Good morning. Happy Friday.

The Asian/Pacific markets mostly did well. Japan, China, South Korea, India and Malaysia all posted solid gains. Europe, Africa and the Middle East are currently doing well. The UK, Denmark, Poland, Turkey, Finland, Norway, Austria and Sweden are up moderately. Futures in the States point toward a moderate gap up open for the cash market.

————— VIDEO: Using Technical Indicators to Pick Tops —————

The dollar is down slightly. Oil and copper are up. Gold and silver are up. Bonds are up.

Stories/News from Seeking Alpha…

Employment situation

The U.S. economy is expected to add fewer jobs in August vs. July, but still stay in the sweet spot seen for a soft landing. Economists are expecting to see a print of 170K at 8:30 AM ET, down slightly from the 187K climb the prior month, with the unemployment rate staying near 50-year lows at 3.5%. The labor force participation rate, or the percentage of the population that is either working or actively looking for work, is also expected to be unchanged at 62.6%, with average hourly earnings growth forecast to stay at 4.4% Y/Y.

Snapshot: In its effort to squash inflation by jacking up interest rates, the Fed has wanted to see more slack in the jobs market. Indeed, an overall imbalance between labor demand and supply is causing wages to remain elevated, but a batch of data this week has pointed to just what the Fed wants to see: moderating labor demand. Wednesday’s ADP jobs report, for example, showed companies in August added the least number of jobs in five months.

The BLS’ JOLTS, short for Job Openings and Labor Turnover Survey, also revealed the number of job openings in July unexpectedly fell to the lowest level since early 2021. Elsewhere, job cuts announced by employers more than tripled in August vs. July. One outlier this week was initial jobless claims, a leading indicator, slipping below the consensus estimate. Also in the Fed’s favor, the dual strikes in Hollywood are expected to impact today’s jobs data as many companies support the movie and television industry.

SA commentary: Analyst Christopher Robb is confident that August’s jobs report will show “something in line with a soft-landing narrative that continues the trend from the last three reports,” citing a steady decline in worker quits. He also points out some risks that could, in turn, counter his hypothesis, including the potential for workforce increases from immigration. “This could lead to a level of job growth that pushes wage pressure outside of the Goldilocks zone needed for inflation to keep coming down without Old Testament labor market carnage.” (18 comments)

By the numbers

U.S. personal spending in July came in stronger than expected, while personal income rose less than anticipated, according to the latest figures that will be closely watched by the Federal Reserve. Household spending is the biggest driver of economic growth and has already raised projections for third-quarter gross domestic product. Moreover, the headline and core personal consumption expenditures PCE price index – the central bank’s preferred inflation gauge – held steady in July on a M/M basis and came in line with estimates. That indicates the central bank isn’t considering cutting interest rates soon, with Atlanta Fed President Raphael Bostic saying on Thursday that the Fed’s policy is “appropriately restrictive.” (36 comments)

Strike goes on

Warning of “an absolute collapse of an entire industry,” media mogul Barry Diller continues to speak out about the devastating double strike plaguing Hollywood. The “old majors” like Disney (NYSE:DIS), NBCUniversal (NASDAQ:CMCSA) and Paramount Global (NASDAQ:PARA) “should certainly get out of the room with their deepest, fiercest and almost conclusive enemy, Netflix (NASDAQ:NFLX), and probably Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN),” Diller declared, stating the streamers should be cut out of the negotiations with the unions. “When they have to gear up to make more programming to get back subscribers, they won’t have the revenue base to be able to produce,” he added. “So that is kinda catastrophic.”

Fresh stimulus

Stimulus measures continue to be rolled out as real estate headwinds weigh on China’s economy. The government will now allow the country’s largest cities to cut down payment percentages for home buyers and will persuade lenders to lower rates on existing mortgages. However, the question remains whether these steps will be able to revive the property market and an economy that President Biden has referred to as a “ticking time bomb.” Other new stimulus actions unveiled by China include lowering bank reserve requirement ratios for foreign currency deposits, as well as expanding tax breaks for child and parental care and education.

Today’s Economic Calendar

Auto Sales

6:00 Fed’s Bostic Speech

8:30 Non-farm payrolls

9:45 PMI Manufacturing Index

9:45 Fed’s Mester: “Inflation: Drivers and Dynamics 2023 Conference”

10:00 ISM Manufacturing Index

10:00 Construction Spending

1:00 PM Baker Hughes Rig Count

What else is happening…

SEC delays decisions on Invesco, Fidelity spot bitcoin ETFs.

Broadcom (AVGO) slips despite in-line guidance in Q3 results.

Lululemon (LULU) gets mixed reception as sales stay strong.

World Wrestling (WWE) slammed by Saudi investment in UFC competitor.

Biden administration says it ‘has not blocked’ chip sales to Middle East.

Reclassifying cannabis as Schedule III not preferred outcome – Bernstein.

Discounter pain: Dollar General (DG) tumbles following guidance cut.

FDA gives 23andMe (ME) clearance to report more genetic variants.

Dell (DELL) takes off as artificial intelligence shows continued potential.

Hawaiian Electric’s (HE) role in Maui fire said to be target of GOP probe.

—————

Good morning. Happy Thursday.

The Asian/Pacific markets leaned down. Japan did well, but China, Hong Kong, Thailand and the Philippines were weak. Europe, Africa and the Middle East are currently mixed. Germany, the UAE, Switzerland and the Netherlands are up; Poland, Hungary, Saudi Arabia and the Czech Republic are down. Futures in the States point toward a positive open for the cash market.

————— VIDEO: Using Technical Indicators to Pick Tops —————

The dollar is up. Oil is up; copper is down. Gold and silver are down. Bonds are up.

Stories/News from Seeking Alpha…

Like a hurricane

Idalia has come and gone, with heavy rainfall, winds, flooding and local residents continuing to assess the damage. It made landfall Wednesday morning on the Gulf Coast of Florida as a Category 3, but the hurricane was downgraded to a tropical storm as it crossed Georgia and the Carolinas. The eye of the storm is now going back out to sea, but by the look of related stocks, Idalia appears to have thankfully caused much less destruction than initially feared.

On the move: Allstate (NYSE:ALL) rose 3.4% on Wednesday, along with other insurers like Progressive (NYSE:PGR), RenaissanceRe (NYSE:RNR) and Universal Insurance Holdings (NYSE:UVE), with claims not expected to be as bad as previously forecast. Meanwhile, backup generator player Generac (NYSE:GNRC) – which can see outsized trading activity from adverse weather events – fell back following a run-up over the past few sessions. Home Depot (NYSE:HD) and Lowe’s (NYSE:LOW) also traded mildly higher, but no major jumps were seen as homeowners look to rebuild in the aftermath of the hurricane.

Putting things into context, AccuWeather issued a preliminary estimate of economic damages from Idalia in a range of $18B-$20B for the Southeastern U.S., compared to last year’s Hurricane Ian, which caused an economic loss of $180B-$210B. “I let each governor I spoke with know if there’s anything, anything the states need right now, I’m ready to mobilize that support,” President Biden said in a statement.

Elsewhere: Duke Energy (NYSE:DUK) in Florida aimed to have the power of 95% of impacted customers restored by Wednesday night, and so far, 135,000 homes and businesses are back online. NextEra Energy (NYSE:NEE), which owns Florida Power & Light Company – America’s largest electric utility – is also on watch. In terms of air travel, the Tampa and Tallahassee International Airports said they expected to resume full operations today, which is good news for carriers like Southwest (NYSE:LUV), Delta (NYSE:DAL) and American Airlines (NASDAQ:AAL).

No end in sight

Things are getting rocky over in Hollywood. Reports suggest that a high-profile meeting between Amazon Studios (NASDAQ:AMZN), Disney (NYSE:DIS), Netflix (NASDAQ:NFLX), Universal (NASDAQ:CMCSA) and Warner Bros. Discovery (NASDAQ:WBD) will take place today amid divisions over how to proceed to end strikes by writers and actors, which are now in Day 122 and 49, respectively. Failing to resolve the issues may lead to “devastating effects if it is not settled soon,” according to Barry Diller, former CEO of Paramount Pictures and founder of the Fox Broadcasting Company, and could potentially “produce an absolute collapse of an entire industry.” Also see Disney ends at nine-year low, bearish bets rise

The earnings front

Shares of Salesforce (CRM) rose 5.6% AH to $215 after the cloud-computing giant reported Q2 results that topped expectations. Continued growth was seen in all of CRM’s biggest segments, while guidance was raised for fiscal 2024. “I’m a growth CEO. So that’s what I like to do… but I’ll tell you, now I am quite addicted to the bottom line as well,” CEO Marc Benioff announced on an earnings call. In terms of artificial intelligence, he said Salesforce is “looking at the evolution in a broad way, and you’re really going to see it take place over four major zones.” (22 comments)

Offshoring, onshoring, nearshoring

What about a different approach entirely? Apple (NASDAQ:AAPL) is reportedly testing 3D printers to make the steel chassis used by some of its upcoming Apple Watches. The new approach could potentially make the U.S. tech giant’s supply chain more efficient, cut the time it would take to build devices and reduce its environmental impact due to using less material. The work is being done internally by Apple’s manufacturing design team, and if the tests on the Apple Watch work out, the company could expand the use of 3D printing to other products in the future. (10 comments)

Today’s Economic Calendar

3:15 Fed’s Bostic Speech

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Personal Income and Outlays

9:00 Fed’s Collins Speech

9:45 Chicago PMI

10:30 EIA Natural Gas Inventory

3:00 PM Farm Prices

4:30 PM Fed Balance Sheet

What else is happening…

Report: Federal Reserve quietly issues warnings to regional banks.

UBS (UBS) reports mega profit skewed by Credit Suisse takeover.

Economy watch: U.S. Q2 GDP revised down to 2.1% from 2.4%.

Visa (V), Mastercard (MA) said to be planning credit card fee hikes.

Cannabis watch: DEA may reclassify drug as less risky.

U.S. expands AI chip export curbs to some Middle East countries.

CrowdStrike (CRWD) in charts: Subscription revenue, ARR expand.

Baidu (BIDU) among first companies to get China nod for AI models.

On the move: Palantir (PLTR) rides the latest wave of AI euphoria.

Is Ambarella (AMBA) a takeover candidate amid share price plunge?

—————

Good morning. Happy Wednesday.

The Asian/Pacific leaned to the upside. Japan, South Korea, Taiwan, Australia and the Philippines did well; Hong Kong was weak. Europe, Africa and the Middle East currently lean to the upside. The UK, Poland, Finland, South Africa, Israel, Austria and Saudi Arabia and leading; Denmark and Portugal are lagging. Futures in the States point toward a flat open.

————— VIDEO: Using Technical Indicators to Pick Tops —————

The dollar is down. Oil is up; copper is flat. Gold and silver are up. Bonds are up.

Stories/News from Seeking Alpha…

Data dependent

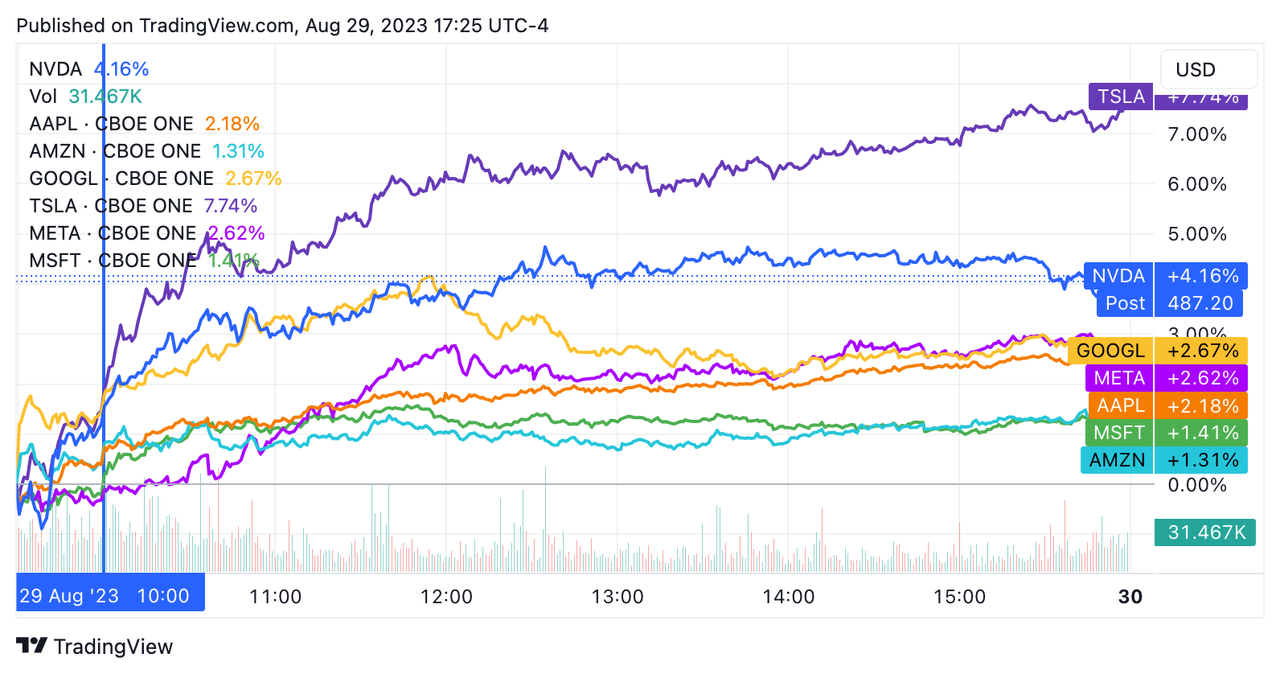

AI may be the future, but the day still belongs to the Federal Reserve when it comes to risk assets. The Magnificent 7 megacaps all rallied Tuesday, driving the broader market to its third straight session in the green and best one-day performance since June. The S&P 500 (SP500) (NYSEARCA:SPY) (IVV) (VOO) rose 1.5%, the Nasdaq (COMP.IND) popped 1.7%, while Info Tech (XLK) was up more than 2% on the day. The VIX (VIX) also dropped to its lowest level in a month.

Snapshot: XLK hasn’t seen a rise like that since June, when chips were still riding the AI wave of Nvidia’s (NASDAQ:NVDA) stunning guidance in late May. Nvidia exceeded lofty expectations with its latest results and guidance last week, but the sell-the-news reaction led to speculation the market was oversaturated on the AI front. On Tuesday, NVDA rose more than 4% to close at a fresh record high. Yes, there were headlines of a Google AI partnership, but the difference was the double dose of Fed-friendly weak data out at 10:00 a.m. ET (in the chart below, you can see the Magnificent 7 take off). Is a megacap breakout in the cards?

The first figures in a week full of key economic data began with JOLTS, which showed an unexpected drop in job openings to below 9M for the first time since March 2021. The “report bodes well for the Fed’s ‘soft landing’ dreams,” Wells Fargo economists wrote. “This indicator is clearly on a downward trajectory amid cooling labor demand growth and impressive labor supply growth… and today’s data are yet another sign that the inflation pressures of the past few years are slowly diminishing.”

On watch: Elsewhere on the economic front, the Conference Board’s latest measure of consumer confidence wiped out the gains of June and July. That helped trigger the bad-news-is-good-news trade – with equities rallying and Treasury yields retracing to prior levels – to reflect a slightly more dovish Fed path than the one plotted after Jay Powell’s Jackson Hole speech (see how rates are trading across the curve). Meanwhile, fed funds futures that had shifted to pricing one more quarter-point hike in November post-Powell moved back to a 52% chance of a pause, and expectations for a first rate cut were pulled forward to May from June. (6 comments)

Incoming!

Hurricane Idalia is bearing down on Florida’s Gulf Coast, where it is expected to make landfall today in the Big Bend area. “While we are not in the business of forecasting the weather as industrial analysts, should Idalia hit as the National Hurricane Center is projecting, there is historical precedence for certain E&C stocks to outperform in the short term,” said Citi analyst Andrew Kaplowitz. His list includes Quanta Services (PWR), Fluor (FLR) and several others. “We usually see more mixed performance for U.S. multis, where large hurricanes could cause factory shutdowns and temporary decreases in sales, but also opportunities in the form of energy/water infrastructure repair that could positively impact multis such as Emerson Electric (EMR) and Xylem (XYL).” (4 comments)

Crypto victory

Bitcoin (BTC-USD) is trading above $27,000 again after a federal court vacated an SEC ruling that had prohibited Grayscale from starting a Bitcoin exchange-traded fund in the U.S. Cryptocurrencies jumped on the news on Tuesday, as well as stocks exposed to the industry. “This is a monumental step forward for American investors, the Bitcoin ecosystem, and all those who have been advocating for Bitcoin exposure through the added protection for the ETF wrapper,” Grayscale CEO Michael Sonnenshein declared. While things could still get held up, the company plans on “next steps” to bring OTC:GBTC to NYSE Arca as a spot Bitcoin ETF, which could potentially pave the way for similar products. (72 comments)

Taking a hard line

Earlier this month, The Guardian reported that Amazon (AMZN) workers in the U.S. were being tracked and penalized for not spending sufficient time in company offices. Now, CEO Andy Jassy appears to be fed up. “It’s past the time to disagree and commit,” he said in a recording obtained by Insider. “And if you can’t disagree and commit, I also understand that, but it’s probably not going to work out for you at Amazon.” The e-commerce behemoth’s three-day-a-week policy went into effect in May, which prompted protests outside the firm’s Seattle headquarters. (213 comments)

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 GDP Q2

8:30 International Trade in Goods (Advance)

8:30 Retail Inventories (Advance)

8:30 Wholesale Inventories (Advance)

8:30 Corporate Profits

10:00 Pending Home Sales

10:00 State Street Investor Confidence Index

10:30 EIA Petroleum Inventories

11:00 Survey of Business Uncertainty

What else is happening…

Back to Earth: VinFast (VFS) plunges on market cap reality check.

Best Buy (BBY) posts better-than-feared earnings report.

Demand for cloud, AI in focus for Salesforce (CRM) results.

Planet Fitness (PLNT) expands pricing pilot to more states.

Opera: Hit a high note with this top growth stock.

Apple (AAPL) sets Sept. 12 event to launch iPhone 15.

HP (HPQ) cuts FCF, profit outlook amid weak rebound.

HP Enterprise (HPE) also slips, while light guidance hits BOX.

NHTSA pushes harder on Tesla (TSLA) Autopilot safety.

Jefferies picks a baker’s dozen of top small and midcap stocks.

—————

Good morning. Happy Tuesday.

The Asian/Pacific markets did great. China, Hong Kong, Taiwan, Australia, Malaysia, Indonesia and the Philippines led. Europe, Africa and the Middle East currently lean to the upside, but are mostly quiet. The UK, Finland, Italy and Portugal are up; South Africa and Israel are weak. Futures in the States point toward a down open.

————— VIDEO: State of the Market —————

The dollar is up. Oil is up; copper is down. Gold and silver are down. Bonds are down.

Stories/News from Seeking Alpha…

Getting bigger

There’s a new target date for the expansion of the European Union proposed by European Council President Charles Michel. Coming meetings by EU leaders should focus on the enlargement of the trade bloc by 2030 in order to boost influence and assertiveness, and help remodel the global approach to development. Parts of the speech at the Bled Strategic Forum also focused on not importing past conflicts to block the accession process, but sticking to a merit-based process that outlines economic, judicial and administrative reforms needed for membership.

Backdrop: The EU’s last major expansion occurred in the early 2000s, when the trade bloc stretched to Central and Eastern Europe, but starting in the 2010s, a different wave of thinking arose. The European debt crisis, as well as the European migrant crisis, gave rise to Euroskepticism, which ultimately saw Britain vote to exit the European Union during the Brexit referendum of 2016. Struggles for the U.K. economy, COVID, and Russia’s invasion of Ukraine have swung the pendulum back to the side of pro-Europeanism, though there are still many hurdles that need to be overcome in order to promote greater integration.

In June 2022, the EU accepted Ukraine and Moldova as formal EU candidates, while the bloc has tried to push forward the accession process of several Balkan countries that have spent decades on seeking membership. Georgia has also been recognized as a potential member, though membership talks with Turkey are currently frozen. In his speech, Michel called some of those countries out by name, but acknowledged that relative prosperity would not follow immediately, but rather significant funds would be needed to help poorer countries catch up.

Quote: “To be stronger and safer, the EU needs to reinforce our bonds and become more powerful,” he declared. “The GDP of the future member states is about 50-70% of the smallest EU economy. This means they will be net recipients, while several current net recipients will become net contributors, so we need to work out how to manage this complex transition. It will be difficult and sometimes painful… [but] enlargement is no longer a dream. It is time to move forward.”

Hurricane warning

Florida is preparing for its first major storm of this year’s Atlantic hurricane season. Idalia may intensify into a major Category 3 hurricane before making landfall in Florida, according to the National Hurricane Center, while Gov. Ron DeSantis declared a state of emergency for more than 45 counties in the state. Idalia isn’t estimated to be as strong as Hurricane Ian, which last year killed at least 140 people as it swept through Florida and the Carolinas, but backup generator player Generac (NYSE:GNRC) still rose about 4% on Monday. The stock has posted gains in the past as regions throughout North America face blackouts and power disruptions because of extreme weather. (4 comments)

Advised to sell

Scaling back ambitions to push into mass-market financial planning, Goldman Sachs (GS) has reached an agreement to sell its Personal Financial Management unit. The business oversees around $29B in assets and was built up from United Capital, a registered investment adviser that Goldman bought for $750M in 2019. However, the deal may not bode well for CEO David Solomon, who is seeing another strategy unravel after attempting to push into the mass-affluent sector, only to renew the bank’s focus on the ultra-wealthy. Earlier this year, Goldman put online lending service GreenSky up for sale, unraveling another deal of the Solomon era.

Shipping minimums

Amazon (AMZN) is increasing its free shipping minimum to $35 (from $25) for non-Prime members in some markets, matching the minimum order amount required by rival Walmart (WMT) to avoid shipping fees for its Walmart+ subscription service. “We continually evaluate our offerings and make adjustments based on those assessments,” spokesperson Kristina Pressentin said in a statement provided to Seeking Alpha. Amid the heightened focus on profitability, SA analyst Stanislas Capital called AMZN an underappreciated margin improvement story and well-positioned to benefit from previous investments and efficiency initiatives. The latest decision could also incentivize non-Prime members to sign up for the $139 per year Prime service. (52 comments)

Today’s Economic Calendar

9:00 S&P CoreLogic Case-Shiller Home Price Index

9:00 FHFA House Price Index

10:00 Consumer Confidence

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $36B, 7-Year Note Auction

3:00 PM Fed’s Barr: “Banking Services”

What else is happening…

WSB survey results: Most not a fan of unions in the private sector.

Rally on: Vinfast (VFS) now world’s third-most valuable automaker.

Tech giants set to meet with Sen. Schumer on AI next month.

Kimco (KIM) to acquire RPT Realty (RPT) in $2B all-stock deal.

Hawaiian Electric (HE): Power lines were out before deadly Maui fire.

3M (MMM) board approves $6B settlement for combat earplugs.

Expanding portfolio, Danaher (DHR) pays $5.7B to buy Abcam (ABCM).

Assembly lines at Toyota’s (TM) plants in Japan are shut down.

On the move: Carvana (CVNA) pops following CEO share purchase.

Largest fine ever leveled on airline for breaking tarmac delay rules.

IPO Roundup: Arm (ARM), Instacart (CART), Klaviyo (KVYO) and more.

—————

Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets did great. Japan, China, Hong Kong, South Korea and Singapore posted big gains. Europe, Africa and the Middle East are currently doing great. France, Turkey, Germany, Greece, South Africa, Finland, Switzerland, Norway, Spain, the Netherlands, Italy and Sweden are leading. Futures in the States point toward a moderate gap up open.

————— VIDEO: State of the Market —————

The dollar is unchanged. Oil and copper are up. Gold is up; silver is down. Bonds are up.

Stories/News from Seeking Alpha…

Labor rising

Unions are in focus across the country as more workers threaten industrial action and strikes continue to impact entire industries. Joining the train in 2023 have been pilot associations at major airlines like American (AAL) and Southwest (LUV), the Teamsters Union at UPS (UPS), Workers United at Starbucks (SBUX) and the International Association of Machinists and Aerospace Workers at Spirit AeroSystems (SPR). Don’t forget the damaging walkout that continues to plague Hollywood – with both writers and actors conducting a historic double strike.

Bigger picture: Many workers feel compensation and conditions have worsened over the past three years despite bumper corporate profits since the pandemic. Besides pay not keeping up with the rising cost of living, employees might see a moment of leverage in a tight labor market, while big changes are threatening control of entire industries (think EVs/autos, or AI and the screenwriting process). A contagion effect is also rippling across sectors as employees see better working terms and pay hikes occur after companies come to the bargaining table, while new union leadership and younger members continue to push for stronger deals.

The latest case in the spotlight is the United Auto Workers union, which has landed approval from workers at Ford (NYSE:F), General Motors (NYSE:GM) and Stellantis (NYSE:STLA) to strike if a new contract is not worked out before Sept. 14. A work stoppage by its 150,000 workers could result in an economic loss of more than $5B in just 10 days, according to the Anderson Economic Group, given current inventories and the manufacturing environment. Auto stocks have typically traded higher following resolution and contract ratification in the past – in what has typically been a recovery from aggressive selloffs during the contract talks – but some carmakers may be at more risk than others.

Outlook: On the corporate side, businesses have to decide whether to dig in for the long haul (Hollywood) or agree to new terms for their workers (UPS). At issue are terms that may impact a company’s bottom line and decrease competitiveness, or limit powers to balance merit-based progress and employee motivation. On the other hand, better worker terms can give corporations access to a steady and well-trained labor force, as well as a sense of operational cost predictability and the ability to attract talent in a tight labor market. Take the WSB survey.

Bilateral relations

U.S. Commerce Secretary Gina Raimondo has become the third cabinet secretary to visit China this year after landing in the country for a trip that hopes to get the two sides talking again (prior trips were made by Janet Yellen and Antony Blinken). “Of course, in matters of national security, there is no room to compromise or negotiate,” Raimondo told Chinese Commerce Minister Wang Wentao. “And as you say, the vast majority of our trade and investment relationship does not involve national security concerns.” Tightening restrictions on technology and advanced semiconductors have weighed on U.S.-Sino tensions, but Beijing has also been struggling with an economic slowdown and worries about its property sector, with shares of China Evergrande (OTC:EGRNF) tumbling around 80% in Hong Kong on Monday. (2 comments)

Combat-grade plugs

3M (MMM) has reportedly agreed to a more than $5.5B settlement to resolve over 300K lawsuits claiming the company sold the U.S. military defective combat earplugs. 3M had argued the earplugs worked properly when soldiers were trained on how to use them, but veterans had sued subsidiary Aearo Technologies, claiming that its foam earplugs were flawed and didn’t protect them from damage to their hearing. The case is one of two big disputes that 3M has found itself in. The other is related to “forever chemicals,” with the potential for liabilities that analysts have estimated may cost the company billions of dollars. (133 comments)

Medicare negotiations

Amid reports that the Biden administration is gearing up to announce the first ten drugs that will be subject to Medicare price negotiations early this week, Wall Street analysts have come up with their own lists of potential inclusions. The pricing negotiations introduced as part of last year’s Inflation Reduction Act allow the Department of Health and Human Services to bargain for Medicare Part D drugs for the first time in history. While revised prices for the first ten drugs are unlikely to take effect until 2026, the impact will only grow afterward as the list of targeted drugs expands, with the program expected to save an estimated $98.5B for the U.S. healthcare system over ten years. (40 comments)

Today’s Economic Calendar

10:30 Dallas Fed Manufacturing Survey

1:00 PM Results of $46B, 5-Year Note Auction

What else is happening…

Horizon Therapeutics (HZNP)-Amgen (AMGN) trial withdrawn by the FTC.

CDC advisors to meet Sept. 12 to discuss new COVID shots.

Gran Turismo revs up, while Barbie becomes year’s top film.

California judge rules Diablo Canyon nuclear plant can stay open.

Angry oil industry sues U.S. over new Gulf auction rules.

Databricks in discussions to raise funds at $43B valuation.

It’s been a tough month for crypto – will it get even worse?

Love and shun: Hedge and mutual funds are rotating positions.

Jabil (JBL) to sell China mobility business in $2.2B deal.

XPeng (XPEV) scoops up DiDi’s (OTCPK:DIDIY) self-driving division.

—————