Let’s take a look around the world. What’s leading? What’s lagging? What are the notable developments?

A perspective I’m using is: In the US, the market topped in late 2021…bottomed in June and then in October 2022…and has generally been trending up since. With this in mind, we can note what’s outperforming and underperforming.

Asia/Pacific

China put in a higher low in October and then almost got back to its July high. It’s been basing in a wide range the last year, beneath the 2021 range that preceded it. It has potential here. It has spent this entire year above its 200, which is now trending higher.

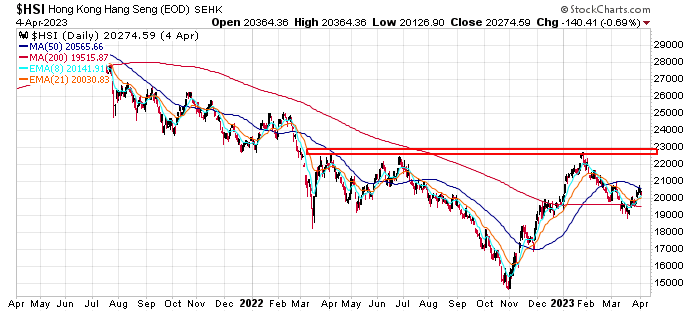

Hong Kong fell much further during Q4 of last year but then rallied huge into its late-January high. It seems to be basing, but until it can break out, at best, it’s neutral.

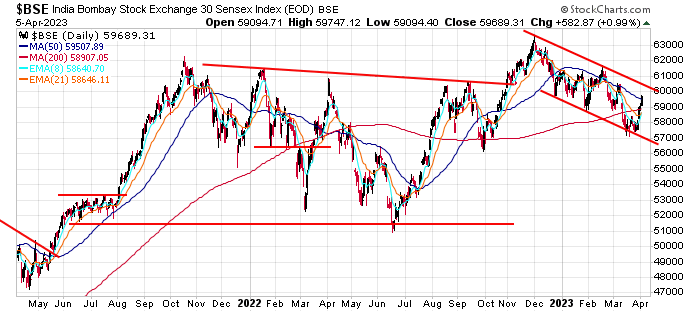

India put in a significantly higher low last fall and then rallied to a 52-week high in November and December. How many markets can say that? But it’s been downhill since then. Maybe this is a falling pattern within an uptrend, or maybe we should just note the index is unchanged over the last 18 months.

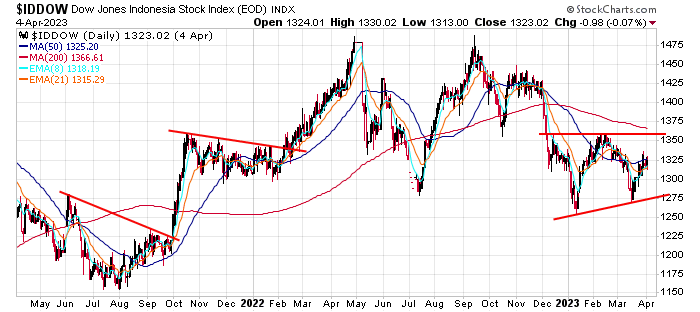

Indonesia printed a new high in September and then put in a higher low in October. But its December drop was so big, its January rally only recaptured about half the loss. I consider this a consolidation pattern on the right side of a big top.

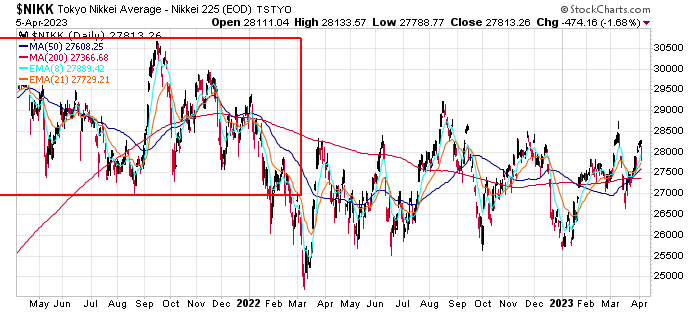

Japan has been uninteresting for a long time. The Nikkei has been stuck in a 20% range for two years. But if this chart was backed up, you’d see the range was above a base from 2018, 2019 and 2020.

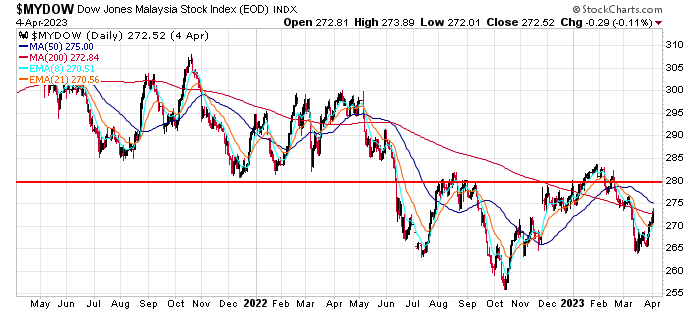

Malaysia is basing under a large top. Its October low was below its June low, and at best it’s neutral down here.

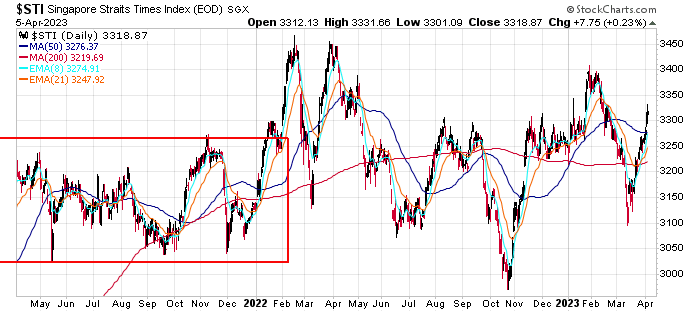

Singapore likes to reverse quickly. Spike highs and lows are everywhere. The October low was well below the June low, but the November and January rallies almost put the stock at a 52-week high. Overall, it’s just chopping around.

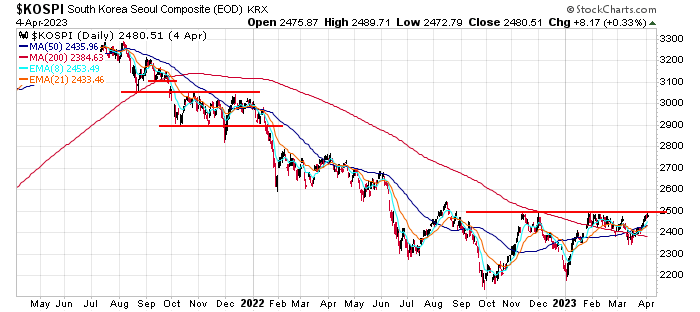

South Korea stayed weaker longer but has been basing since last summer. The downtrend has neutralized. Now it needs a forceful move up to reverse the trend.

Australia nearly went from a 52-week low in November to a 52-week high in February. That’s usually only possible if the index has been stuck in a tight range for a long time. There are lots of sudden reversals and quick, trending moves, but overall, nothing sticks.

New Zealand was one of the world’s strongest countries, but it fell of a great deal in 2022. Now it’s basing and above its 200, which is curling up. It has potential, or it can sit down here for a while.

Europe/Africa

The UK never looks like an interesting place to trade. All moves are muted, and there is a lot of overlapping activity. The February high was a 52-week high. Not many countries can say that.

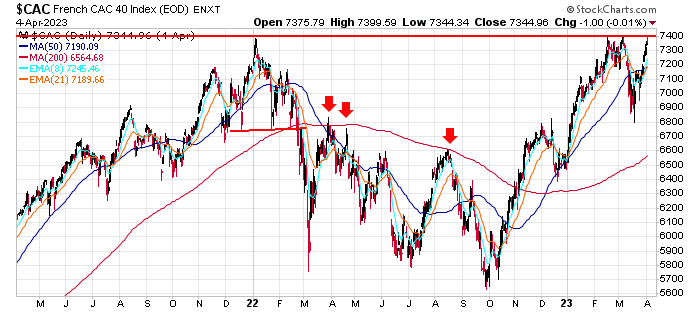

France printed a 52-week low in October and then a 52-week high in February – heck of a turnaround. The last two years could be considered a large consolidation period coming off an early-2021 breakout.

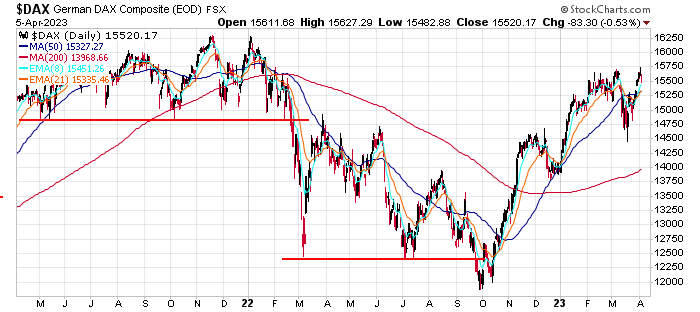

Germany dropped to a new low last September and then rallied back to the 2021 consolidation range. This is a 52-week high.

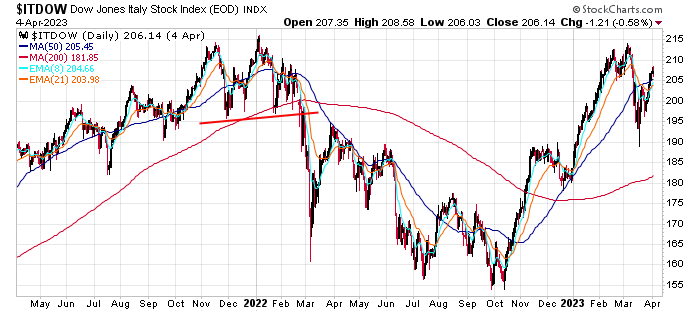

Italy printed a new low in October and then rallied with force to a 52-week high last month. That’s a great recovery. Can gains be built on top of gains.

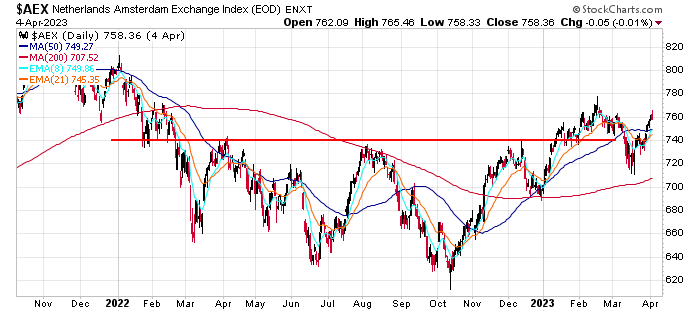

The Netherlands started basing earlier in 2022 while much of Europe continued dropping. Then it rallied to match previous highs before getting support from its 200 in December. A 52-week high was printed in February.

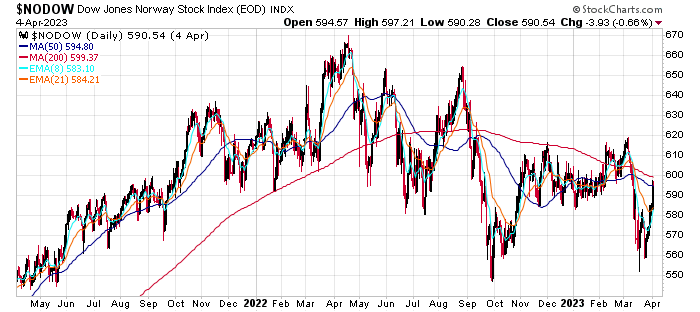

Norway is a mess. Directionless. Trendless. It’s still trending lower and underperforming other European nations by a wide margin.

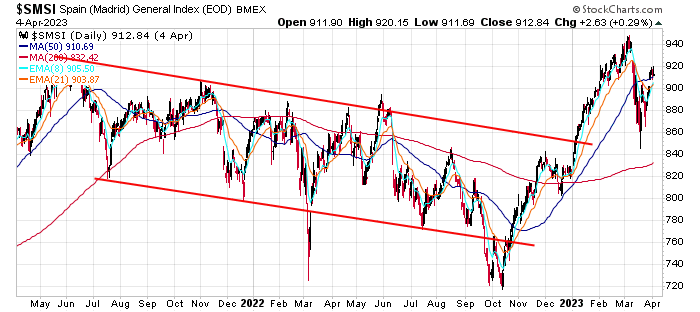

Spain trended lower for about 18 months and then broke out and rallied to a new high this year. There has definitely been a change in character.

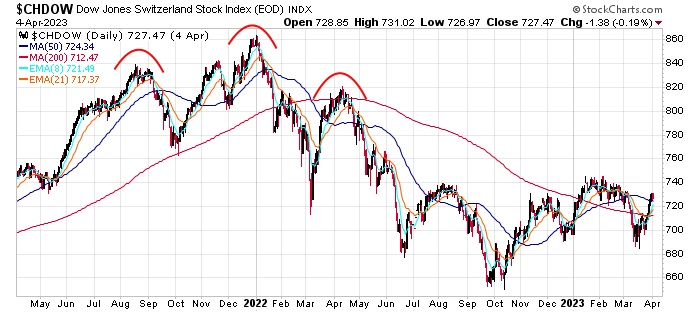

Switzerland is basing well below its late-2021/early-2022 top. The country is lagging its peers by a wide margin.

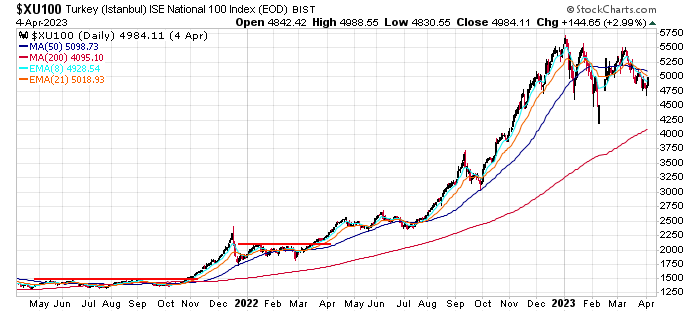

Turkey: Don’t be fooled. Turkey’s success has more to do with their currency than their economy. In the near term, it’s closer to a multimonth low than a high.

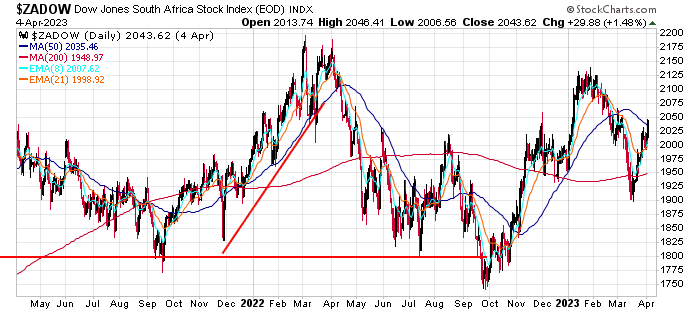

South Africa is trendless and range bound.

The Americas

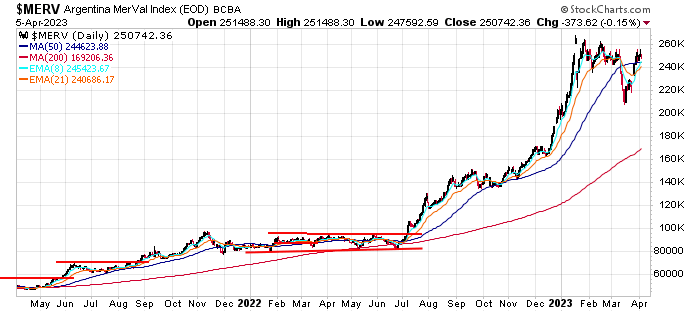

Argentina: Like Turkey, Argentina has currency issues.

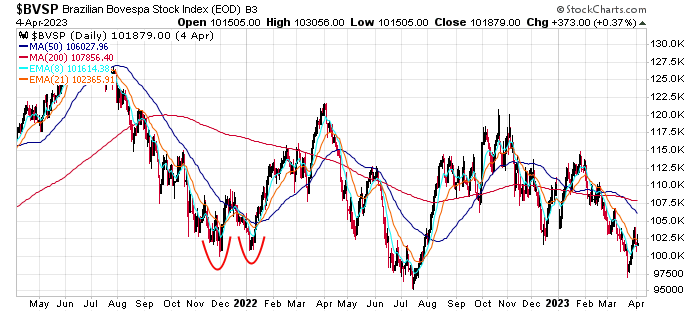

Brazil nearly got cut in half after COVID broke out, so it had a huge hole to dig out of. It topped in June 2021, well before most of the world, and although it put in a higher low last October, it has mostly struggled since.

Mexico did incredibly well for about two years off its COVID low. A deep drop last year has been countered by a rally that has almost put the country back at its high. A breakout from the current consolidation seems likely, barring the entire world moving down.

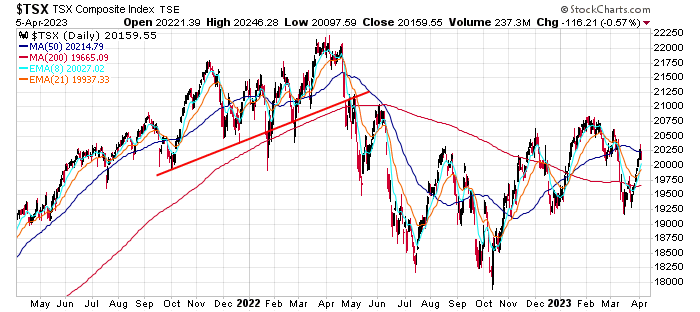

Canada has been mostly basing, below its breakdown level from 2022. The country is back above its 200-day MA, so it’s trying to turn a corner. But I’d consider it neutral.

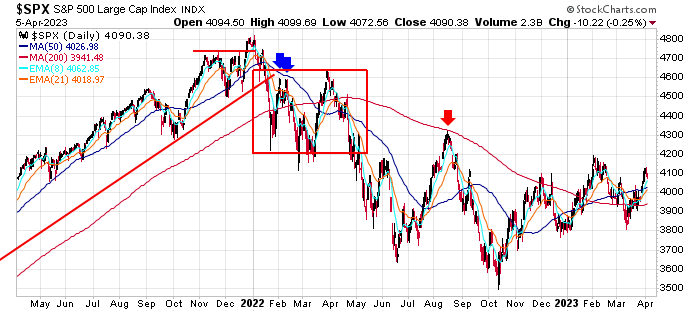

The United States put in a lower low in October and then rallied into a range that has defined most of the last year. Yes, it’s above its 200, which is starting to curl up, but compared to Europe, where most of the indexes are near their highs, the US is lagging by a wide margin. The US led the world for many years, but it’s not even close now.

Random Comments:

Most notable is the leadership in Europe. The largest markets – the UK, France, Germany, Spain, Italy – are at or near their highs.

The US is lagging Europe by a wide margin – it’s not close. The US was the strongest market in the world for many years. Not any more.

The Asian markets are no better than the US. Several are basing, but most are well below their highs and are neutral, at best.

This is a different world than we’re used to. I’ve been writing this type of summary for 10+ years, and I don’t think there’s ever been a time when the US wasn’t leading. We need to look at ETFs of foreign countries. It seems money is flowing elsewhere.

Jason Leavitt