The market is in terrible shape.

On the index level, tops have formed and confirmed downtrends are in place.

Among individual stocks, 80-90% of tech is in a bear market.

The internals have been weak for at least six months.

But while most of the market is off limits to investors, oil has offered a place to be for long-only participants. But this may be coming to an end, and if it does, it suggests the final leg down for the market is not far off. And unfortunately, it’s likely to be the worst.

As bad as the selling has been, it hasn’t been extreme. The VIX hasn’t spiked, and a glance at social media tells me traders are interested in buying bargains. Capitulation hasn’t taken place. Fear is not high enough.

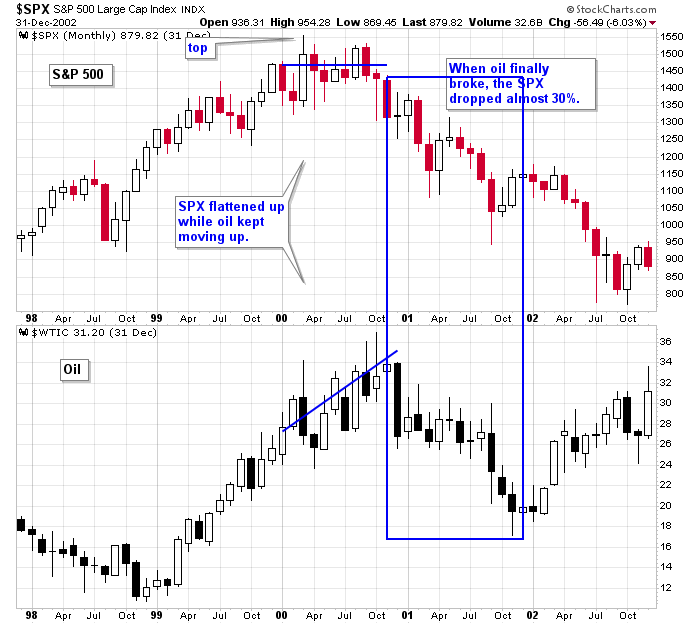

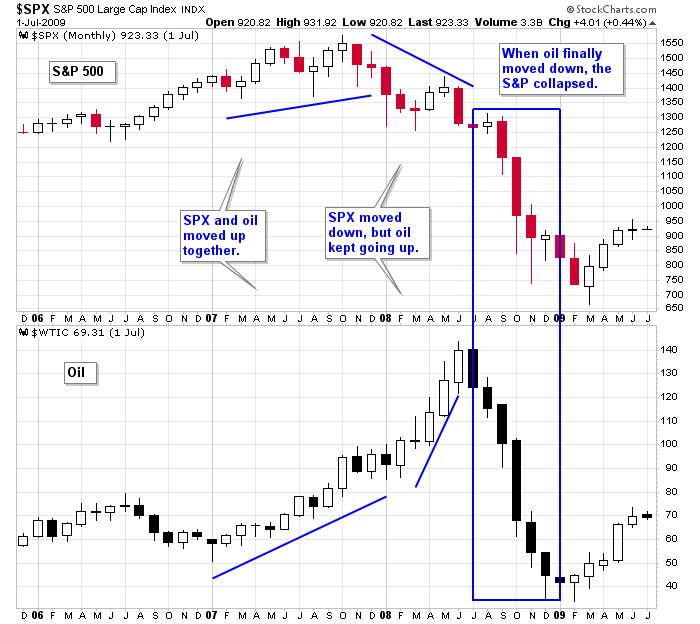

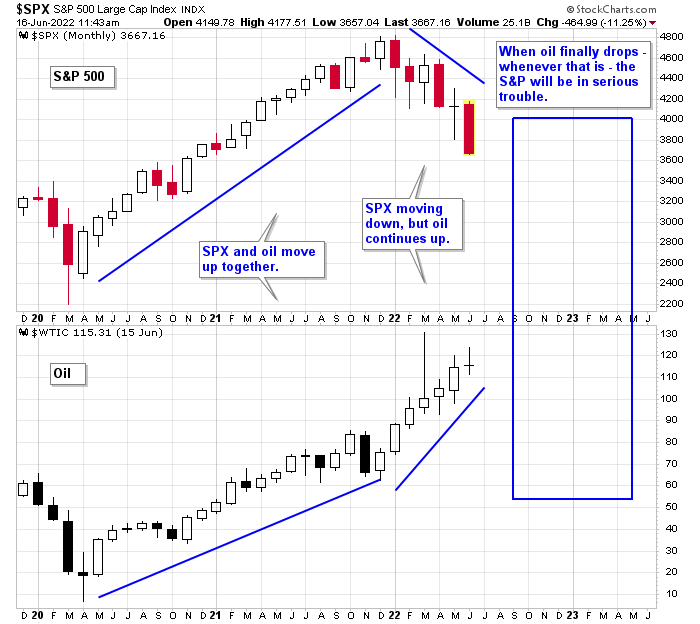

One “tell” we may lean on is oil. In the past, oil has not only outperformed in the beginning stages of a top; it’s trended up while the market has trended lower. But when oil cracked, the entire market collapsed. Here are some examples.

In the first half of 2000, the S&P flattened out in a range while oil continued trending up. But when oil finally topped and dropped, the S&P dropped almost 30%. Oil was the last shoe to drop. Everything else was down; oil was the last place to hide. But when it topped, the market headed down with force.

In 2007, the market started to flatten out while oil posted a solid gain. Then the S&P topped and pulled back within its range while oil surged 50%. The market was off its high but still in a large range. But when oil topped in mid 2008 and posted many consecutive months of losses, the S&P collapsed. Oil, again, was the last shoe to drop. When it fell, it was lights out for everything else.

Today is similar to 2007-2008. First the S&P and oil moved together, but this year they have diverged. The S&P has come down while oil has doubled. If this bear market resembles the Dot Com bust and Financial Crisis bust, we haven’t seen the market’s stiffest selling yet. That will come after oil tops.

In my opinion, this will not be a rank-n-file bear market that only lasts 7 months. The S&P is down 20%, and oil hasn’t even topped yet. When it does, look out below!. The S&P can easily drop to 3000, and time wise, we may only be halfway through.

Look at oil for a hint of when the next big leg down will come.

Have a great night.

Jason Leavitt

email list: https://www.leavittbrothers.com/email-subscribe.cfm

subscription: https://www.leavittbrothers.com/videos/LBoverview.cfm

masterclass: https://www.leavittbrothers.com/masterclass.cfm