Let’s do a quick update of several breadth readings.

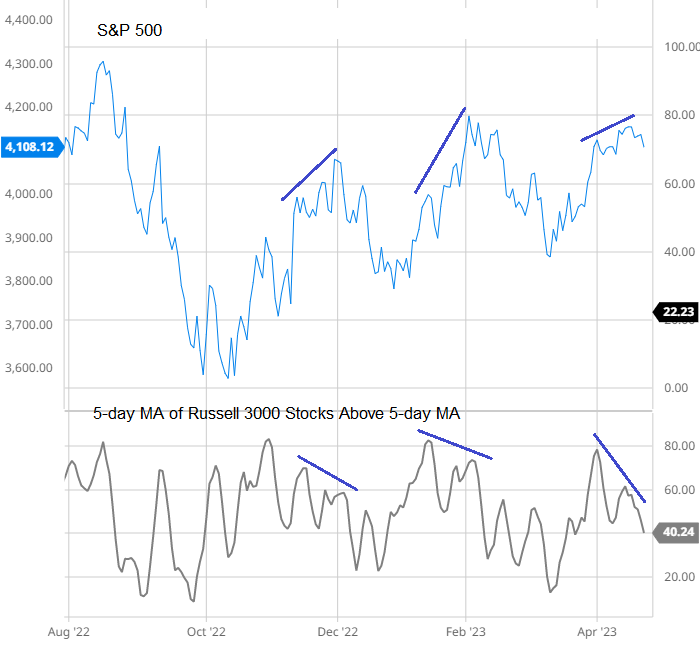

Less stocks were above their 5-day moving average on the most recent push higher than early-April high.

Unlike last October, when the number of stocks at a 1-month high broke out of a base and followed through, we got no follow through on the most recent breakout. The print has retraced back to the base.

Stocks printing 3-month highs did not break out.

A negative divergence formed between the S&P and the number of Russsell stocks above their 5-day MAs. Participation declined, leading to the current weakness.

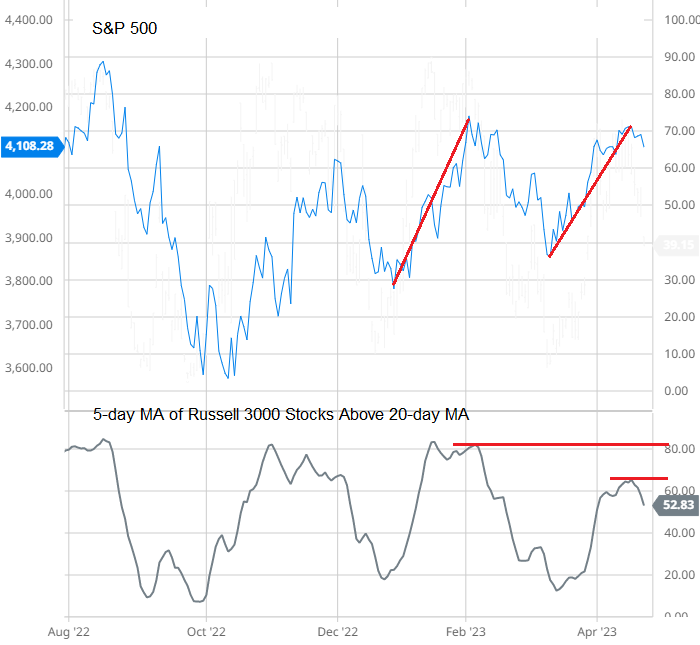

The S&P trended higher for nearly 6 weeks, but the number of Russell stocks at a 4-week high was much less than the previous market rally.

Despite the March/April rally being very similar to the January rally, significantly less stocks have been able to get above their 50-day moving averages.

Ditto for stocks above their 200’s.

Breadth is weak. Negative divergences have formed short term and long term on several readings, but the market hasn’t fallen much yet. The market is either correcting with time or the negative pressure will be released to the downside.

Be careful out there.

Paid Service:

https://www.leavittbrothers.com/videos/LBoverview.cfm

Masterclass:

https://www.leavittbrothers.com/masterclass.cfm

Email List:

https://www.leavittbrothers.com/email-subscribe.cfm

Jason Leavitt