on a weather contract at the CME seems almost like a good idea.