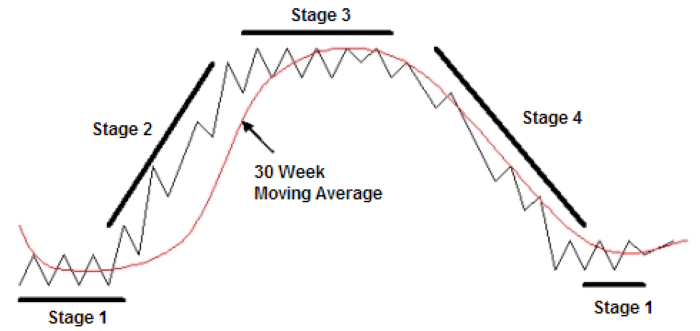

Stage analysis was popularized by Stan Weinstein in his book Secrets for Profiting in Bull and Bear Markets. This is the first book I recommend to all traders. In fact, it’s so good, I recommend it as the second book too because reading it a second time is more valuable than reading a different book a first time. Here’s a picture from the book outlining the stages stocks go through.

Weinstein uses a weekly chart with a 30-week moving average. It doesn’t have to be exactly this. The structure is more important. Is a stock basing? Is it advancing? Is it showing signs of distribution and topping? Is it declining? Let’s briefly to through each stage.

Stage 1 – The stock is basing. Buyers and sellers are in equilibrium. Volume and volatility dry up. Sellers are no longer aggressively selling. Longer term moving averages flatten out. The stock becomes very uninteresting. Even if you can nail a bottom, your money can be tied up for a long time because Stage 1 bases can last many months or even a few years.

Stage 2 – This is the advancing stage. The stock breaks out of the base and above a key moving average. Volume is strong, suggesting a change in character. If a stock can bust out of a long base on strong volume, odds increase a lasting uptrend can materialize. But the invisible hand of the market operates to prevent most people from participating, so expect enough pullbacks and consolidation periods to weed out weak holders. An investor should do his best to hold through the entire stage while a trader can trade in an out many times over the course of a few months or years.

Stage 3 – This is the topping area. The upside momentum morphs into a sideways range, and key moving averages flatten out. Volume and volatility are high. In fact, one tell-tail sign that a stock is shifting from Stage 2 to Stage 3 is volatility increases noticeably. Instead of trading calmly, there are big swings. Buyers and sellers are in equilibrium, but instead of smart money accumulating shares, they are selling to late-to-the-party investors who missed the entire advance.

Stage 4 – This is the declining stage. A top is in and downtrend begins. Stocks fall faster than they rally, so what took two years to gain during Stage 2 can be wiped out in 6 months in Stage 4. Lower highs and lower lows characterize the movement. At first, traders will rationalize the drop is just a pullback within an uptrend, but this is nonsense. You should never buy or hold a stock in a Stage 4 decline. Never.

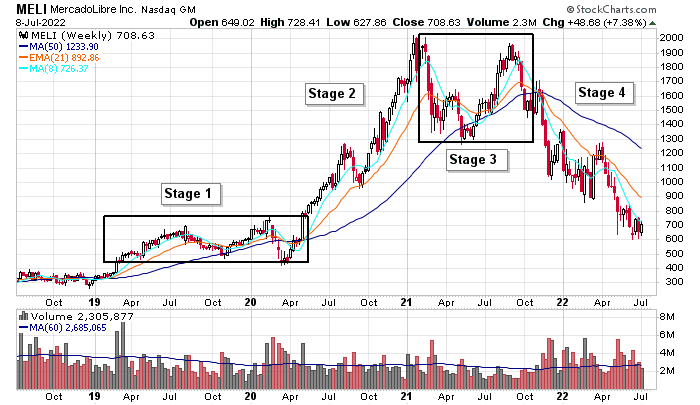

Here’s an example.

Don’t be an engineer and try to fit everything into a nice neat box. Have some flexibility. Just ask: Is the stock basing quietly and calmly? Is it trending up or down? Is it bouncing around in a range with a lot of volatility?

Stage 1 bases only suggest potential – they suggest stocks many be done falling and in the process of building a foundation to support the next Stage 2 advance. But a mini Stage 1 base can resolve down and continue the overall downtrend, and we may look back several months later and realize the Stage 1 base we thought was forming was just a consolidation period within a downtrend.

Or, even if a Stage 1 base is forming, it can last a long time. We don’t know. It can last two months or an entire year. So even if we are correct with regards to entries, we may not get much upside other than a bounce within a range.

And a Stage 3 decline doesn’t always result in a massive drop lasting months or years. It can last a couple weeks and be followed by a quick recovery.

Ask yourself: What stage is a stock in? But maintain some mental flexibility.

Jason Leavitt

email list: https://www.leavittbrothers.com/email-subscribe.cfm

subscription: https://www.leavittbrothers.com/videos/LBoverview.cfm

masterclass: https://www.leavittbrothers.com/masterclass.cfm