The S&P 500 fell 0.40% on the first trading day of the year. Not horrible, but it wasn’t overly encouraging either.

After starting with a moderate gap up and pushing a little higher during the opening minutes, sellers took over and drove prices down for several hours. The indexes bottomed during lunch and then moved up most of the afternoon.

Is this a big deal? Is it telling? Does it suggest anything for the rest of the year? Let’s look at some numbers.

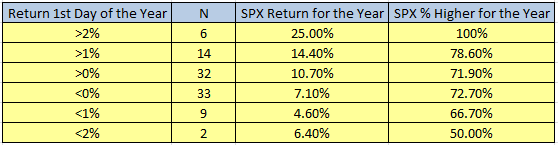

Since 1950, here’s what the market has done for the entire year as a function of what it did the first day of the year.

On line #1, when the market gains more than 2%, it has posted an average gain of 25% and has never posted a loss. On the last line, when the market has dropped more than 2% on the first day of the year, the market has posted an average gain of 6.4% and has 50% win rate.

There’s a definite difference between the gains in the top-half of the table and bottom-half, but even the worst-case scenario (dropping more than 2%) wasn’t horrible.

Today, the S&P dropped 0.4%, which puts it on line #4. The win rate is 72.7%, and the average gain is 7.1%.

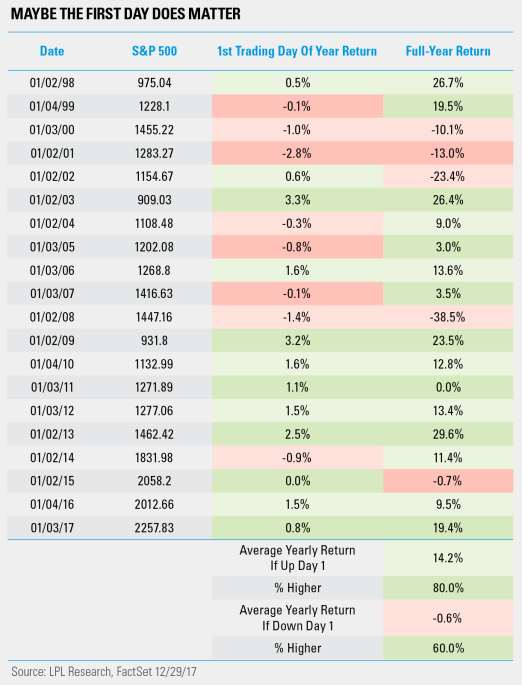

Here are numbers for years 1998-2017. When the market has posted a gain the first day of the year, the market was higher 80% of the time, with a 14.2% gain. When the first day was down, the win rate dropped to 60%, and the average return fell to -0.6%. This seems like an extreme drop, but the negative stats are bunched in 2000-2002 and 2008; otherwise, it’s not that bad. There were several years – 1999, 2004, 2005, 2014 – where a bad start to the year didn’t propagate and get worse. This leads me to conclude market conditions are more important than the performance of the first day.

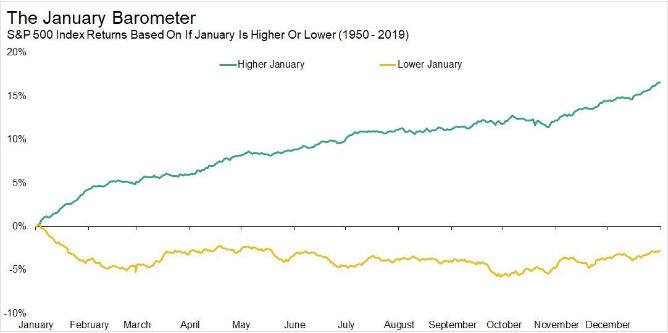

The first day is less important than the entire month of January. The month really does set the tone. When January is up, momentum builds, and the year tends to be very good. But when January is weak, the market has tended to flatten out and never recover. Here are two curves showing the average path, dependent on January being up or down.

The first day wasn’t great, but it wasn’t a catastrophe. And if the entire month is more important than the first day, there’s plenty of time to recover.

Jason Leavitt

Jason@leavittbrothers.com

email list: https://www.leavittbrothers.com/email-subscribe.cfm

subscription: https://www.leavittbrothers.com/videos/LBoverview.cfm

masterclass: https://www.leavittbrothers.com/masterclass.cfm